Balkrishna Industries Ltd.: What does the fundamental analysis of this stock say?

Balkrishna Industries Ltd. – Company Highlights:

Balkrishna: Manufacturer of off-the-road (OTR) tyres, a niche tyre market, with focus on foreign market (90% export revenue)

Market View of Balkrishna Industries Stock Price (13th April’11):

Latest Stock Price: Rs. 132.85

52 Week-High Stock Price: Rs. 161.60

52 Week Low Stock Price: Rs. 104.00

Latest P/E: 6.52

Latest P/BV: 1.94

Tell me more about Balkrishna Industries –

Balkrishna Industries Ltd. (BIL), the flagship company of Siyaram Poddar Group, engages in manufacture of OTR (off-the-road) tyres, a niche tyre segment. These tyres are used in agriculture (tractors, trailers, farm equipment), industrial and construction activities (dump trucks, loaders etc. and for utility vehicles (golf carts, All Terrain Vehicles etc.). The company has established its presence in this segment with around 1,800 stock keeping units (SKUs). It also has a presence in paper and textile processing.

Balkrishna Industries Ltd. (BIL), the flagship company of Siyaram Poddar Group, engages in manufacture of OTR (off-the-road) tyres, a niche tyre segment. These tyres are used in agriculture (tractors, trailers, farm equipment), industrial and construction activities (dump trucks, loaders etc. and for utility vehicles (golf carts, All Terrain Vehicles etc.). The company has established its presence in this segment with around 1,800 stock keeping units (SKUs). It also has a presence in paper and textile processing.

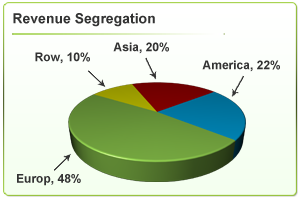

The company exports around 90% of its total tyre production. Nearly 50% of total production is sold in Europe while other major markets for BIL are North America, Asia, Middle East followed by South America, Africa and Australia. It has three manufacturing facilities located at Bhiwadi & Chopanki in Rajasthan and Waluj in Maharashtra.

How has the Financial Performance of Balkrishna been?

The 10 YEAR X-RAY of Balkrishna Industries indicates that the financial performance of the company has been very good over a 10 year period. Net Sales have shown good, consistent growth. The EPS of the company has also been robust, recording consistent growth each year. FY 2009 however witnessed a fall of 32% due to weak global market and recession. The fall in EPS in FY 2009 was a result of a loss in Forex transactions(90% export revenue) to the tune of Rs. 38 Cr. However, EPS recorded a whopping 196% rise in FY 2010 backed by a lower base effect, lower raw material prices and a drop in interest costs. The BVPS figures have also shown consistent Y-o-Y growth. The company’s has clocked an impressive 6 year ROCI average of 21% indicating efficient utilization of the funds by the management. The Debt to Net Profit ratio is 2.2 (as of March 2010) which indicates a comfortable debt position of the company.

Debt figure expected to increase owing to capital expansion: BIL recently redeemed around Rs. 100 Cr. ($ 22 million) of FCCB. Thus, the debt as of December 2010 stood at Rs. 464 Cr. Further, BIL is setting up a Greenfield operation at Bhuj for which it is incurring a capex of around Rs. 1200 Cr. Out of this, the company will be raising ECB worth around Rs. 800 Cr. ($ 165 mn – $175 mn) at an interest rate of 3.5%. The company has already tied up the loan facilities for this and will be drawing the funds in phases. The first impact of the debt is expected to appear on the balance sheet in June 2011. The debt will be repaid within three years after a three year moratorium ending FY 2014. Thus, going ahead the debt for the company is expected to increase and the Debt to Net Profit is expected to be close to 5.

