Introduction:

Thanks to an intricately integrated world, something as small as a microbe originating in one province of China has the power to engulf everything from the economy to the lives of people and cloud the present, the future, and put our very survival in uncertainty.

Almost everyone in the market including the Harvard Business Review seems to be convinced that the aftermath of the COVID-19 crash would be a V-shaped recovery where growth eventually rebounds- as was the case after the previous pandemic-induced recessions of SARS and Spanish Flu.

However, as long-term investors, we shouldn’t be concerned if it is a V, or W, or U, or L-shaped recovery. What we should be concerned with is identifying businesses that will weather a long-term storm if it turns out that way.

Impact of COVID on businesses

The US benchmark oil futures contract — West Texas Intermediate (WTI) made history in April 2020 for the first time entering negative territory. Prices had fallen to minus $37 per barrel (made possible due to an extreme glitch in the way oil futures operate) due to the steep fall in demand while the availability remained uncontrolled.

People all over the world are locked down in their homes, to be safe from COVID-19, and factories are shut. Add to this the price war between Saudi Arabia and Russia, the world’s biggest oil producers. The result- an unprecedented fall in oil demand globally—

“so much so that we ran out of space to store it, and ultimately producers and traders had to pay buyers to take it off their hands!”

This, unfortunately, is not just a single industry. The travel & tourism, hospitality, food, and entertainment industries had almost come to a standstill. Consumption other than essential items e.g. consumer staples had fallen. Consumer discretionary hit worse than others. This has also affected commodities.

The manufacturing sector is coming to a halt due to migrant workers returning home to be safe from COVID-19 and the lack of money to stay in the cities. Border lockdowns and shipping restrictions have only furthered the panic.

Governments all over the world have introduced travel restrictions to try to contain the virus. Airlines have cut flights and customers have canceled business trips and holidays.

Impact of COVID-19 on Global Economy

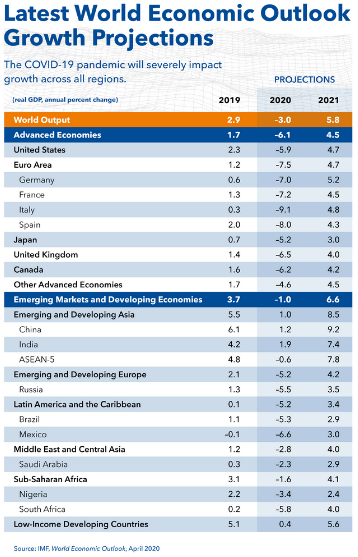

Investors fear the spread of the coronavirus will destroy economic growth and fears of recession loom large. The IMF projects the global economy to contract by 3% in 2020. In a base case scenario, which assumes that the pandemic fades in the second half of 2020, the IMF expects global growth to rise to 5.8% next year. India and China are the only two economies projected to grow in 2020. The IMF expects the Indian economy to grow by 1.9% in 2020, followed by a 7.4% growth in 2021.

However, as we all know, predictions about the economy rarely turn outright and it is more so in this case.

As an excellent article by Mark Lilla, a professor of humanities at Columbia University, which appeared in The New York Times stated, ‘the post-COVID-19 future doesn’t exist. It will exist only after we have made it.’

The IMF’s projections coming true depends on:

- how effectively all countries can control the pandemic

- how many people will fall ill in turn depends on

- how people react to lockdowns and reopening of economies

- will they be cautious enough

- are the countries testing enough

- will reopening of economies also resume the spread of disease and force new lockdowns

- how soon can we develop a vaccine

- will the various fiscal and monetary policies by countries world over suffice to offset the economic damage caused by COVID-19

Like Howard Marks said in his memo dated May 11, 2020,

‘if you’ve never experienced something before, you can’t say you know how it’s going to turn out.’

Steps taken by Governments

The response of governments all over the world is unprecedented too. Put together, a $10 trillion stimulus has been announced, by governments world over, just in the first two months, which is three times more than the response to the 2008–09 financial crisis. Given the broad global impact of the COVID-19 crisis, few populations, businesses, sectors, or regions have been able to avoid the knock-on economic effects. That means government measures have had to support large parts of the economy in a very short time to maintain financial stability, maintain household economic welfare, and help companies survive the crisis.

