Details of the issue:

Issue Date: May 20, 2013 – May 22, 2013

Face Value: INR 10 per equity share

Issue Type: 100% Book Built Issue IPO

Issue Size: 17,497,458 equity shares of INR 10

Issue Size: INR 822.38 Cr. – 950.11 Cr.

Price Band: INR 470 – INR 543 per equity Share (10% discount on the issue price to the retail individual investors)

Safety net arrangement: A safety net to the resident in India in accordance with the SEBI regulations

Market Lot: 25 Shares

Minimum Order Quantity: 25 shares

Listing at: BSE, NSE, MCX-SX

So, what’s the offer for sale? Here’s the review of the Just Dial IPO..

Just Dial, one of the initial companies to offer local search services in India is coming up with a public offer for sale of 17,497,458 equity shares of INR 10 each by the selling shareholders. The issue is being carried out through an offer for sale (OFS) route, and thus no fresh issuance of shares is done by the company. This means that none of the funds raised through the IPO will go to the company; it will go to existing shareholders who are selling their stake in the company. The IPO price band has been fixed at INR 470 – INR 543 per equity share and the discount to retail investors is INR 47(10% to the floor price). The offer opens on May 20th, 2013 and closes on May 22nd, 2013.

According to the offer, the company has reserved 10% of the shares to be allocated to retail shareholders, 15% to HNIs and remaining 75% to QIBs. As proposed by SEBI, the company has incorporated ‘safety net’ period of 180 days from the date of listing to retail investors. The ‘safety net’ gets triggered if the weighted average market price of equity shares for the previous 60 days on completion of safety net period (6 months) is below the allotment price for retail investors. If this happens, then promoters will buy back shares from the original retail shareholders at the retail offer price. This seems to be the reason for the relatively smaller proportion reserved for the retail investors as the company wants to reduce the “Safety Net” burden.

The company hopes to raise approximately INR 822 Crores – INR 950 Crores from the issue, which will constitute 25% of the fully-diluted, paid up equity capital of the company, post offer. Since it is a secondary sale, all proceeds from the issue would go to the selling promoters and private equity investors, and not the company. It is an exit opportunity for the existing investors (16% of the OFS by promoters and the remaining 84% by PE investors). Thus, no part of the funds raised would be used towards business development. The primary motive is to enhance the brand name and provide liquidity to the existing shareholders. Listing will also provide a public market for the equity shares in India.

Citigroup and Morgan Stanley Limited are the book running lead managers to the issue. Karvy Computershare Pvt. Ltd. is the registrar to the issue.

Tell me more about Just Dial…

The company was incorporated in 1993 as A&M Communications Private Limited. Later the name was changed to Just Dial on Dec 26th, 2006. Just Dial Limited is one of the leading local search engine portals which provides B2C (business to customer) and B2B (business to business) listings of micro, small and medium advertisers (MSME). Search services provided to the users are reviewed from its database of local businesses, products and services across India and are available through multiple platforms: internet, mobile internet, telephone (voice) and text (SMS). Search service is a free service for users; the company generates revenues from advertisers who subscribe to its fee – based campaign packages to be given priority ranking in the search results.

Who are the selling shareholders?

Apart from promoters including VVS Mani, Ramani Iyer & V. Krishnan; SAIF partners, Tiger global Five Indian Holdings, Tiger Global Four JD Holdings, EGCS, Sequoia III and SAP ventures are the strategic and private equity investors who are offloading their stake in the company for the offer for sale of 17,497,458 shares.

What sets the company apart? Here is the analysis of Just Dial..

Just Dial provides search services across two genres;

- Company search, which can be general or specified

- Category search, which can be product or service based on a given classification, location or key words

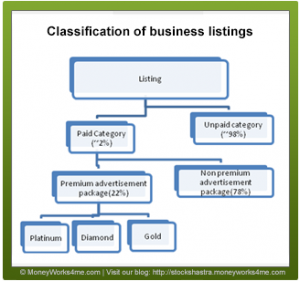

It started with voice based search services and later ventured into internet, mobile-internet and SMS-based services. Annual and long-term membership are provided to its paid advertisers, who can opt for premium or non – premium advertisement packages on advance payment on a monthly or annual basis. Premium advertisement packages including platinum, diamond and gold membership packages allow preferential listing of these advertisers ahead of non – premium and free listing. The company has no listed peers for comparison; however it faces competition from Askme, Asklaila, Getit and Sulekha.

First mover advantage: Just Dial launched the first phone – based search engine in India and thus enjoys the first mover advantage. It initiated search operations via phone and later diversified into the new-era media of the internet, mobile internet and SMS’s. As of February 2013, it had 9.0 million listings in its database, out of which 195, 100 were paid. Its ability to update the database has been the reason for strong growth in usage of its search services.

Ability to monetize growth in searches: Users contact the company to fetch the contact details of a business or a service provider as required by them. The company reciprocates by providing free information from its business listings. Through conversion of business listings into paid listings, it monetizes the growth in searches on its platforms. It collects 100% advance for paid campaigns, thus leading to low receivables, enabling it to operate with negative working capital.

Financial performance: Revenues and net profit of the company witnessed a 5 year CAGR of 40% and 100% respectively during 2008-2012. The company has no debt on its books and has cash reserves of approx. INR 475 Cr. As the company’s business is not capital intensive, improvement in EBITDA margins is likely to boost profits. The company has good growth prospects as business model is moving towards non linearity through increased penetration in high growth and mobile internet platform, which constitutes 60% of the total traffic as compared to 35% in FY 09. However, the company’s ability to raise the proportion of paid advertisers will be the key revenue driver. Further, being a small player and rising competition in the internet could impact its revenues and consequently profits.

But, what are the concerns?

