We do know that the Sensex is at 17000 today and the Nifty at 5100, but majority of us Investors may not necessarily be buying the top 50 stocks.

So when we look at the Index which we all generally invest in – Midcap/Smallcaps for long term – is at levels equivalent to 13000 on the Sensex and 3800 on the Nifty.

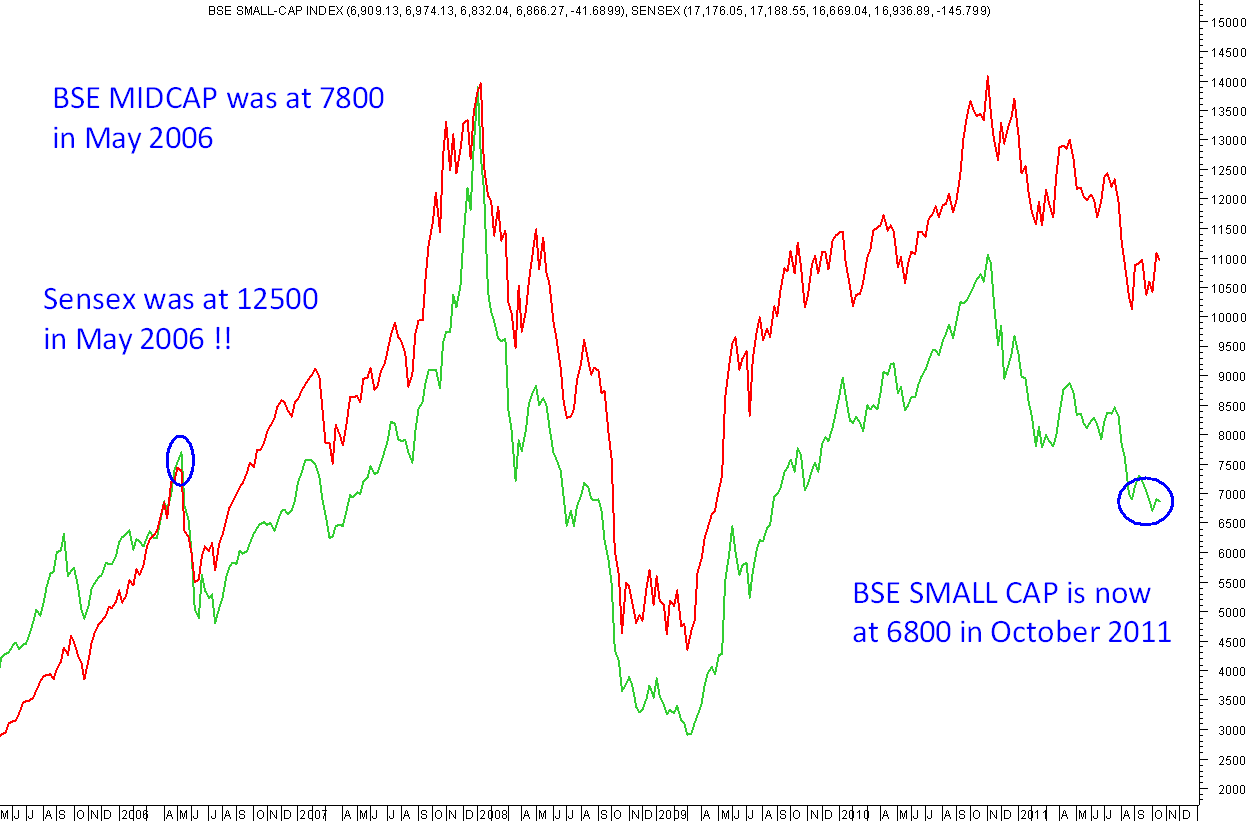

This is evident from the charts shown below. So go ahead start researching on Quality Midcaps/Smallcaps, as they are very much in the investment zones.

BSE MIDCAP

The major part of the investments for an investor is generally spread over the broader market. The BSE Midcap Index has almost 250 + stocks. Check the list here

- BSE Midcap is down 33% from recent high of November 2010. It is down 42% from January 2008 highs.

- The BSE Midcap Index is right now around 6100-6200, and hit around 5900 recently. Almost 5 years back in May 2006, the BSE Midcap had first hit 6000. That time Sensex was at 12500+ and Nifty at 3800.

- So if you have been waiting for a long term entry point, then this is it ! Do not worrying about the benchmark indices.

BSE SMALLCAP

The BSE Smallcap Index has almost 550 stocks. Check the list here

- BSE Small cap is down 40% from the recent highs of November 2010. It is down 52% from January 2008 highs.

- The BSE Small Cap Index is right now around 6800. Almost 5 years back in May 2006, the BSE Small Cap was at 7800. That time Sensex was at 12500+ and Nifty at 3800.

- The small Cap index really tells how bad the sentiment is, and this will open up a lot of opportunities if one does proper research.

Both the charts suggest that currently the broader markets are at a really interesting juncture, and one should slowly start buying into quality companies which have a good 5-10 year history or good managements with decent growth.

The main thing we need to understand is, that had one just been sleeping over the stocks bought in 2006, he may not have made a lot of money!!! In the last 5 years however, many of these stocks gave multi-bagger returns.

Ever since the Sensex broke 19900/19000 levels, we have maintained a view to get onto High Cash!! Use a trading approach using the bear rallies for small trades. The same way in 2008, we had taken a similar view in Feb 2008/June 2008 ( youtube video explaining why to hold cash and be patient ).

But looking into the past for the last couple of months, we have been consistently advising clients to deploy cash. Today, we are high on equities and just 10-15% on cash. The strategy now is to book partial profits on rise to 5200-5400 and 17300-18000 levels for the indices or on specific stock moves.

For more on our technical views which have been published for last 5+ years, visit www.nooreshtech.co.in

NIFTY – The Current Technical picture is as below:

The band of 4950 -5010 is a good support zone. Resistances are placed around 5180/5320/5450 where partial booking should be done.

Nooresh Merani

CEO – Analyse India

This guest post has been written by Mr. Nooresh Merani, CEO of Analyse India which is a website that focuses on Technical Analysis for Equity & Commodity markets in India.

Disclaimer : The views expressed by the author in this post are entirely his own and do not necessarily reflect the views of MoneyWorks4me. This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while taking investment decisions.

We do know that the Sensex is at 17000 today and the Nifty at 5100, but majority of us Investors may not necessarily be buying the top 50 stocks.

So when we look at the Index which we all generally invest in – Midcap/Smallcaps for long term – is at levels equivalent to 13000 on the Sensex and 3800 on the Nifty.

This is evident from the charts shown below.So go ahead start researching on Quality Midcaps/Smallcaps,as they are very much in the investment zones.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

interesting mail as usual Nooresh!

Pankaj Shah