Since, the company has performed well on all parameters in the past, , currently we can say that the 10 YEAR X-RAY of Balkrishna Industries is Green (Very Good). But, going forward the company’s debt position needs to be monitored as it is expected to rise significantly

What can we expect in the future? Here is the fundamental analysis of Balkrishna Industries…

In the Short Term

Higher raw material costs and interest outgo dampens profits for December 2010 quarter

For the December 2010 quarter, BIL recorded a 42.75% increase in Net Sales to Rs. 492.93 Cr. from Rs. 345.55 Cr. in December 2009. However, the total expenditure witnessed an increase of 57.5% largely due to a 75.4% increase in raw material costs (up from Rs. 171.23 Cr. in December 2009 to Rs. 300.36 Cr. in December 2010). Also, the interest payments were up this quarter by 152.36% to Rs. 11.04 Cr. This included Rs.7.64 Cr. paid as cumulative interest on redemption of FCCB of $22 Millions. As a result, BIL’s Net Profit was down by around 20% to Rs. 38.21 Cr. from Rs. 47.61 Cr. in December 2009.

For the December 2010 quarter, BIL recorded a 42.75% increase in Net Sales to Rs. 492.93 Cr. from Rs. 345.55 Cr. in December 2009. However, the total expenditure witnessed an increase of 57.5% largely due to a 75.4% increase in raw material costs (up from Rs. 171.23 Cr. in December 2009 to Rs. 300.36 Cr. in December 2010). Also, the interest payments were up this quarter by 152.36% to Rs. 11.04 Cr. This included Rs.7.64 Cr. paid as cumulative interest on redemption of FCCB of $22 Millions. As a result, BIL’s Net Profit was down by around 20% to Rs. 38.21 Cr. from Rs. 47.61 Cr. in December 2009.

Strong order book expected to drive revenue growth

The company has a strong order book of 34000 MT (32000 metric tonnes from replacement and 2000 metric tonnes from OEM segment), which is equivalent to 3.5 months of sales volume approximately. With this order book, the company is expecting total sales volume of 1, 00,000 – 1, 10,000 metric tonnes in FY-11 up by around 20-30% from 84,454 MT in FY-10. This has been a result of strong demand in the western markets mainly in the agriculture domain.

Increase in rubber prices a major concern:

The rise in the rubber prices since the beginning of FY10 is a major concern for the raw-material-intensive tyre industry. Natural Rubber is an important raw material for the industry and constitutes nearly 42% of the total raw material cost of the industry. Prices of Natural Rubber have increased considerably over the last year from Rs. 160 per kg to Rs. 240 per kg currently. As a response to this, the company has hiked the price of its products by 20-25% over the last year (in January and July 2010 followed by January 2011) and may undertake another price hike between April – June 2011, if the rubber prices continue to remain high. However, if the rubber prices increase more than expected, BIL may not be able to pass on the rise completely to its customers and thus its bottom line may be hit. Further, price hikes may also lead to loss of market share.

Thus, considering all these factors we can say that the Short term future prospects of Balkrishna Industries are Orange (‘Somewhat Good’).

In the Long Term

Positive Industry Outlook:

The global OTR segment, valued at around Rs. 30,000 Cr., is highly concentrated with the top 3 players – Bridgestone, Goodyear and Michelin – having around 55% market share. OTR demand is mainly derived from industries such as Agriculture, Construction, Earthmoving, Mining, Quarrying. These industries are closely related to the growth of the economy. They are expected to grow at 8% -10% per annum globally, because amount spent on infrastructure development and capacity expansion by various industries is robust in almost every country. Agriculture is the main focus area of almost every country. Most of the BIL’s exports are to EU (European Union) countries and these countries are now focused on increasing productivity. The large size of farms in these countries, coupled with declining manual labour, is boosting demand for tractors and other agriculture related applications.

Low cost manufacturing, the key to increasing market share:

BIL currently holds a 3% market share of the global OTR tyre segment. Out of total sales, around 70-75% comes from the replacement market. The balance production is mainly for companies who outsource production to BIL. The company’s EBITDA margins are a hefty 20.2%, against 5%-6% of its global peers. This is mainly due to the low labour costs in India, and also lower power and fuel costs. The low cost of production also enables BIL to sell its products around 25%-30% cheaper, compared to global rivals. The company already has around 1,800 SKUs in production. It aspires to be a full range OTR manufacturer, offering around 2,400- 2,500 SKUs in its product portfolio going ahead.

