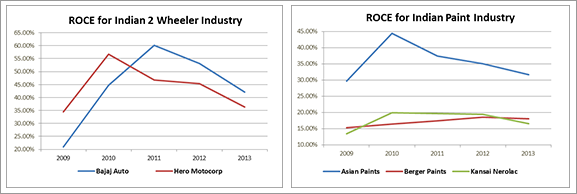

Why is Asian Paints one of the most loved companies in India? Well of course, the company has performed extremely well in the last decade. Apart from being the market leader, the company has given excellent returns to its shareholders. In 2008, the stock was available for around Rs. 85 (adjusted for stock splits and bonuses). Currently it is trading at over Rs. 500 per share, a whopping 42% CAGR over 5years! You can’t get better than that now, can you? Well actually you can. Another company with stellar performance, i.e. Bajaj Auto would have given you 72% CAGR over last 5 years. These firms have managed to grow and at the same time create value for the investors.

So, what separates them from their peers? What is so special about these companies who have outperformed the market and their own sectors by a huge margin? When we look closely at these companies, they have actually done better in all the major financial parameters than their competitors. Bajaj auto and Asian paints have done extremely well on value creation and growth. They have not only managed revenue growth but they have also managed to maintain higher margins as well.

It’s the competitive advantage that has helped them perform better than the others.

As investors, our primary objective is to make sure that we earn over and above inflation. For years, equity market has been time tested and has proven to beat inflation over the long run. Although equities are capable of giving high returns, they come with higher risks associated with them…

So we will look for companies, which not only provide good returns over time but also have comparatively lower risk associated with them. These will be the companies, which will have distinguishable and sustainable competitive advantage. Such companies will have higher chances of success as these will be the firms, which are fundamentally strong. We must look for firms, which possess competitive advantage or moats, which can help us earn higher returns over time.

So, how to spot and grab such opportunities? Let’s find out…

Competitive advantage basically is something that adds value and, is unique to the firm. In simple terms, competitive advantage differentiates great companies from good companies. As we saw in the earlier example Asian Paints outperformed all its competitors due to some unique capabilities that it developed over the years. The company has a wide distribution network, provides great quality products and has a very strong brand name. Thus, we can say that a firm with a competitive advantage(s) over its peers will create higher value and will be able to garner more respect from the market. Such a company will not only have a better financial performance, but it will also demand higher valuations from the market and will give returns higher than the returns given by its competitors. These Companies could be market leading giants or be niche players. The size does not matter too much. What matters is the ability to be better than the competitors on a sustainable basis.

So let’s find out the factors that we need to look at while searching for competitive advantage:

Price Premium: Most companies in commodity markets are generally price takers, i.e. they sell their products at market price in order to generate business. This happens because as competition increases, product differentiation becomes more and more difficult, and so does the ability to charge price premium. Price premium can be maintained by ensuring some of the following traits:

a. Innovative products: Innovative products can turn out to be a firm’s biggest competitive advantage but only if they are either protected by patents or are difficult to replicate. Such products yield high returns on capital. Pharmaceutical industry is a good example of innovative products protected by patents. Also companies like Bajaj Auto, Relaxoetc. are known for their innovative products.

b. Product Quality: Firms who provide products and services of superior quality enjoy high price premiums. For more than a decade, Maruti Suzuki has been enjoying market leadership and pricing power on account of its high quality cars.

c. Brand Equity: A good brand drives the company’s fortunes and it has been observed that products receive price premiums over others due to brand name. People associate strongly to good brands and thus, they don’t hesitate in paying higher prices. An appropriate example for brand equity in Indian scenario is Asian Paints which has managed to dominate the paints industry with support of its strong product portfolio.

d. Customer Lock in: In industries where the switching costs are high, people prefer staying with a particular supplier rather than scouting for a new one and thus the company can ask for a price premium. Oracle Financial Services has been benefiting from its customer.

Cost and Capital efficiency: A firm can improve its returns by working on a cost efficient structure or by being efficient in applying capital. Capital efficiency can be achieved if the firm can manage to sell more products at lower incremental investments. Companies having the following characteristics achieve higher efficiency in terms of cost and capital-

a. Innovative business model: Business model describes the rationale behind how the organization creates, delivers and captures value. It includes all the different aspects that form a part of the value chain from sourcing to production to marketing and selling. Companies can have superiority over others in one or more parts of the value chain and can thus attain competitive advantage. Companies such as Info Edge, with innovative business methods, manage to outshine their competitors in the long term as they have better cost management and asset utilization.

b. Unique resources: In some cases companies may have access to certain specific resources and thus use it to its benefit. The company may either have rare resources or a source which provides resources at lower costs than its competitors. This holds true mostly in Metals and Mining where companies like Hindustan Zinc, NMDC, Coal India etc. have excelled.

c. Economies of scale: The companies which can manage to increase the scale and size of production without hurting its costs too much can achieve economies of scale. Economies of scale should be considered in correlation with the markets that the firm operates in. However it is important that the company has optimum size rather than a huge one. Indian IT giant TCS has successfully achieved economies of scale which has contributed to its cost efficiency.

d. Scalable products: Company can achieve maximum benefit if it can scale up its operations. This can happen if the firm can attain more customers at lower incremental costs. This is seen in some IT services, where up-gradation of products for a larger base may not require lot of added costs.

Very few companies manage to achieve such advantages and with the whole global scenario getting competitive so quickly, attaining such advantages becomes more difficult. Hence, the companies, who still manage to do it, are the real gems in the stock market. Investors must hunt for these gems. It is highly advisable to add competitive advantage to their investment checklist.

Disclaimer: This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while taking investment decisions.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

visu_ani@yahoo.co.in