Nothing pains the heart more than to see your stock investment portfolio filled with the colour red. But, over the last year or so, that has been the exact situation. The value of Sensex has gone nowhere and many stocks have taken a beating leading to losses.

We, as investors always try to find and invest in the best stocks that help us earn great returns. But this is easier said than done. It would be safe to assume that our stock portfolio does not always consist of all fundamentally strong stocks. But, what we need to understand is that even one rotten stock can spoil your portfolio returns and affect subsequent investment decisions. And this is more likely in the current situation when the global and domestic economy is experiencing a lot of problems. So, how do you assess the health of your stock investment portfolio? How do you know which stock can give you good returns over the long term and which stock won’t?

To help you find the answers to these very questions, MoneyWorks4me.com has launched a unique tool called Portfolio Verdict. This is a first of its kind application where investors can get an insightful analysis of their stock portfolio in just a few steps. What’s more, this tool is completely FREE to use!

So, how does the Portfolio Verdict tool help you assess your portfolio?

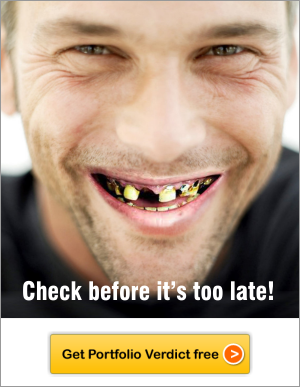

To get the Portfolio Verdict report, all you need to do is register for free and enter the names of 5 stocks in your portfolio and their average buy prices. Once you do this, a personalised report is created and mailed to you on the e-mail ID provided by you. What’s more is that this report is always available to you on the site for your reference. Sounds simple, doesn’t it? So do make sure that you get your portfolio verdict before it’s too late!

To get the Portfolio Verdict report, all you need to do is register for free and enter the names of 5 stocks in your portfolio and their average buy prices. Once you do this, a personalised report is created and mailed to you on the e-mail ID provided by you. What’s more is that this report is always available to you on the site for your reference. Sounds simple, doesn’t it? So do make sure that you get your portfolio verdict before it’s too late!

What does the report tell me?

The report provides an incisive analysis of the stocks entered by you in an easy-to-understand format. The Portfolio Verdict checks the stocks in your portfolio with respect to two critical factors:

1) Fundamental Verdict: Here the tool checks whether the company’s financial performance has been Green (Very Good), Orange (Somewhat Good) and Red (Not Good) by analysing its 10 YEAR X-RAY (a tool that helps you analyse the financial performance of a company). It is always best to have a major chunk of your portfolio invested in companies which have had an excellent (Green) financial performance and a small portion in somewhat good (Orange) stocks. Companies that have performed well in their business are the ones that will most likely help shareholders earn great returns in the long run. And companies that have had a bad (Red) financial performance are the ones that investors should stay away from.

Click here to read more about 10 YEAR X-RAY. Based on the colour codes, you also get a fundamentals score which gives you the overall fundamental strength of your portfolio.

2) Valuation verdict: The ‘Valuation Verdict’ column tells you how much upside your stocks have considering their current price and respective MRP as calculated by MoneyWorks4me.com. MRP is the reflection of the true worth of a stock, calculated based on the future earnings expectation of the company. If a stock is trading well above the MRP, it is overvalued (maybe you should consider selling the stock) and its potential upside is minimal while if it is quoting well below the MRP, it is undervalued and potential upside is high (If the upside is high, you may consider buying more of the stock and averaging).

With all of this, the report gives you action points for each of the individual stocks so you can take appropriate BUY/HOLD/SELL decisions. Thus all the information in this report is based on principles of fundamental analysis and can help you maximise your returns as also minimize your losses

The report concludes with observations about your investing style and suggests some actions you could take to improve your stock investing decisions.

So, to summarise the Portfolio Verdict helps you:

1) Analyse your top 5 stocks

2) Find their fundamental strength i.e. whether they are Green, Orange or Red.

3) Understand whether your investments are undervalued or overvalued

4) Find out which stocks to hold and which ones to sell

5) Get a personalized action plan to maximize returns

As mentioned before, it is imperative that in times like today, investors be aware of the stocks they have in their portfolio. Portfolio Verdict helps you do this so that you can get great returns from your stock investments.

So, what are you waiting for? Check out how solid your stocks portfolio is, for FREE!!