But has it worked?

The crisis is far from over, and recent consumer surveys show that spending is not coming back yet. This is somewhat expected. The world’s economic response to date has focused on relief. Further interventions will likely be necessary to revive aggregate demand once economies reopen if consumer and business sentiments do not fully rebound, resulting in muted spending and investment.

Senior economics consultant Neil Irwin summed it up best in a New York Times article on April 16, when he says

‘It would be foolish, amid such uncertainty, to make overly confident predictions about how the world economic order will look in five years or even five months.

It’s however, safe to say that the global economy will be completely different from the one that has prevailed in recent decades. And the companies and countries that can evolve with these changing times will emerge as the new leaders.

India’s economic recovery and opportunities

India has the capability to turnaround the COVID 19 crisis into an opportunity by becoming a manufacturing hub. Many countries including Japan and the USA have indicated that they would be moving their manufacturing operations to other countries from China. Buyers across the globe are looking for other sourcing solutions. These include products ranging from homeware, ceramics, fashion and lifestyle goods, textiles, and engineering goods. As the supply chain remains distorted and disrupted as an effort to contain the spread of the virus, India may enter multiple trade channels as a more feasible supplier for raw materials and manufactured goods. This in turn will bring in substantial foreign investments and provide a much need impetus to the economy.

India can also leverage its competitive advantage in the fields of pharmaceuticals, biotechnology, medical tourism, and information technology. In IT itself, India’s capability and unbeatable competence as an outsourcing hub for both core and non-core operations are standing out amidst the global COVID-19 pandemic. the initiative is a step in the right direction.

Impact on Stock Markets

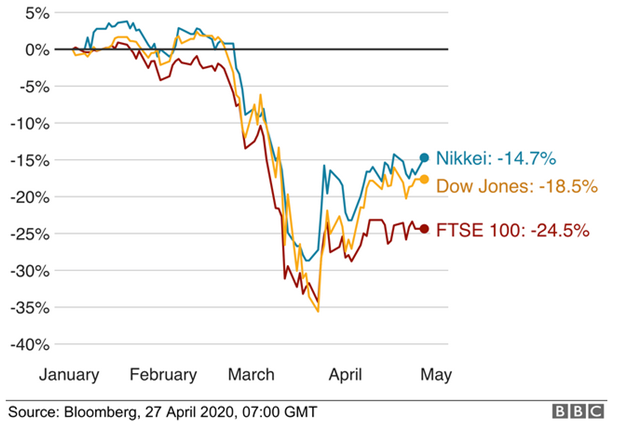

The onset of novel coronavirus has led to panic selling episodes and global share market crashes worldwide.

The FTSE, Dow Jones Industrial Average, and the Nikkei have all seen huge falls since the outbreak began on 31 December.

Both the Dow Jones and India’s Nifty index fell by as much as 35%.

UK’s FTSE, Japan’s Nikkei, and the NASDAQ fared better declining by 26%, 24%, and 22%, respectively in the same period.

Brazil’s BVSP BOVESPA was down by 31.6% while France’s CAC 40 was down by 25.8%.

Germany’s DAX was down by 19.9% and MOEX Russia was down by 13.6%.

While most nations are struggling with the fallout initiated by the pandemic, the source of the pandemic – China – has seen the least decline in its benchmark index, the SSE COMPOSITE which declined just 8.8% in the said period.

Thanks to the unprecedented fiscal and monetary stimulus world over, stock markets have bounced back as quickly as they had fallen.

The Nasdaq and Japan’s Nikkei are back to their previous highs. The Dow Jones is down by merely 1.5%. India’s Nifty and UK’s FTSE have recovered too but still remain about 15% down from previous highs.

Now that we’ve seen how the markets reacted, how should you – the investor – react to these changing times? Let’s take a look.

Two things you shouldn’t do now when the stock market is in the red and volatile

Volatility in the stock market due to COVID-19 has affected every person differently depending on their financial situation. As the stock market declines, many of you may be confused and thinking — how to respond at this time?

Here are a few things no to do when the stock market’s being volatile —

-

Don’t panic sell (but also don’t hesitate to sell when required)

Shelby MC Davis said

“Invest for the long haul. Don’t get too greedy, and don’t get too scared.”

