What is Index@MRP?

As investors, we are used to seeing the stock indices move every minute. And to make investing more profitable and not a game of mere chance we need a solution. A solution which could help us ascertain whether the market is over-reacting or under-reacting, whether it is grossly depressed or irrationally exuberant; so that you can decide whether you should BUY stocks or SELL them off. This is exactly what Index@MRP is!

Stocks are driven by their earnings over the long term. The MRP at MoneyWorks4me is based on the long-term earnings capacity of the company. Thus Index@MRP gives an indication of whether stocks in a particular sector are fairly valued or whether irrationality is driving prices in this sector.

Check our earlier reports on Sensex@MRP to learn more about this unique concept. Click here

BSE FMCG@MRP value

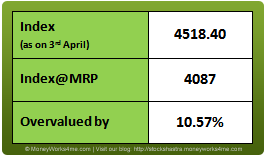

As on 3rd April 2012, BSE FMCG index closed at 4518.40, which is 10.57% or ~431 points above the FMCG@MRP of 4087. This indicates that the index is overvalued at this point of time. While the December quarter results have been pretty good for the top companies, a major reason for the overvaluation could be attributed to the current economic scenario. In times of economic uncertainity, investors tend to flock defensive sectors like FMCG driving up prices of the companies which seems to be the case with the FMCG sector currently.

As on 3rd April 2012, BSE FMCG index closed at 4518.40, which is 10.57% or ~431 points above the FMCG@MRP of 4087. This indicates that the index is overvalued at this point of time. While the December quarter results have been pretty good for the top companies, a major reason for the overvaluation could be attributed to the current economic scenario. In times of economic uncertainity, investors tend to flock defensive sectors like FMCG driving up prices of the companies which seems to be the case with the FMCG sector currently.

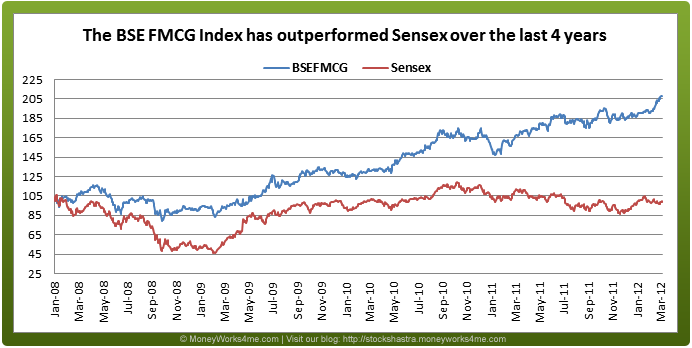

This is also reflected in the performance of the BSE FMCG index as compared to Sensex over the last 4 years. In 2008-09, stock markets were affected by economic downturn due to subprime crisis in US economy. Thereafter, markets recovered in 2010 on back of fiscal stimulus and got hit again in 2011 due to European debt crisis and other domestic reasons. During this period, the Sensex has been volatile and has virtually given zero returns over the four year period. As compared to this, the BSE FMCG index has outperformed delivering ~20% returns (CAGR).

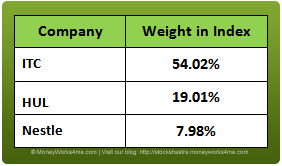

Index concentration level: The index is largely driven by ITC and HUL, as they contribute around 75% to the total index. Both companies have posted good results, thus helping the index to grow despite weak domestic market. If both these companies are excluded then the index comes out to be overvalued by only 7.82%. Therefore, the index has high dependency on these two companies.

Sector Analysis: Overview of 9 months performance:

Net sales & net profit analysis: For the 9 month period of FY 12, the cumulative net sales of the FMCG index companies have gone up by ~28%. Cumulative net profit has also witnessed a growth of ~22% as compared to the same period last year despite severe domestic economic condition. All companies have posted more than 15% sales growth except United Breweries Ltd (10% sales growth). As far as profitability is concerned, 7 companies have posted profit growth of more than 15%. Despite rising commodity prices and adverse currency fluctuations, the FMCG companies have performed well over the 9 months period. Despite inflationary pressures the companies have more or less passed on the high input costs to the consumers in a bid to maintain margins. Volume growth has also been good.

Future Outlook:

After a disappointing budget, the domestic economy is expected to remain in red zone for couple of quarters due to high fiscal deficit (5.9% of GDP) and lack of much needed reforms. Going forward, RBI’s monetary action and annual corporate results will decide the market movement. It is expected that interest rates could be decreased in coming months to revive the growth of the economy. This could the next positive trigger for the market. In the absence of such softening of interest rates, we expect the markets to remain volatile.

Industry, in particular: The Union Budget 2012-13 proved to a mixed bag for the FMCG industry. On one hand, minor increase in the tax exemption limits and some incentives on equity investments were positives as this would increase the disposable income levels. But on the other hand, the increase in excise duty more or less offset the above effect. We feel that smaller players would find it difficult to pass on the duty hikes to end consumers and will chose to take the brunt of this hike in a bid to maintain and grow market share. On the other hand, deep-pocket players like Nestle, ITC and HUL with their leadership position and strong brands will be able to pass on the hike to consumers.

Going forward, the easing of raw material prices and appreciation of rupee against dollar would help the FMCG companies to maintain their margins in future. With increase in disposable income and favourable government policies, net sales growth is expected to remain robust in coming quarters. Considering on-going economic uncertainty, we expect that FMCG industry will remain an attractive industry for investment, being a safe haven for investors.

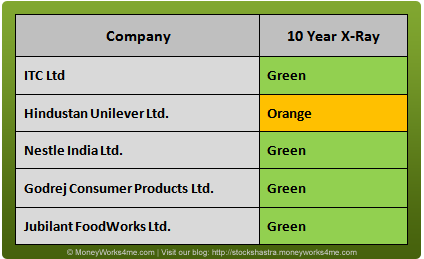

FMCG industry, as an investment: FMCG index has consistently given good return to investors over the years. Infact, FMCG index has given a return of 12% in 2011 despite negative returns from Sensex. Going forward, HUL and ITC are expected to record good performance, which could lead to positive impact on the valuation of the overall FMCG index. In FY-11, HUL has changed its business strategy and started focusing on rural market through increase in ad-spends, new launches and expanding distribution network. As a result, it posted good results so far and is expected to deliver good results in coming quarters as well. ITC, market leader in cigarettes, has benefitted by favourable announcement in the Union Budget-13 wherein the Government increased the excise duty on bidi and other tobacco products which could lead to consumers shifting to cigarettes. With favourable government policies and its focus on growing food processing category, ITC is expected to post good results in coming years. Thus, FMCG index, being a defensive sector, will remain a safe bet for investors.

But, as the FMCG@MRP figure indicates, most of the companies are trading at a premium to their MRPs. Despite this, there are a few fundamentally sound companies in FMCG industry, which are currently available at a good discount from their MRPs (intrinsic value). With the overall economic situation not expected to change much in the coming quarters, investors would be well-advised to:

Be on the lookout for attractive buying opportunities in the FMCG sector to protect your capital as well as get good returns over the long-term.

To find which companies in the FMCG sector offer good buying opportunities, log on to MoneyWorks4me.com.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

No doubt these information is very relevent