The apparel segment is the 2nd largest category of the Indian retail industry. India ranks sixth among the 30 countries that were surveyed in the 2011 Global Apparel Index. The last decade saw the emergence of domestic players like Pantaloons, Provogue, Koutons etc. who strove to get a share of the booming retail market. Growth drivers like growing disposable income, changing consumer life-style and increasing preference for branded products, led to rapid expansion, with sales growing at more than 20% pa.

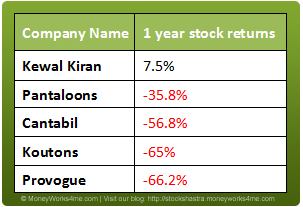

Investors also flocked these counters betting on the future for retail in a developing economy like ours. However, it would be fair to say that they have been in for a rude shock. Many of these stocks have performed dismally, especially over the past year, belying the hype that surrounded retail some years back. The last year has seen stock prices of mid-size players like Cantabil, Koutons and Provogue fall by more than 50% (see table). Even the larger sized Pantaloons has failed to perform with the share price dropping more than 30%. Compared to this, the Sensex has witnessed a fall of just 9% over the same period.

So, what ails these retail apparel companies?

Most of these companies expanded aggressively focusing on reaching a larger consumer base, but this came at the cost of profitability. Big expansion plans require big money – both for creating new retail outlets and for working capital. With very few companies making enough profits and having surplus cash to fund this, borrowing was the only resort. As a result, most of these companies piled up huge debts on their books. To make matters worse, the demand did not live up to the expectations, thus leading to an increase in inventory and receivables and further aggravating working capital needs.

So, now these companies are left with high debt, huge inventories and bulging receivables. With the interest rates at high levels, the cost of servicing the debt has gone up drastically, further denting margins. All in all, these companies have got themselves into a vicious circle and the effect of this has been amply visible in the stock prices of these companies.

How bad is the situation?

The bleak situation is highlighted by the recent stake sale by Pantaloons Retail to Aditya Birla Nuovo. If a large apparel player like Pantaloons Retail had to opt for a stake sale to reduce its debt, one can imagine the situation the mid-sized retailers might be in. The problems have intensified for these players due to both – tough competition from larger brands and a weak financial position.

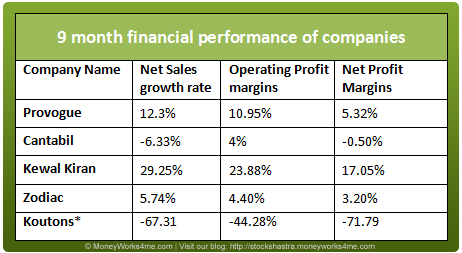

Sales of both Cantabil and Koutons have suffered with Cantabil phasing out its ‘La Fanso’ brand while Koutons closing half of its stores to pay off some of its debt and manage its working capital and cost structure. An exception has been Kewal Kiran, with its flagship brand – Killer. It has out-performed with good sales and profit growth. It has also been able to effectively manage its working capital while keeping the debt at very low levels.

Renowned player, Provogue which has a well-established brand in India, has managed to increase its sales by ~29% CAGR over the last 5 years. However, high debt and in-efficient management of working capital led to negative operating cash flow and has also been a drag on the margins of the company.

In conclusion, the going seems to be tough for almost all the players. Till sometime back, larger established brands like Pantaloons seemed better placed owing to their size and growing outlets, but with the recent stake sale of Pantaloon format to Aditya Birla, things look bleak for the industry as a whole.

What lies ahead for these companies?

The last 9 months have been very challenging for these companies. Apart from sales slowing down, significant increase in prices of major raw materials like Cotton, Polyester and Viscose affected margins. To add to this the government increased the excise duty to 10% on branded garments. An effort to pass on the duty hike by increasing prices further has affected sales growth.

The March quarter is not expected to be any better but there might be some hope in the next financial year. RBI has shown some signs of softening the interest rates and any such move would be a positive for these companies. More importantly, good monsoons and decrease in domestic and international cotton prices will be cheered. Apart from these key factors, if the government eases the excise duty and provides access to low-cost foreign funds, it would be a big boost for the sector.

So, what should you as an investor do?

All in all, be it large or small players, apparel retailers are witnessing troubled times currently. While the macroeconomic growth drivers remain intact, it will be a tall order for these companies to come out of this scenario unscathed and start making profits. Investors would be well advised to be highly cautious before thinking of investing in these companies. It might be quite some time before these companies see some light at the end of the tunnel.

MoneyWorks4me.com recently covered the Pantaloon stake sale article which was well-received by StockShastra readers. Click here to read the article.

Also Read: Decoding the Indian Banking Industry – Growth Drivers and Future Prospects

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463