Panic selling is the worst thing to do during this pandemic panic. Instead, you need to reassess your portfolio with a calm mind. Sell out investments in which your previous hypothesis doesn’t hold. Realign your portfolio to make it stronger and in the process, it is okay to sell some stocks at a loss and buy fundamentally stronger companies that are also available at attractive prices. Also, look for the opportunities to put unused cash into the right investment. Look for companies that will perform well irrespective of the time taken for recovery.

-

Don’t Stop SIPs

Stopping SIPs because of the fall in the market is a big mistake that retail investors sometimes make. Investors don’t need to stop their Systematic Investment Plan (SIPs) in equity funds when the stock market is in the red. Instead, when the market tumbles, stick to the SIP discipline (provided the selection was correct to start with) because it will help you to achieve their long-term investment goals.

As Charlie Munger said, “Waiting helps you as an investor, and a lot of people just can’t stand to wait. If you didn’t get the deferred-gratification gene, you’ve got to work very hard to overcome that.”

Stopping your SIPs will only defeat the very purpose of starting it and interrupt the compounding benefits of equities.

A correction is in fact, a time to increase your SIPs.

What should you do

Benjamin Graham said, “The best way to measure your investing success is not by whether you’re beating the market but by whether you’ve put in place a financial plan and a behavioral discipline that are likely to get you where you want to go.”

If you haven’t already listed out your financial goals and planned on how to achieve them, there is no better time to start.

But before that, you need to take care of these essential commitments:

3 essential things to do before you invest:

Given that companies are hit adversely by the pandemic and the lockdown, it is extremely important that remain in a financially sound position to take on unexpected situations. Before thinking of investing, it is paramount that you put you and your family members first and ensure their lives are secured.

Here’s what you should look at right now in the order of priority:

- Health insurance to cover any medical expenses for yourself and family

- Life insurance term plan to cover the income you are likely to earn in the future say 20 years (in case of your death or otherwise inability to earn this)

- An emergency fund of 6 to 12 months of your expenses in case you are in-between jobs for whatever reasons

The two insurances are expenses while the third is money you put in a Fixed Deposit (in the top 3 banks and no less). The emergency fund is even more essential today, where there are increased chances of job losses and emergency health-related expenditures.

Calculating investable surplus:

The 4th essential thing that follows the above is estimating the money available for investing your investable surplus.

First, check how much investable surplus you generate every month.

From your total monthly income, you subtract your monthly expenses (include the money you have to spend on your life and health insurance).

Some expenses we incur once or twice in the year e.g. vacation, convert this into a monthly amount. Any EMIs will also have to be provided for thus reducing the monthly surplus.

Now to estimate your lumpsum investable surplus. After setting aside your emergency fund, the savings are all an investable surplus. However, if you have any big expenses in the next 5 years you need to set aside money for this, again invest in an FD.

You will see that in the MoneyWorks4me Financial Planning this expense (happening in the next 5 years) is always put in the Debt or fixed income asset. The money that you can invest in Equity is money you don’t require in the next 5+ years and even longer.

Where should you invest?

As a retail investor you should invest in multiple assets for the right reasons:

- Equity (stocks and mutual funds) to earn high (well over inflation rate returns but it carries risk

- Debt Funds/FD (fixed-income funds): to keep a portion of your money safe and if possible earn returns slightly better than inflation. (not all Debt Funds are low risk, but you need to choose the low risk funds/options when investing. Investing in debt funds with higher risk e.g. credit risks to earn higher returns goes against the very purpose of the allocation to Fixed Income Assets)

- Gold – As insurance in times of distress like an earthquake, currency crises, economic risks, or government failures.

How much to invest in each asset class?

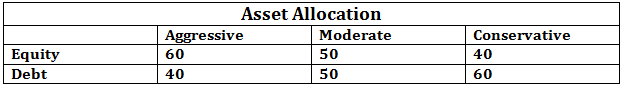

There are certain well established and time-tested rules that govern how much of your surplus you should invest in different asset classes. This is known as asset allocation in investing parlance.

