Some days back Coal India Ltd. (CIL), the near-monopoly coal producer announced that it will seek shareholder approval at its upcoming Annual General Meeting to amend its Articles of Association in order to facilitate buyback. As soon as this news was out, stock prices of CIL rose by more than 2%. The reason for this price rise was primarily the expectation that the company will announce a share buyback.

Historically, share buybacks or even company announcements of a share buyback have had a similar effect on the respective stock prices. The market is usually quick to react positively to such news. But are share buybacks always beneficial to investors? Before we answer this, let’s understand what is a share buyback.

What is a share buyback?

There are four basic options available to a company when it makes a profit: sit on the cash, re-invest it into profitable opportunities, pay a dividend or buyback shares.

Buyback is generally seen as a method of rewarding shareholders by returning excess cash to them, when a company doesn’t see good growth avenues to deploy its resources. This can be done in two ways:

- It can tender an offer to existing stockholders to buy up to a certain number of shares at a fixed price within a fixed period of time, or,

- It could offer to buy the shares in the open market over a period.

What are the motives behind a buyback?

There are different motives that prompt the management to go in for a buyback of shares:

1. To reward shareholders: When a cash-rich company doesn’t see good growth avenues to deploy its resources, it can choose to return cash to its shareholders via buyback of shares. Such an action can be viewed positively by the analyst community and reflect positively on the management.

2. To send out a confidence signal to the market: When a company announces a share buyback, investors see it as a positive sign in terms of the management’s belief in the company’s future growth & earnings. This could act as a confidence booster and lead to investors buying into the company’s shares leading to a price rise.

Take for example, the Reliance Industries buyback scheme which was announced in February this year. After a series of quarterly results which were below expectations, the share price was languishing at INR 700. The share buyback announcement which was just 2 days before announcement of its quarterly results, led to a 5% jump on the day of announcement. It was largely seen as an attempt to shore up the market sentiment in order to prevent a further fall in share prices after the announcement of another set of poor quarterly results.

3. To improve Financial Ratios: A buyback gives a temporary boost to some of the key financial ratios of the company that are based on the number of shares and cash as an asset.

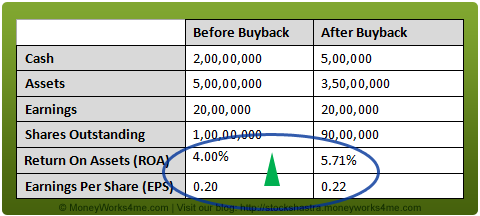

Suppose a company buys back 10 lakh shares at INR 15 per share for a total cash outlay of INR 1.5 crores. Below are the components of the Return on Assets (ROA) and Earnings per Share (EPS) calculations and how they change as a result of the buyback.

In the above case, following a buyback, the company’s cash holding reduces from INR 2 crores to INR 0.5 crore, and the total assets of the company (cash being an asset) reduces from INR 5 crores to INR 3.5 crores.

This leads to an increase in its ROA (Earnings/Assets) from 4% to 5.71%, even though earnings have not changed.

A similar effect can be seen in the EPS number (Earnings/Shares Outstanding), which increases from INR 0.20 to INR 0.22.

4. To prevent dilution of control: A buyback helps absorb the excess shares, which cause dilution of per share earnings, from the market which may have resulted from the exercise of employee stock option programs. Thus, a buyback reduces the total number of shares outstanding in the market and helps increase shareholder value.

5. To prevent unfriendly takeovers: By undertaking a buyback, the company makes it more difficult for a raider to take control by acquiring majority stake from the open market.

Now we know the different motives behind buybacks. But share buybacks are not always a good idea and might also decrease shareholder value.

When do buybacks destroy shareholder value?

1. Buyback of overvalued shares: a company buying overvalued shares from the market would lead to destroying shareholder value, and would be better off paying that cash out as dividends, so that shareholders can invest it more effectively.

2. To boost earnings per share: contrary to popular wisdom, increasing EPS doesn’t increase fundamental value of the shares. Though the EPS derived from the P&L statements of the company may seem to rise, there is no net increase in the cash EPS. Since companies have to spend cash to purchase the shares, valuations are adjusted for reductions in both, cash and shares.. The result is a cancelling out of any impact in the cash EPS, as now lower cash earnings are divided between fewer shares to produce no net change in the earnings per share.

3. Using borrowed money to fund the buyback: Using debt to fund a buyback could have an adverse effect on the credit rating of the company, since in effect the company reduces its equity, increases its debt, with no net increase in cash to serve as a cushion for the increased leverage.

So, are buybacks really beneficial for shareholders?

Stock buybacks can be great for shareholders if the company cannot utilise the excess cash productively. As mentioned before, it could lead to a cash inflow for shareholders as also lead to appreciation in share price. However, the price at which the company buys back the shares should be right.

On the other hand, you should be careful and assess the reasons for the buyback. You must exercise a reasonable amount of caution in the following cases:

- Where a stock grant to employees by way of employee stock options or a stock issuance for merger & acquisition is offsetting the shares taken out of circulation, thereby resulting in no net increase in share value.

- Where the management aims to cover up weak ratios or improve the market price of the shares by playing with investor sentiments.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

Good article, eye opener for investors on how the company can play with their sentiments. Good work Moneyworks4me, keep it up.

@ba3fe8c329254a4c779110cc53ce445f:disqus Thanks frank! we will keep publishing more of such eye opening articles for our readers. Do keep reading and posting your feedback!

this good education to uneducated share holders,

@6beb9eadbe357cfc4205f829aabe2a33:disqus Thanks Pragathitraders! educating new investors is the aim of our StockShastra initiative.