Shipping Corporation of India, India’s largest shipping company, is coming up with its Follow-on Public Offering with a total of 84.69 million equity shares, including a fresh issue of 42.35 million Shares of Rs.10/- each.

So, what’s the subscription offer? Here’s the review of SCI FPO

The government will dilute 10% stake in SCI, while the company would issue fresh equity to the tune of 10% of the paid-up capital through the follow on public offer. The FPO would consist a total of 84.69 million equity shares, including a fresh issue of 42.35 million Shares of Rs.10/- each. The price band for the upcoming FPO of Shipping Corporation of India Ltd. is fixed at Rs.135/- to Rs.140/- per equity share. At the upper end of the band, the fresh issue would raise around Rs 593 crore, a chunk of which would be spent towards vessel acquisition. Total issue proceeds would be around Rs 1,186 crore. The offer opens on November 30 and closes on December 3.

Tell me more about Shipping Corporation of India…

Incorporated in 1950, Shipping Corporation of India Ltd (SCI), a Navaratna PSU, is India’s largest shipping company. The main business of the company is to operate cargo passenger cum-cargo and tanker services. SCI has around 35% of the total market share. It operates in both very large crude carriers (VLCC) and dry bulk segments and owns a fleet of 77 vessels with approximately 5.3 million dead weight tonnage (DWT). SCI’s fleet includes dry bulk carriers, very large crude carrier (VLCC) tankers, crude oil tankers, product tankers, container vessels, passenger-cum-cargo vessels, phosphoric acid and chemical carriers, LPG and ammonia carriers, and offshore supply vessels. Its primary customers are Government agencies, large industrial concerns, international oil companies and public sector undertakings.

Use of the Proceeds:

Out of the total issue of 82.7 million shares, the size of fresh issue is 42.35 million shares. The proceeds from the fresh issue will be used to fund SCI’s fleet expansions.

How has been the performance of SCI?

Historical Financial Performance:

SCI’s financial performance has not been very good in the past years. Key financials like EPS, BVPS and Net Sales have been growing at sluggish rates, on a year on year basis for most of the years. The company’s Net Sales has grown from Rs. 2542.76 Cr. in 2000 to Rs. 4166.64 Cr. in FY 2009 with 5.6% CAGR growth rate over the 9 years period. Till FY2009, SCI’s EPS grew by 10% CAGR in 5 years and BVPS grew by 21% CAGR during the same period. Though, the company has maintained a decent Return on Invested Capital (ROIC) in last six years, with an average of around 20%, it is showing a declining trend over the years mainly due to rising debt. The company has huge debt position of Rs 3700 Cr (Sept 2010) which is expected to increase further due to ongoing and future expansion plans.

SCI has had a difficult FY 2010, with income from operations and net profit declining by 20 per cent and 60 per cent over the previous year to Rs 3,460 crore and Rs 387 crore. Its major segments bulk carriers (including tankers)which contributed around 69% of income, and liner (around 21 per cent of income) witnessed a sharp decline in profits (around 30 per cent and 50 per cent respectively).

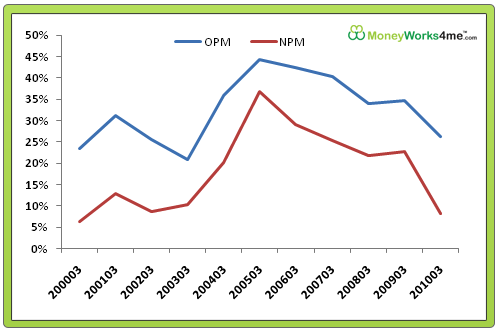

SCI’s margins have also been very volatile in past, mainly due to cyclicality of the industry it operates in and also due to its ever increasing depreciation and interest costs. Going forward, considering the expected rise in debt and interest cost and also higher level of depreciations due to expansion, we do not expect a stable or margins in near future.

Q3FY2011 performance:

The current fiscal has been better, with freight rates having revived relative to the same period previous year. The company’s net profit stood at Rs 134.66 crore for the quarter ended September 30, 2010 as compared to Rs 33.70 crore for the quarter ended September 30, 2009, up by whopping 300%. Its total income increased by 17.5% from Rs 909.26 crore for the September 2009 quarter to Rs 1,068.21 crore for the September 2010 quarter mainly due to revive in freight rates globally.

What can we expect in the future? Here’s the analysis:

Quarters Ahead:

The company’s good cash position Rs 2,310 crore should help fund-raising for expansion plans. However, SCI’s ongoing aggressive expansion plans may weigh down the company’s financial performance in the near to mid-term due to increased depreciation and interest pressures. Also, due to increase in equity base, we will see a slight dip in the EPS going forward.

