Tell me more about Lovable Lingerie …

Lovable Lingerie Ltd (LLL) is one of the leading women’s innerwear manufacturers. Its products include brassieres, panties, slips/camisoles, home-wear, shape-wear, foundation garments and sleepwear products. The company’s flagship brands are “Lovable” (premium segment) and “Daisy Dee” (mid market segment). It acquired the premium brand ‘Lovable’ on an exclusive basis from US-based Lovable World Trading Company for the territories of India, Nepal, Sikkim and Bhutan in the year 2000. Currently, ‘Lovable’ is amongst the top three most-preferred brands in women’s innerwear in India. Incorporated in 1987, LLL is headquartered in Mumbai and has three manufacturing facilities with a total capacity of 6.75 mn pieces a year; two facilities are located in Bengaluru and one in Uttarakhand.

So, what’s the offer?

Lovable Lingerie plans to raise issue 45.5 lakh equity share (face value of Rs. 10 each) at a price band of Rs. 195-205. At the upper-end of the band, the company will raise around Rs. 93.28 Cr. of funds which will be used for the following activities:

What sets the company apart? Here’s the Lovable Lingerie Review and Analysis

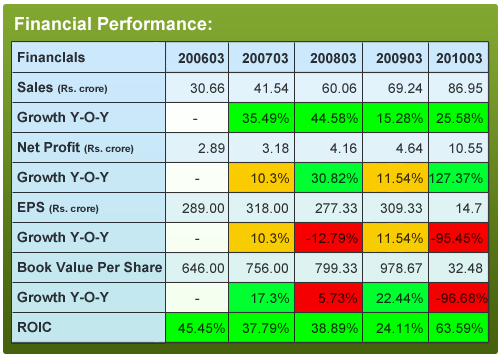

Financial Performance:

Lovable’s financial performance has been good over the last 5 years. It has recorded more than 30% and 42% CAGR growth in Net Sales and Net Profit respectively over the last 6 years. It has increased its equity base significantly in the last two years and as a result its EPS and BVPS have witnessed a drop. An impressive ROIC average of 42% over the last five years indicates an efficient utilisation of funds. With a debt of Rs. 16.3 Cr. (as of December 2010), its Debt to Net Profit ratio stands at a comfortable 0.97.

Strong Presence in Branded segment:

‘Lovable’ is India’s First Premium International Lingerie Brand and has been a pioneer in the Lingerie industry. Currently, it is one of the leading brands amongst all Large Format Chain Stores, Department Stores and Lingerie Stores. The company also has other brands like ‘Daisy Dee’ which caters to the mid-market segment and ‘College Style’ which caters to the teenage segment. ‘Lovable’ is amongst the top 3 most-preferred brands in the lingerie segment which helps the company stay ahead of the competition. Further, it has a product range of approximately 50 styles under ‘Lovable’ brand and a product range of approximately 100 styles under the ‘Daisy Dee’.

Robust distribution network:

Lovable’s distribution network is one of its key strengths. Its products are retailed through 103 distributors in India. The company supplies to approximately 1,425 retail outlets for ‘Lovable’ brand and around 7,500 retail outlets for ‘Daisy Dee’ brand. The number of retailers selling Lovable innerwear brands has grown steadily over the years from 100 in the year 1996 to 1,425 in the year 2010. Currently, the company has 121 counters in stores like Westside, Shoppers Stop, Lifestyle amongst others in across India.

Expansion Plans to meet rising Demand:

To meet the rising demand of branded lingerie, the company is setting up a manufacturing facility at Bengaluru with a capacity of 2.5 mn pieces a year at an estimated investment of Rs. 22.84 Cr. It will further invest an additional Rs. 25 Cr. in a 90:10 JV with Lifestyle Galleries of London Ltd, UK to introduce the brand ‘London Calling’ in India. Considering low penetration of branded products in India, it plans to set up 60 exclusive brand outlets (EBOs) for ‘Lovable’ across the country.

Rising disposable income and growing urbanization to drive growth:

The premium and super premium lingerie segment in India accounted for only ~16% of the total lingerie market in 2009. According to a research report by CARE, this segment is expected to grow more than 20% CAGR over 2009 – 2014E on account of rising disposable income levels, increasing number of working women, and shifting consumer preference towards branded products.

But, what are the concerns?

Highly competitive and fragmented market:

Lovable faces tough competition from both international and domestic (organized and un-organized) players. The major competitive brands are Triumph, Enamor and Jockey. Also, there is high competition from the highly dominant unorganized sector. Hence, to keep up with the competition in this industry, it has to develop very innovative product which should match the current life style of the targeted market. The high competition can also lead to customer switching over to other brands. All this may hamper its market share, revenue as well as margins.

Higher marketing & advertising expenditure may affect margins:

The company plans to spend Rs. 24 Cr. in the next two years to strengthen its brands to retain and increase its customer’s base. This is a significant increase from its previous spend on advertisement which was Rs. 2.65 Cr in FY 2010 and Rs. 4.33 Cr. in FY 2009. The company’s aggressive marketing focus may fuel the growth in its revenue but it is difficult to quantify the growth. This heavy marketing expenditure will most likely affect their margins in FY-12 and FY-13.

Concluding we can say that the company’s strong financial performance, strong presence in the branded segment and robust distribution network augurs well for its future growth. However high competition and ad-spends could hurt margins going forward.

So, should I invest in Lovable Lingerie IPO?

Lovable Lingerie Ltd. is offering 45.5 lakh equity share (face value of Rs. 10 each) through the IPO at a price band of Rs. 195-205.

According to MoneyWorks4me.com analysis, the IPO looks overpriced. Looking at all the scenarios, we expect that the company will continue to grow its revenue; but margins will most likely come down in near future due to its marketing spend. Considering the growth prospects we expect the company to grow its EPS at a rate of 16-18% on an average, in the coming years. We expect the company to trade at an earnings multiple of 16 going forward. At the current price band, the issue is priced at a PE band of 19.5 and 20.5 and seems high. At the upper end of the price band, the IPO offers virtually no margin of safety. Considering this, we advice retail investors to avoid subscribing to the issue.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463