Low entry barriers: Local search industry has a low entry barrier as any player can establish a database and offer services & search platforms and use sales & marketing to drive search requests. Initial investment is high; thus players with strong balance sheets can enter and offer competitive pricing, making a strong impact on the local search services industry.

IPO proceeds not meant for company: The net proceeds of the IPO would be taken by promoters and PE investors, as it is an exit opportunity for the existing investors. Moreover, 16% of the issue size is an offer for sale by promoters, which is least likely to generate any confidence amongst the investors. Though company won’t be receiving any IPO proceeds, it does have a cash balance of INR 475 Cr.

Technological obsolescence: As the technological cycles are getting shorter and shorter, the failure/delay in adaptation of technology is likely to affect the company’s scalability and growth. It is dependent on digital advertising on computers and smartphones. Even, if it manages to achieve scalability on the database front, translating it into advertising revenues would be a challenge for the company.

Intense competition: Intense competition among local search engines and the growing local presence of global players pose a threat to the company’s growth. Internet by providing a wide-ranging platform for hosts of businesses to launch services poses formidable competition to the company. Moreover, Sulekha, Asklaila and Askme are its peers which operate on similar business models backed by strong VC’s and PE players, projecting a fierce competition amongst the players in market.

So, should you invest in the IPO?

According to MoneyWorks4me analysis, at the IPO price band of INR 470 – INR 543, Just Dial would be trading at a significant premium as compared to its equity’s intrinsic value.

Just Dial is into service business with an asset light business model; hence Price/Sales ratio is being used for its valuation. The company’s financials, till now, seems decent with good revenue growth, zero debt, negative working capital cycle and good cash flow. With the price band of INR 470 – INR 543, the company expects the market capitalization to be INR 3,289 Cr. – INR 3,800 Cr. Even in the too optimistic scenario of company being able to maintain its past revenue growth (~40%), the price band seems aggressively priced. Considering the revenues of 350 Cr. (estimated considering 262 Cr for 9MFY12) with Price/Sales ratio of 6, valuation of the company comes to be INR ~1,850 Cr., which makes the share fairly valued in 235 -270 range. As the company operations closely follow the retail industry, P/S ratio of retail industry is used.

Thus, though company has shown robust revenue growth in the past with good cash flows, it does not possess sustainable moat which can justify the high valuations of IPO. Retail Investors are thus, advised to stay away from Just Dial IPO.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

WELL ANALYZED

@87c035f745250f1d87686d142d19248f:disqus Thanks for the feedback. We appreciate it.

Well analysed.

@google-00ab9fe37040d0cf87a54aa4932c443c:disqus We appreciate your feedback.

Very good analysis and advice.

@ravisathe:disqus Your feedback is very much appreciated. Do keep reading!

nice suggestion . kindly discuss the holding of 75% of QIBs share in retaining the share price nearer to the issue price.

@pammi sarma

In 2012, SEBI has made QIB participation in IPO’s mandatory, which includes no spillover to be allowed from retail to QIB in IPO’s. The move was put into action, when in 2011-12; lot many IPO’s saw zero participation from institutional investors, with some IPO’s being banned by SEBI on account of irregularities and violation of norms and some only managed to sail through on the back of oversubscription in the retail segment.

If an IPO fails to generate a minimum of 65% demand for QIBs and HNIs, then the issue has to be either withdrawn or be underwritten by the merchant bankers. For companies planning to tap the capital market, they need to have a minimum average pre-tax operating profit of Rs 15 crore in three of preceding five years; failure of which will require an increased QIB participation of 75% as against the existing 50% in IPOs or will have listing on the SME(Small & Medium enterprises) platform.

Thanks for the correct opinion. As an advertiser, I have had a poor experience with the company for booking an adv and also for refund of the money paid.

@2993bf980ec287b1c93d6065ae69c83f:disqus Thanks for sharing your experience. We appreciate your feedback.

you have advised to stay away from just dial ipo,as it was over valued as per P/sales but today it is trading at almost at triple price from issue price..and investors made lot of money within a year..acc to you,it is notional loss for others if i’m not wrong…

i’m confusing from all this..please clear this thing…how this happened..what are the factors behind it..!!

The factors behind Just Dial rise is the same as investors fancy with high growth companies like Tesla, Lovable Lingerie. We do believe that statistically it is possible that some companies can stand out from the averages and grow at such rates for long duration. However, the data says that most companies do not sustain such kind of growth rates for more than 5 years. We believe that at current valuations market is pricing only the positives by expecting a very high growth (50%+) rates for more than 5 years. We believe that given the pressure on the business model of Just Dial from the likes of Google, and other local search platforms like Zomato, there is an expiry date to the business model. Hence we continue to advise our investors to stay away.

We would just like you all to know that MoneyWorks4me investment philosophy is towards identifying companies with strong moat at great prices such that they can generate sustainable returns for the investors. Over the years, we have learned that such fancy company like Just Dial do not fall in to this category.

So we are happy for people who have made money, we are equally comfortable staying away from investing in Just Dial.

SEE THE STOCK PRICE NOW AND WASH UR FACE!11

ALL the best!!!

Be invested and lets meet after 5 years and then see. We have seen such companies with crappy business model come through IPO at times. We have seen investors lose shirts going after such companies pursuing momentum. For eg, MIC electronics, DLF, V2 retail (Vishal Retail Ltd.). So, be invested in high PE company like Just Dial and we will meet after 5 years.

I believe this is among the most vital intromafion for me. And i am happy studying your article. However should observation on few general issues, The site style is wonderful, the articles is in point of fact nice : D. Good process, cheers

Hi friends, I want enter into share market, but I am new, can any of u know me how to invest in the share market.www.khajamk1@gmail.com this my mail