Also, recently global shipping freight rates, though higher than the all-time lows seen earlier, have suffered some reversal after a tentative pick-up in the first half of this calendar. This is reflected in the weakness in the Baltic Dry Index and the Baltic Tanker Indices. As a result the impact of this depressed tanker market may lead to lower realisation from oil refiners that currently employ 6 ships of SCI to haul petroleum products along the coast. Going forward, the company should be able to manage a better performance in the current fiscal, helped mainly by a low base effect.

Massive Expansion Plans:

In its bid to remain competitive, SCI is aggressively expanding fleet capacity. It has 26 vessels on order with total cost of nearly Rs. 7,500 Cr, and additional order for 20 vessels planned for FY-2011. These additional vessels are expected to be delivered in phases over the next three years. These new arrivals will decrease the average age of SCI’s fleet from 17 years to 15 years and will help improve efficiency and realisation by reducing maintenance cost. These expansions will also add nearly 2.2 million dwt of fleet capacity to SCI. The company is also planning to buy three second-hand ships with a budget of Rs 1400 Cr. Going forward, SCI plans to invest almost $ 4 billion to double its tonnage capacity from current 5.4 mn DWT, to around 10 mn DWT over the next 5-6 years.

Joint Venture to Tackle Volatility:

SCI is in process to launch a joint venture shipping company with state-owned steel maker Steel Authority of India Ltd. The JV is to start operations with an initial fleet of eight dry-bulk carriers that can transport up to 4 mt of cargo. The new company, in which the two partners will have equal equity shareholding, will annually ship nearly one million tonnes of raw materials used by SAIL in manufacturing steel. SCI is also planning to start a long-term JV with NTPC. This JV will be involved in shipping thermal coal for NTPC from abroad for periods ranging from 5 to 10 years. SCI is also in talks with state-run Coal India Ltd (CIL) to float a joint venture shipping company to cater to the requirements of CIL. Besides providing sizeable business opportunities, these long-term tie-ups with steel makers, power and coal producers will ensure steady business for a number of years and shield company from volatility in the shipping freight market.

Integrated Growth:

In order to become an integrated company, SCI is planning to get into shipbuilding business. And for this purpose, SCI is currently in talks with several ship building companies (Bharti, ABG Shipyards) for starting shipyard though a JV. These integration plans if successful are expected to boost its margins significantly in coming years.

Shipping Industry to Revive:

Over the past few months, the operational environment for shipping companies has shown some signs of revival, with freight rates in the tanker segments like VLCC having gone up. A recent report by the global energy association IEA is hinting at signs of a pick-up in global oil demand and the corresponding improved demand for vessels to transport crude oil products also indicates recovery. Also, dry bulk segment is expected to witness faster growth than tanker demand, given the strong demand from the Chinese metal industry for transporting key raw materials. Among other drivers, the huge coal import requirements for the rapidly growing power sector, increasing imports of crude oil, and India fast emerging as a refining hub should provide good opportunities for diversified players such as SCI. We can expect SCI to continue with a better operating performance on the back of addition of new vessels and rising demand.

But, what are the concerns?

Exchange Rate Fluctuations:

Given that more than 90 per cent of SCI’s income is denominated in foreign currency, sustained appreciation in the rupee could impact its performance. A significant portion of SCI’s revenue and expenditure is denominated in foreign currencies. As a result, it is exposed to foreign currency exchange rate fluctuations and exchange rate risks, which may affect its financial performance and profitability of the company.

Volatility in Freight rates and Dependence on Oil Industry:

SCI has nearly 60% of its capacity on long-term contracts. But nearly 40% of its capacity is exposed to volatile spot freight rates. The company has deployed nearly 70% of its fleet capacity towards the tanker segment which are used mainly to transport crude oil. Any fall in the demand for oil leads to a sharp fall in the freight rates and hence the profitability of the company. This over exposure to Oil shocks may hamper its realisations going forward.

Thus, we can conclude that SCI‘s positives include reviving demand in shipping activities, growing exports, long term contracts with major domestic players, massive expansion plans and its plan to be a vertically integrated player. However, volatility in freight rates and exchange rates will continue to be major concerns for the company going forward.

So, what should my action be on SCI FPO?

The economy is expected to go up roughly about 5-7% pa on an average in next 5 years. This is likely to boost export activities and hence we can expect a rise in shipping activities as well. Considering the company’s focus on expansion and integration, this economic growth will have positive impact on company’s earnings in coming years.

The price band for this public issue has been fixed at Rs.135-140 per share; and employees of SCI and retail investors will get 5% discount to the issue price. With this 5% discount, the maximum price a retail investor would pay for the stock is Rs 133 per share. But, does this price offer an attractive discount to its right value (MRP) or is it over-priced? It is always best to invest at an attractive discount to its MRP, to get maximum returns at minimum risk. Become a member of MoneyWorks4me.com to know its sensible buy- price and hence take the right action for this FPO.

Disclaimer: This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while taking investment decisions.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463