This is determined by your Risk Profile i.e. your ability and willingness to take risks. Your ability to take risk depends on your income, expenses, age, responsibilities, total net worth, etc. Your willingness to take risks is determined by your temperament, how much risk or loss you are able to handle beyond which you are likely to take incorrect decisions out of fear or inability to handle the pain and discomfort.

This requires you to answer a Risk Profiling Questionnaire which then informs you what asset allocation suit you. You will then be assigned to any of the following 3 categories: Conservative, Moderate, and Aggressive with a Debt: Equity allocation of 60:40, 50:50 and 40:60 respectively.

Why is asset allocation important, especially in steep market corrections?

By allocating a portion of your investable surplus to Fixed Income assets popularly known as Debt Funds, Bonds, Fixed Deposits, etc, investors can navigate market corrections and cut losses significantly.

So, if you allocate 1 Cr in a 50:50 ratio to Debt and Equity, a 25% fall in the market (like the current COVID-19 crisis) would probably result in about 12.5% drop in your portfolio; 12.5 lacs on your 1 Cr portfolio. The 50% allocated to Debt would earn you some returns say 6% i.e. 3 lacs on your 50 lacs resulting in you seeing a 9.5 lacs drop in your portfolio.

This will cause you some pain no doubt but not distress or panic (better than losing 25 lakhs if you had invested 100% in equity), thus ensuring you stay invested. And even if you have a goal that needs funding you don’t have to sell your stocks but can fund it from your Debt investment e.g. by breaking an FD.

How to build your Equity Portfolio?

The objective of your investment in equity is to earn healthy high returns by taking manageable risks. You cannot avoid risk when investing in Equity but by having reasonable returns expectations you manage it at a level where you stay invested. You can build your equity portfolio by investing in:

- Direct Stocks

- Actively Managed Mutual Funds

- Index funds and ETFs

How does one decide the mix Stocks: MF: Index?

There is no model allocation. The mix between Stocks:MF: Index would depend on an individual’s preference. All three have risks as they belong to the equity asset class.

Index funds should be limited as returns are likely to be lower than the MFs/stocks portfolio. The allocation to Stocks: MF will depend on your ability to stomach volatility. The stock portfolio will be more volatile than an MF portfolio and can cause investors to take irrational decisions like not booking losses frequently, the inability to stay invested, etc.

Important tips for investing in the stock market amidst a pandemic

-

Be diversified:

One of the best ways to manage risk in your portfolio is to diversify your investments. You can diversify both within and among different asset classes, and within particular asset subclasses. The key lies in building your portfolio with investments that are not correlated to each other. There is no simple answer to how many different investments and the different types you should own to diversify your portfolio broadly enough to manage investment risk. However, talking to a licensed investment professional like MoneyWorks4Me can help.

-

Invest for the long term:

Marathon or a sprint, what would you prefer when it comes to making an investment decision? While short-term investments have their perks, long-term investment is the way to go. Long-term investments allow compounding to work the magic on your portfolio. Long term investments also reduce the risks substantially, as equities have proven to have positive ROI over the long term, no matter when you invested. Long term investments also reduce trading expenses and provide tax advantages to capital gains.

-

Invest in tranches:

Investing in tranches is an effective strategy in uncertain times like the correction due to COVID 19. It allows you to take advantage of the correction in case the stock market corrects further. At the same time, it saves you from the fear of missing out if the stock markets rise and lend courage to average up your investments.

-

Invest in quality companies/funds:

Quality-companies are those that have delivered profitable results even during a tough market and economic conditions. In fact, they are ones that have bounced back at the stock market after the COVID-19 tumble.

- Look for a proven track record over 10 years as it usually has at least one tough period.

- Only companies with some moat-competitive edge can deliver this performance.

- Look at the key ratios and if most of them are good you have found a quality company.

Sounds complicated? Don’t worry!

At Moneyworks4me, we have simplified this through a unique colour-coded 10-Year X-ray of companies that would indicate the health of a company with a single glance.

For details read, ‘How to Choose Quality Companies?‘

-

Don’t borrow money to invest:

Borrowing money to invest can be extremely risky and can wipe out your entire capital. One reason for this is that there is no guarantee that your investments will go up soon enough to afford the interest payment. If your investment does go down, you will end up borrowing more money to cover up the losses, in turn paying higher interest, and the vicious cycle continues. The losses also impact you behaviorally, leading you into making suboptimal decisions. Investing in equity is always done with your own money.

