Stock investing is all about the future, you invest today with the expectation of a return tomorrow. And when it comes to anything about the future, we are prone to believe in predictions and predictors. Our belief may range from mild interest to staunch conviction; so much so that we may not do anything significant without consulting the stars and the astrologer/forecaster. So, how do we differentiate anything said in stock investing as an act of prediction (a forecaster approach) or sound analysis (an Analyst approach)?

What is the difference between these two approaches? Finally, forecaster/astrologers also analyze a lot of data, don’t they? So, let’s get some insights about this through our favorite game, cricket. Some of us follow it more ardently than others and all of us are familiar with it. One thing fans cannot resist is talking about what will happen in the next match, who will win, who will score how much especially Sachin? And some of us get so excited by this that we take bets, big and small, on it. When the bets are about the next match, especially who will score how much, how fast etc. we are indulging in predicting, in forecasting.

Instead, suppose we were trying to estimate Sachin’s average score in the next 10 matches or the next 40 matches, wouldn’t it be possible to be significantly more accurate? Yes, it would be. And which would be more accurate the 10 matches average or the 40 matches? When it comes to averages we are safer betting on the larger 40 matches. Why? Because we have proof of Sachin’s talent, know his performance track record and we know that he is paranoid about playing well. There may be some matches that he may not score well, either due to his own mistake, his partner’s mistake or just a wonderful delivery from the bowler, or he may not be in full form for a season! But we can still analyze his past performance and estimate how close he will be to his long term average. And we will definitely be more accurate. And that is our next Stock Shastra, Stock Shastra 17: Don’t forecast future stock prices, Analyze Company’s ability to earn future profits.

Let’s see why

In both cases mentioned above we are talking about the future, so what is the difference?

- The former (score in the next match) cannot be estimated by any kind of analysis as it is close to a random event, the latter (average score in next 40 matches) is driven by things more under the control of the player, his skill etc and hence can be analyzed and estimated

- The Analyst approach would be to study the capability and talent, the past & recent performance, the strength of the opponent, etc. to estimate the run scoring capability under a variety of situations and then make an estimate of the average over a number of matches. The Forecaster may see a pattern in the run scored in the earlier matches and make a prediction about the next match’s score, but there is very little correlation here because what one scored in the last match does not influence the score in the next match.

The scenario in stock investing is much similar to the one described above

A technical analyst is like a forecaster, who tries to predict the future price based on price movement. This depends on various players buying and selling shares and has nothing to do with company performance. It is strongly impacted by recent news and short term events. No wonder we have different recommendations from different ‘forecasters’ and buy and sell targets are within short ranges. While it may work for someone glued to the ticker, it will not work for retail investors.

A fundamental analyst who looks at the company’s ability to earn profits is like the analyst described above. It is an analyst’s job to do his analysis based on the facts e.g. the assets, earnings, dividends and also an analysis of the future prospects.

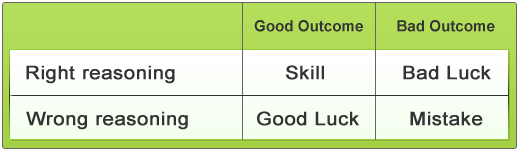

As an investor, we should be concerned with getting better at our analysis. Just measuring how many times our decisions are right or wrong, is not a good way of assessing our ability to analyse. It is important to know how many times our decisions worked out for the right reasons and how many times our reasoning was wrong. Look at the following matrix to help you make things clearer:

Thus, when right reasoning leads to a good outcome would be a measure of skill. But when right reasoning leads to a bad outcome would be bad luck. Similarly, when wrong reasoning leads to good outcome it would be good luck. But when wrong reasoning leads to a bad outcome, we can be sure it’s a mistake!

Can we completely ignore the market movements?

While we don’t base our valuations on market movements, we cannot ignore how it behaves. An important criterion would be to determine if the markets are irrationally exuberant or unnecessarily depressed. Imagine buying a fundamentally strong company at 21000 levels in 2008. You would have been deep in the red as of March 2009 and might have just recovered your money recently. Thus, it is not about knowing future prices, but knowing the market trends. The markets may price even a fundamentally strong company at extremely low prices when in a bearish mood or price them at irrationally high prices when in a bullish mood.

MoneyWorks4me’s Sensex@MRP is one such good indicator of where you are in the cycle. If the Sensex crosses the MRP, it is a sign that the movement is being driven primarily by sentiments and we may be near the peak of the cycle whereas if the Sensex is at a substantial discount to the MRP, it indicates the trough. You can read more about Sensex@MRP here and learn how it helps you to identify the position in the cycle.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

This is a great article, with an excellent similie to explain the rationale behind fundamental analysis. We welcome such thoughtful articles.

This is a great article, with an excellent similie to explain the rationale behind fundamental analysis. We welcome such thoughtful articles.

Hi,

As you must have read above it is very important to analyse a stock before investing. Stock Shastra is an educational initiative by http://www.moneyworks4me.com to help a retail investor gain from stock investing. Please do read all our 13 Stock Shastras (Timeless Principles of Stock Investing) http://bit.ly/aHBGTC , where we have explained a complete methodology to invest in stocks, the right way.You can start by applying these principles to your analysis while keeping your behavioral biases in check.

If you need any help understanding this methodology or putting it into action, do let us know

thanks for reply.

how can we analysis, if we want to do intraday-trade ,

Hi,Intra-day trading is almost like a gamble. It is usually done by looking at daily market prices/averages which are driven only by the markets irrational behavior as a result of some short-term news, rumors etc. Hence, this involves high risk and can lead to you gaining or losing a lot of money.Rationally over the long-term the market price of the company is driven by the ability to earn profits consistently. You must always look for fundamentally strong companies, with an ability to grow its earnings consistently over the years. When such a stock is available at an attractive price, it is worth buying. Hence, by following this methodology, you can remove the gamble out of stock investing and earn great returns with minimum risk.

Thanks a lot for the appreciation. Do keep reading & posting your feedback.

Hot info