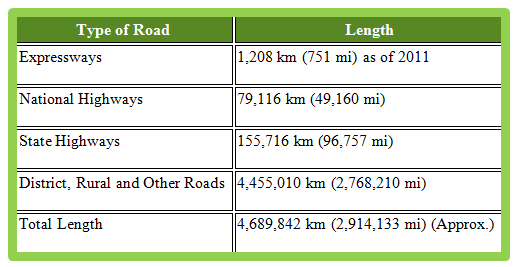

Road Construction forms the most crucial part of the economy. As per the National Highways Authority of India, about 65% of freight and 80% passenger traffic is carried by the roads. The National Highways carry about 40% of total road traffic, though only about 2% of the road network is covered by these roads. Average growth of the number of vehicles has been around 10.16% per annum over recent years.

At 0.66 km of highway per square kilometre of land the density of India’s highway network is higher than that of the United States (0.65) and far higher than that of China’s (0.16) or Brazil’s (0.20), however, the highways in India are narrow and congested with poor quality surface. All national highways are metalled, but very few are constructed of concrete, the most notable being the Mumbai-Pune Expressway and Yamuna Expressway. The major national highways include, the Golden Quadrilateral and North-South and East-West Corridors which link the largest cities in India, started by NDA government led by Atal Bihari Vajpayee.

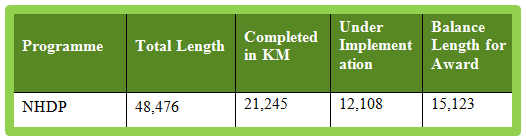

*As on FY 2014

What Does the past say?

Looking back, the construction sector has faced many headwinds due to indecisive nature of UPA led government concerning the environmental clearances and land acquisition, resulting into delay in execution of projects. In addition to that, poor governance and policy paralysis led to higher inflation rate with implied cost overruns. With no clear direction from the government with respect to funding of such projects, the companies have long tangled into bureaucratic procedures which have resulted into highly levered balance sheets.

With new government in the parliament led by Narendra Modi, with a strong conviction of infrastructure led growth of economy, there is a sense of revival in this sector. This segment is expected to pick up in FY15 through ordering of more than 2,300 km of new projects on Engineering, Procurement & Construction (EPC) mode, and 3,000 km in PPP mode. As per the budget, the government is committed to invest upto Rs. 37,880 Cr in NHAI and state roads with target construction of 8500km.

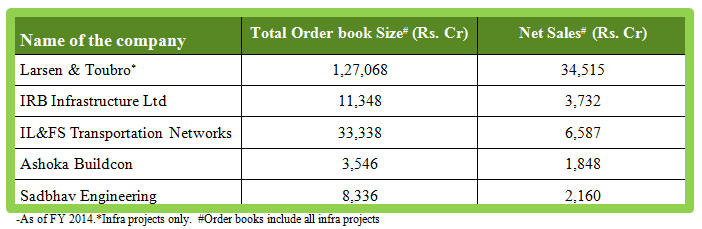

Here is the list of companies which are likely to benefit from upcoming projects:-

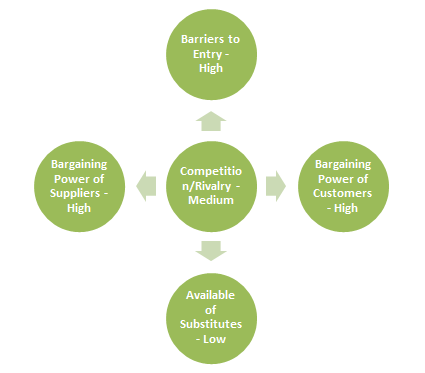

Porter’s Five Force Model for Infrastructure- Road Construction

Barriers to Entry – High

- Due to capital intensive nature of business with high outlay of funds in initial years of operations in form of capital, security deposit and working capital, the barriers to entry are high

- Since the sector is regulated by Government, the entry into large projects depends on government policies as to allow newer contractors to bid for projects

Available of substitutes – Low

- There has been increase in number of road contractors, but low capital raising ability restricts them from bidding for the large projects.

Bargaining power of Customers – High

- The sector is regulated by the government with respect to project order flows

- Due to lack of infrastructure funds flowing from the government, the consumers have to pay for the usage of the infrastructure facilities in BOT projects. However, the toll prices are regulated by the government, which may affect the cash flows

- Maintenance cost is passed on to the company post completion of the project

Bargain of suppliers – High

- Bitumen, semi-solid form of petroleum, is the major raw material which goes into construction of roads. Any fluctuation in global oil and gas prices affect the operating margins

- Low credit period offered by cement companies increases the funds blocked in working capital

- Since the projects are highly labour and sub-contractors intensive, the unavailability of these resources may pose a risk

Competition – Medium

- The competition is fierce amongst the corporates bidding for orders

- These companies have long execution history and have high capital raising ability for such long term projects. These companies get aggressive in acquiring the projects with competitive cost structure which may lower the economic value of the shareholders

- A sense of mutual understanding is also witnessed wherein the players take up projects in joint ventures and later sublet to the one having an edge in execution with respect to location and funds availability

Future Prospects:

Growth in economy

In present situation, the government is likely to break the policy gridlock and roll out approvals. More so, we expect lots of order flows pertaining to brownfield projects, which will kick start the halted projects in near future.

Increase in Traffic

Since a major chunk of projects are on BOT (Build, operate, Transfer) basis, increase in traffic will generate revenues and sooner capital realization. It is fair to assume that with increase in economic activity, the freight and passenger traffic is likely to bounce back.

Concerns:

Government Policies

As highlighted earlier, we believe that the government plays a key role in infrastructure projects. Since infrastructure is government driven initiative, active government will increase the prospects of the segment. However, any delay in award of projects or approval from the government will cripple the activities.

Land Acquisition

The government’s unclear directions pertaining to land acquisitions and inaction to acquire the land for development lead to delay in projects. The owner’s capital gets blocked resulting to poor cash flows.

Leverage

Due to large scope of projects, the companies heavily depend on debt to finance their assignments. The long concession period carries additional risks. Any variation in toll collections or timings of the cash flow may result into default of interest or part of debt. This will severely affect the earnings of the company and question the credibility of the company.

Regional Government

Historically, it is observed that the funds allocated to PMGSY and NHDP by central government are released in timely manner. However, there is standstill at the state government levels (PWD) with respect to release of funds. Many tenders are floated but they do not attract the players due to uncertainty in funds flow from the government.

Way forward:-

Going forward, if the government stance on infra-led growth continues, we can see implementation of infrastructure projects in positive and timely manner. Having said that, the companies having a portfolio with proportionate mix of projects at various stages, viz. (i) under-development, (ii) under-execution and (iii) operational, will see the day light tomorrow. The cash flow from operational projects will act as cushion and take care of capital requirement of intermediate projects. Assessing individual project cash flows with suitable internal rate of return will give better perspective of value. Given the nature of industry which is sensitive to interest rate, inflation and government policies, the companies having aggressive bidding strategy will end up with high debt in their balance sheets, skewed cash flow pattern and shrinking margins – hence, low income on capital.