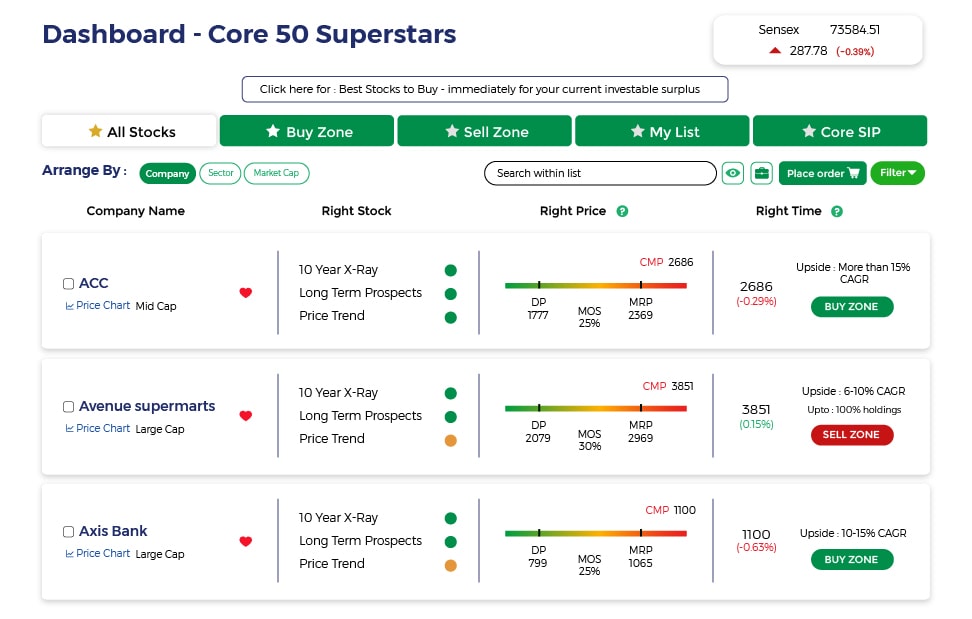

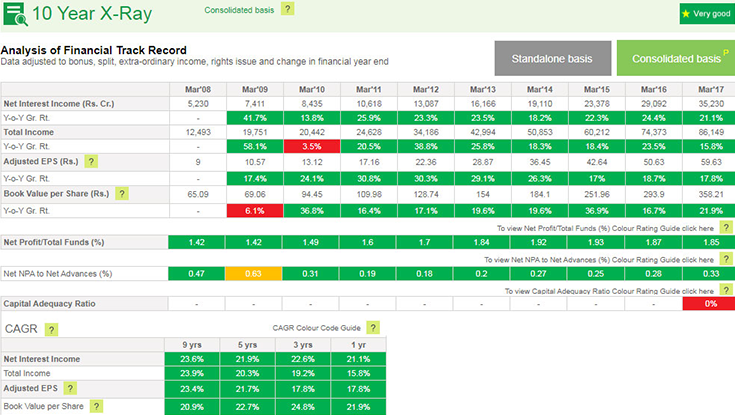

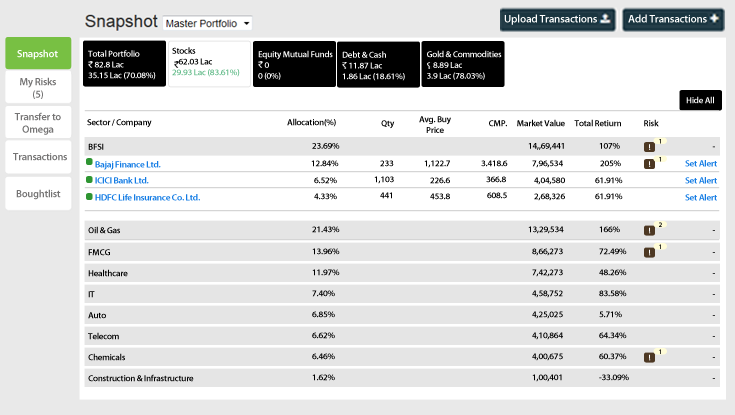

MoneyWorks4me is a amazing website which i have come across. It gives every investor respect for a persons hard earned money to be wisely invested and to reach his/her ultimate financial freedom. The feed back we get from analyst note is a clear...

Read More

Download APP

Download APP