Entry barriers for OTR segment auger well for the company:

Balkrishna Industries operates in a growing niche of “OTR’ or “Off-the-Road’ tyres, fitted on to vehicles or equipments meant for agriculture, industrial, constructions and earth moving applications. The OTR market is internationally defined by large variety and low volumes. This implies that traditional mass manufacturing concept of tyre making does not work for OTR manufacturers and they have to maintain a large number of SKUs. BIL develops newer SKUs every month not only for the existing vehicles but also for those planned couple of years down the line by a manufacturer or existing vehicle introduced in a new market. This ensures that it is abreast of latest technology and products and is expanding its market while creating entry barriers for competitors. Further, this segment is not a priority business for other tyre manufacturers. Putting up a capacity for OTR is an expensive proposition for any existing tyre manufacturer given the specialised equipments which are delivered after a long gestation period and are expensive to operate. The absence of mass manufacturing process and lower output per press makes it impossible to get an advantage arising out of economies of scale. BIL enjoys significant entry barriers in terms of brand awareness and dedication of available capacity which are expected to ensure that the company maintains its profit margins in the near future.

Robust capacity expansion plan: To meet rising demand

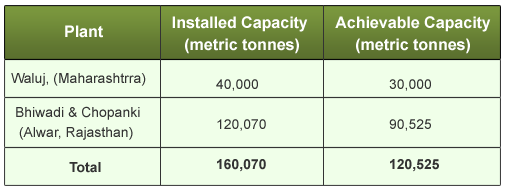

BKT has an installed capacity of ~160,000 MT, spread over its 3 plants – Chopanki and Bhiwadi in Rajasthan and Waluj in Maharashtra.

All these plants are functioning at an achievable capacity at 75% of the total installed capacity. This is due to high variety and low volume of tyres produced by the company. To meet the rising demand, the company is expecting to add 10,000 MT in its Waluj plant which would increase overall achievable capacity close to 130,000 MT.

Further, BIL is setting up a Greenfield plant at Bhuj, Gujarat with an achievable capacity of ~100,000MTfor a capex of Rs. 1,200 Cr., thus expanding the achievable capacity to 220,000 MT. The plant will cater to the increasing agriculture demand in the international markets and also help the company increase its revenue contribution from the Indian markets. After completion of this project, the company targets a market share of 6.5-7% by FY 2015 from the current market share of around 3%.

Key concern:

- Rising debt level due to capacity expansion: BIL’s debt level will increase owing to the capacity expansion plans going forward. Any delay in completing the project and getting it on-stream could lead to a pressure on cash flows and debt repayment capacity.

- Heavy Dependence on exports could be a concern: The company derives about 90% of its total revenue from the overseas market, with Europe accounting for over two-thirds of total exports. The company is trying to diversify its geographical base and has seen revenues from other regions increase and expects revenue contribution from Indian market to increase.

Thus, considering all these factors we can say that the long term future prospects of Balkrishna Industries are Green (Very Good).

So,what does the fundamental analysis of the Balkrishna Industries say?

There is a huge potential market for OTR tyres in global market as well as in Indian market due to increased focus on infrastructure and agriculture. Over the last five years the company has benefited from a shift in demand towards radial tyres in OTR segment. Thus considering its presence in a niche market segment, low-cost manufacturing leading to a price advantage and significant entry barriers, Balkrishna Industries is well poised to make the most of its growth opportunities.

Yes, Balkrishna Industries Ltd. is an investment worthy company, but only at the right price. Currently, its stock price is at Rs. 137 (as on 7th April’ 2011. But, does this price offer an attractive discount to its right value (MRP) or is it over-priced? It is always best to invest at an attractive discount to its MRP, to get maximum returns at minimum risk. Become a member of MoneyWorks4me.com to know its sensible buy- price and hence take the right action for this company.

Disclaimer: This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while taking investment decisions.