Deciding where to invest your money is not an easy task. One of the steps to simplify this is to understand the many different approaches to stock investing.

Fundamental investing and technical investing are the two main schools of thought that have emerged in the stock investing world. Which one is the best for you? And which style would be the safest? These are some of the questions you should ask when trying to figure out which style works best for you.

So, let’s look at 2 of these styles of analysis in detail.

a) Fundamental Analysis

Fundamental analysis is a method preferred by those with long term investments in mind. While sifting through the information, a fundamental analyst pays attention to the finer details. Rather than nitpicking over price, he focuses on whether the worth of the stock is likely to climb.

The analysis begins with the financial records of the company – revenues & profits, assets and liabilities are thoroughly examined to understand a company’s intrinsic worth.

Once the numbers are out of the way, the investor turns his attention to the quality of the company. Here the key elements to consider are the brand and management, technology and competitive clout.

This fundamental approach to stock picking is based on two main assumptions:

1. Market Worth vs. True Worth

The market price of a stock isn’t necessarily the same as its true value. So, the goal of a fundamental investor is to identify and buy stocks that are being sold at less than their determined worth.

2. Fundamentals = Growth

The fundamentals of a company are what truly determine its long-term worth. If it boasts a strong brand with growth potential, it will eventually pay off.

Though strongly advocated by Warren Buffet, this technique still pulls in some negative feedback:

- The list of factors to consider for fundamental analysis may seem never-ending

- Your estimate of the real worth of a company might not really be spot on

- It might take a while for the true worth of the stock to be actually reflected in the stock price

A few strategies like value investing, growth investing or a combination of value and growth are few forms of fundamental investing popularly followed.

b) Technical Analysis

On the opposite end, a technical analyst subscribes to a completely different school of thought. Here the focus is on two main factors – price and volume.

The investor uses tools like charts and indicators to spot market patterns which should, according to theory, re-occur. Better for short-term traders, the goal here is to make a quicker rather than bigger buck.

This technique is based on three assumptions:

1. Price reflects everything

The assumption here is that price reflects everything that has or could affect a company including the fundamentals. Therefore a technical investor believes there’s no need to assess these core factors individually.

2. History repeats itself

Investors tend to react similarly to certain situations. This psychology is what causes repetition in the market.

3. Movement in Trends

Trends cause fluctuations in price. Once it’s set in motion, a trend is likely to continue in the same upward or downward spiral.

On the flip side of technical analysis, there are a couple of points to consider:

- By the time a trend is spotted, it might already be on its last legs, so the rewards might not be much.

- The belief in the accuracy of patterns is what causes investors to react in a certain way, so its trader psychology, rather than the value of stock, which creates a trend.

- Past price doesn’t necessarily impact future movement.

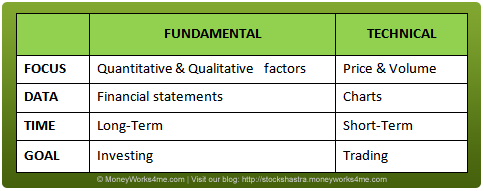

Fundamental Analysis and Technical Analysis – A comparison:

At the end of the day, there are pros and cons to any of these options. And one should remember that there is no foolproof method for investing in stocks. However, a combination of these strategies may work best for investors. MoneyWorks4me.com, encourages investors to analyse the company with a fundamental perspective and buy it for the long-term when it is attractively priced. You can later use the charts to time your buy and sell decisions to get more bang for your buck. Many successful investors use the fundamental approach to find out good stocks to invest in and then use the technical charts to time their investments correctly!

Follow this space for our article on various other strategies like value, growth and GARP investing next week.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463