Some days back we came out with our latest report on Sensex@MRP – our take on the market which helps you understand the fair value of Sensex as a whole and whether the market is irrationally exuberant or panicky. Sensex@MRP, considering the March 2011 quarterly results, stood at 20717 whereas the Sensex stood at 17985 (when we wrote the report i.e. 16th June). This meant that the Sensex was close to 12% below the Sensex@MRP. However, the last 2 weeks have seen a rally and a rise in Sensex leading to this gap narrowing down to close to 9%.

Now, while we have been writing about Sensex, some of our readers have been curious about where the Nifty – a broader index than Sensex – stands with respect to Nifty@MRP. So, here’s the lowdown on Nifty@MRP

Revisiting the basics

Before we get into the nitty-gritty’s of Nifty@MRP, let’s just quickly revisit the concept of Sensex@MRP. Sensex@MRP has been our effort to make sense of the benchmark index Sensex. Considering that the Sensex stocks are the top-traded stocks of the country, we can expect them to be traded at their MRPs –the maximum price that you should be willing to pay for a stock which is dependent on the earnings capacity of the company. Thus, Sensex@MRP gives an indication of whether the Sensex is fairly valued or whether irrationality is driving the markets. However, as mentioned before, quite a few people tend to follow Nifty more than the Sensex. Nifty is composed of 50 of the top companies on the NSE whereas the Sensex comprises of 30 top companies on BSE. All the Sensex 30 companies are part of the Nifty. Thus Nifty is a broader market index as well as more liquid.

So, where does the Nifty@MRP stand?

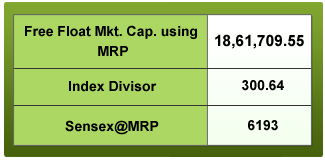

The free float market capitalization at the MRP of the individual stocks as computed by us at MoneyWorks4me.com and using share data as on 30th June 2011 is Rs. 18,61,709.55 Cr. Using the index divisor 300.64 (as on 30th June 2011), Nifty@MRP comes out to 6193. This means Nifty is 533 points or 8.6% below the Nifty@MRP.

With the rally seen in the last 2 weeks, Nifty stood at 5660 on 8th July, 2011. This gap has narrowed during the preceding 2 weeks. However, with India Inc. facing numerous headwinds going forward, the gap is expected to widen. We re-iterate the conclusion given in the Sensex@MRP report – buying opportunities are expected to increase going forward.

What do the earnings reveal?

Full year performance:

An analysis of the full year performance of the 50 companies which form the Nifty reveals that a large number of companies – 39 to be exact – recorded a growth of more than 5% in Net Sales on a Y-o-Y basis. However, a lesser number of companies could pass on this growth to Net Profits with only 28 companies recording a growth of more than 5% as compared to the FY 2010 numbers. The leaders from the Nifty companies were Sesa Goa, Axis Bank, Bajaj Auto, BHEL and Jindal Steel. Bajaj Auto BHEL were also a part of the leaders from the Sensex list.

An analysis of the full year performance of the 50 companies which form the Nifty reveals that a large number of companies – 39 to be exact – recorded a growth of more than 5% in Net Sales on a Y-o-Y basis. However, a lesser number of companies could pass on this growth to Net Profits with only 28 companies recording a growth of more than 5% as compared to the FY 2010 numbers. The leaders from the Nifty companies were Sesa Goa, Axis Bank, Bajaj Auto, BHEL and Jindal Steel. Bajaj Auto BHEL were also a part of the leaders from the Sensex list.

Sesa Goa recorded an impressive growth of around 62% in both the topline as well as Net Profits on a standalone basis. Axis bank reported 31% increase in the NII and a 35% increase in Net Profit. Bajaj Auto outperformed in the automobile space with around 50% profit growth as compared to FY 10 on back of higher demand in the market. Jindal Steel continued with its stellar performance seen in the last quarters and registered 29.7% and 39.5% growth in Net Sales and Net Profit respectively.

The companies which lagged behind in the performance in FY 2011 included Reliance Communications, SBI, Reliance Infra., Hero Honda and ACC. Continuing with its dismal performance and burdened by high debt, Reliance Communication reported a loss of Rs. 764 Cr. Though SBI posted good credit growth, its profit suffered considerably due to significant increase in provisions for non-performing assets (NPA). Hero Honda recorded a growth of more than 20% in topline but margins declined by around 8-10% due to increase in raw material costs leading to a drop in Net Profits by 11%. ACC reported a drop of 4% in Net Sales whereas Net Profits reported a drop of 30%.

So, what should we as investors do??

The rising raw material prices continued to be a major concern for the companies as well as the RBI. The RBI has increased key interest rates as much as 10 times during the past year or so in its bid to rein in inflation. So, while companies have till now suffered on the raw material front, going ahead, rising interest costs are further expected to dent profitability. Going ahead, capex projects may get delayed leading to lower growth in sales. Also sectors like Auto, Banking and Capital Goods may suffer due to lower demand. Companies which will be impacted the most are the ones who are highly leveraged and do not have sufficient pricing power.

With the Greece bailout package coming through, things seem to have steadied somewhat in Europe atleast for the time being. The market reacted to this happening positively and we saw a rally over the last week after a sustained sell-off period. But again over the last 2 days, the bears have outdone the bulls leading to fall. With such a roller-coaster movement seen in the markets, currently 24 of the 50 Nifty companies are quoting below their MRP whereas the rest 26 are quoting above their MRP.

As we mentioned in our earlier report on Sensex@MRP, things do not look good going forward considering the global and domestic economic situation. With headwinds such as high interest costs and inflation denting margins coupled with global instability, the gap between Nifty and Nifty@MRP is expected to widen further with the selloff continuing. However, while the market is expected to remain volatile in the short term, it looks attractive for the long term. Thus, buying opportunities are expected to increase going forward.

We re-iterate our view given before that as investors, the best thing to do now is to look for companies who are not burdened by high debt and command pricing power considering the inflationary environment. Investors should look to buy such fundamentally strong companies at a high discount (healthy margin of safety), and hold them for long term.

Buying opportunities are expected to increase going forward. Make sure that you buy a company which is fundamentally strong and is available at a healthy margin of safety.

To do this make sure you check the MRP of your stock on MoneyWorks4me.com.

Disclaimer: This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while taking investment decisions.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463