-

Invest using Quality at a Reasonable Price (QaRP) method:

QaRP is a way of investing most suited for retail stock investors. This method ensures you invest exclusively in quality companies at reasonable prices. This reduces the chances and extent of a fall in your net worth and thereby dramatically increases your chances of staying invested. Wealth is the outcome of staying invested and compounding the growth of your investment.

There are other ways of investing in stocks – Growth, Value, Quality (at any price), Momentum, Small Cap, etc. However, they demand higher risk-taking ability and higher tolerance to volatility and less than what most of us have. You can invest in these through suitable mutual funds. -

Do not forget Smart Asset Allocation:

Smart Allocation ensures you earn higher than FD returns on the Debt portion of your investment without having to invest in risky debt assets.

In the conventional asset allocation, your portfolio is rebalanced to the debt-equity ratio dictated by your risk profile. In smart asset allocation, when the market corrects and falls below fair value levels and high-quality stocks are available at attractive discounts the asset allocation is changed to increase equity e.g. from 50:50 for moderate it could go to 40:60. You can move a portion from Liquid funds to Equity. When the market goes back to fair value levels or above you move some money back to Liquid funds by selling some equity and you restore your original asset allocation. If the market goes substantially above fair value then using smart asset allocation can reduce the allocation to equity.

If you manage this correctly, a major portion of your funds allocated to debt should be invested very safely in FD (Top 3 banks) and Government securities- GILT bonds and the rest parked in a Liquid Fund. With smart asset allocation, you can invest a portion of the Liquid Funds in high-quality stocks or an Index fund or a Blue-chip/large Cap fund when the market offers attractive discounts instead of risky debt funds.

-

Manage your risks:

The adage “No Risk, No Gain” is equally significant in today’s time if you are planning to invest in assets. While FDs at State Bank of India may be the safest option, returns on this asset will also be the lowest. Similarly, though equities provide the highest return, they also come with substantial risk and the high volatility is not every investor’s cup of tea. To attain equilibrium between the risk and gain, you must seek the assistance of the domain advisors.

A fiduciary advisor will assist you to take calculated risks and participate only in those opportunities whose returns compensate well for the risks undertaken.

To be better prepared to manage your risks, you must be aware of the risks that exist at the stock and portfolio level. Business risk, valuation risk, and liquidity risk are some of the risks that may arise at the stock level. You should be prepared for the risks that are likely to arise at the portfolio level such as asset allocation risk, market cap risk, sector, and stock exposure risk.

With the portfolio manager at MoneyWorks4me, you stand a better chance to identify risks at both portfolio and stock levels in real-time. This will help you to act on the recommended suggestions to reduce risk.

Conclusion:

- There are different investment strategies/processes/styles of building an equity portfolio- Growth, Value, Quality (at any price), Quality-at-Reasonable-Price (QaRP), Momentum, Small Cap, etc. None of these work under all market and economic conditions and hence will have their periods of under-performance. The key is to stay invested.

- For your Direct Stocks portfolio, QaRP is most suitable for retail investors. Using this build a portfolio of around 20 stocks. You need a fiduciary advisor with stock research capabilities to guide you in building this portfolio. For details read, ‘Stock Investing Made Simple – A Complete Step-by-Step Guide‘.

- For other styles of investing use the Mutual Fund route. Invest in 4/5 funds.

- Invest in mutual funds (from among those following the same style) based on relatively better quality, consistency of performance, and lower expense ratio and the one with a higher upside over the next 3 years. For details read, ‘How do you select the right Equity Mutual Fund to invest in?‘

Remember, all this should be done under guidance from a competent advisor. A professional fiduciary adviser can gear your portfolio to achieving the best risk-adjusted returns and help you build wealth even when situations are not optimal such as now.

About MoneyWorks4Me:

MW4M is a one-stop solution for investors, both new and experienced, to track stock easily, manage their portfolio, and a goldmine for expert investment advice. Sign-up to be an MW4ME member.

-

-

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

-