The Profit and Loss statement of any business is based on the following accounting equation.

Revenues – Expenses = Net Profit (or Loss)

Understandably then, if a company wants to show a better financial performance i.e. higher profits (lower loss) improperly, it can either manipulate revenues (show them to be higher than actual) or manipulate expenses (show them to be lower than actual). In the last Stock Shastra, we saw the various techniques through which companies can manipulate sales and some red flags which can help us find out such possible cases. So, what are the different techniques through which companies can manipulate their expenses? And what are the red flags to identify these potential manipulations? But before we get into this, let’s understand the basic logic behind recording expenses on financial statements.

The two-step process for recording expenses..

Companies account for their cost/expenditure in a two-step fashion.

Step 1 – Occurs at the time of expenditure – when the company pays the cost but does not receive the related benefit. This represents a future benefit to the company and is recorded on the balance sheet as an asset.

For e.g. consider a two-year insurance policy purchased by a company. At the inception, the entire amount represents a future benefit and would be classified as an asset on the balance sheet (in accounting jargon – the cost is capitalized)

Step 2 – Happens when the benefit is received. At this point, the cost should be shifted from the balance sheet to the profit and loss statement and recorded as an expense.

Continuing with our example of the insurance policy, one year down the line, half the cost would be shown as expense and half as an asset. After the second year, the remaining cost would be expensed and none of the cost would remain as an asset.

So, how does a company exactly manipulate its expenses? The answer is quite simple: By exerting an influence over the speed at which these two-steps happen. If management knows that the earnings are expected to suffer in the next few quarters, it can slow down the movement of expenses from Step 1 to step 2. It can keep costs frozen on Step 1 on the balance sheet instead of moving them as expenses to the profit and loss statement thereby preventing them from reducing earnings until a later period. In other words, management shifts its current expenses to a later period thus inflating its current profits.

The different techniques to shift current expenses to a later period…

There are four ways in which companies can shift current expenses to a later period. These are

1) Improperly capitalizing normal operating expenses on the balance sheet

2) Amortizing costs too slowly

3) Failing to write down assets with impaired value

4) Failing to record expenses for uncollectible receivables and devalued investments

1) Improperly capitalizing operating expenses on the balance sheet:

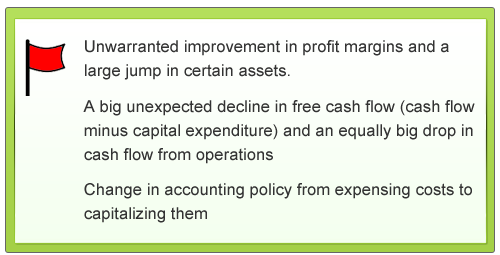

In simple terms, management takes only one step when actually two are required. So, costs such as marketing costs, software development costs, research and development costs are improperly capitalized (frozen on the balance sheet) instead of expensing. This is exactly what WorldCom Inc. did in 2000.

During the dot-com boom in 1990s, telecom services major, WorldCom, entered into many long-term agreements with other telecom carriers; WorldCom agreed to pay them for the right to use their telecommunication networks. These costs were called line costs. However, with the meltdown in 2000, and revenue growth slowing down, investors started paying more attention to WorldCom’s large operating expenses – the major portion of which was line costs. Becoming concerned about its ability to meet the expectations of investors, WorldCom played a simple trick to keep earnings afloat. In mid-2000, it began concealing some line costs through a sudden and very significant change in its accounting. It capitalized large portions of these line costs as assets thus grossly understating expenses and overstating profits from mid-2000 to early 2002.

Other costs which have been similarly manipulated by companies in the past include marketing and solicitation costs, software development costs and research and development costs. Typically, software development costs and R & D costs should be expensed in the early stages. Later stage costs (those incurred once it is certain that the product/project will be feasible and will generate revenues) should be capitalized. However, companies sometimes capitalize these costs too quickly leading to overstated profits.

So, what are the red flags to identify such companies?

2) Amortizing costs too slowly:

The nature of a cost and the timing of its related benefits dictate the length of time that this cost remains of the balance sheet. Assets such as machinery or equipment provide a much longer-term benefit compared to other assets. As such expenditure made for purchasing these assets remains on the balance sheet for the duration of their useful lives and is gradually expensed through depreciation or amortization.

Thus, the next way through which companies manipulate expenses is amortizing or depreciating costs too slowly. In terms of the two-step process, companies basically take the second step too slowly. This can involve depreciating assets slower than comparable companies and increasing or stretching out the depreciation period.

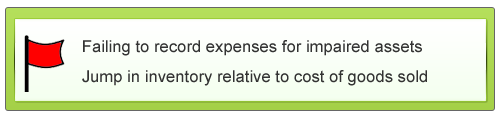

3) Failing to write down assets with impaired value:

Consider company ABC which has a piece of equipment that will be depreciated over a period of 10 years. Suppose, during year 5 the equipment breaks down permanently or in accounting terminology becomes impaired. What should the company do? Ideally the original depreciation schedule must be abandoned and the remaining asset balance must be moved to expense section immediately. If the company however chooses to continue depreciating the asset according to the original 10-year plan, it will have failed to write-down an appropriately capitalized cost that had later become impaired. Once again in terms of the two steps, this technique means company freezes the movement between step 1 and step 2. It fails to record an expense for costs which were properly capitalized but which reduced in value before the expected benefit was received. Similarly excess inventory which may have become obsolete should be written off by recording an expense and reducing the inventory balance on the balance sheet.

4) Failing to record expenses for uncollectible receivables and devalued investments:

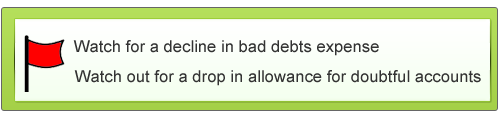

Some companies are lucky to have customers who always pay their bills in full. However, most companies will have a certain number of clients who will fail do so. When this happens companies cannot just close their eyes and pray that all their receivables will eventually be collected. Accounting rules require that accounts receivable should be written down each period by recording an estimated expense for likely bad debts. Companies which fail to do this overstate profits.

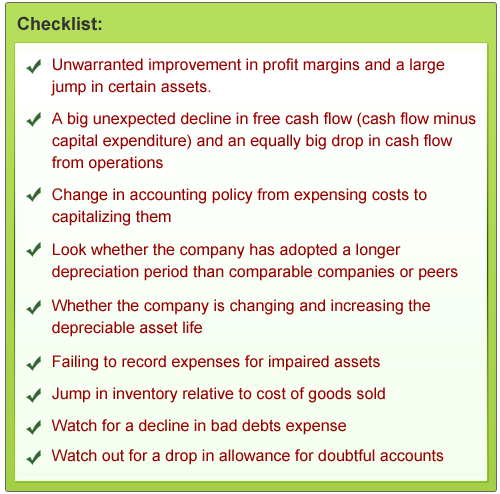

Summarizing, these are just a few ways in which companies can manipulate their expenses. Detecting such signs of possible manipulation will require to carefully going through the Annual Report of a company, especially the various schedules and notes to accounts. The information thus obtained needs to be analysed with respect to what the management has said in the past and its plans for the future. Though time-consuming, doing this will ensure that we do not waste our hard-earned money in investing in fraud companies. Here’s a checklist summarizing the red-flags to spot expense manipulations

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

2 comments