“I don’t want a lot of good investments; I want a few outstanding ones.”

These words reflect the modesty of Philip Arthur Fisher, who, with his 70+ years of successful investing experience, is considered the pioneer and the mastermind of the growth stock school of investing.

About Philip A. Fisher… (1907-2004)

Philip Fisher, a 1928 drop-out of Stanford Business School, worked as analyst in Anglo-London Bank (San Francisco), switched to a stock exchange firm, and subsequently moved on to start his own money management business, ‘Fisher & Co.’ in 1931.

His biggest investing success dates back to 1956, when he acquired a lot of stock in Texas Instruments, long before it went public in 1970. It was first quoted at around $2.70, and went on to go as high as $200 – a rise of 7,400%, that too, without dividends. Fisher’s own gains were significantly higher, given the fact that he had bought the shares privately, and much before the company went public.

Fisher on Investing:

While Benjamin Graham advised investors to invest in companies with well-established track records available at low valuations;, Philip Fisher’s investing guidance was more towards seeking out truly outstanding businesses and willing to pay even higher valuations in exchange for the prospect of much higher returns.

Broadly, Philip Fisher can be seen as a long-term investor in well-managed high quality growth companies at reasonable price. Specialized in innovative companies driven by R&D, Fisher’s main interest was to find growth stocks; companies that had a technological edge on their competition which they could use to their advantage to compound their returns over the very long time scales. He was prepared to hold it for over fifty years in some cases. He was one of the initial professional investors to recognize the merits of hi-tech firms like Motorola and Texas Instruments when they were starting out.

His Investment Philosophy:

Out of the many ways in which Philip Fisher contributed to the acumen of the intelligent investor, the 2 indispensable ideas that hold a special place, which can be found in his investment classic ‘Common Stocks and Uncommon Profits’, the first investment book ever to make The New York Times bestsellers’ list, are:

- Fifteen points to look for in a Common Stock.

- His scuttlebutt or the business grapevine technique.

Fifteen points to look for in a Common Stock

His 15 points can be divided in two broad categories:

- Management’s qualities: He identified the must-have important qualities for high-quality management which includes integrity, innovation, vision, conservative, accountability, accessibility and good long-term outlook, openness to change, excellent financial controls, and good personnel policies.

- Characteristics of the business: This category includes a growth orientation, strong profit margins, high return on capital, a commitment to research and development, an effective sales organization, leading industry position and proprietary products or services.

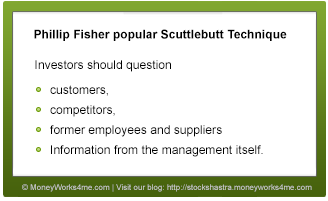

His scuttlebutt or the business grapevine technique

Fisher’s popular scuttlebutt approach endorses expanding foot leather in search of real information about a stock. He considered researching a company extremely important. It involves seeking out information about a business from both published sources as well as through the “business grapevine”. Investors should question customers, competitors, former employees and suppliers, as well as get information from the management itself. Through this process, one can often assemble a view of the business that a pure quantitative analysis could not reveal. The most important aspect of this, however, was about asking the right questions.

His view on dividends and P/E ratios:

Dividends: Fisher believed dividends were a distraction for growth companies. Companies on a growth trajectory should be able to use their earnings more effectively by re-investing them in the business, rather than by distributing them to shareholders. Hence, he looked for managements he trusted; making the risk of re-investment of his earnings much lower.

P/E Ratio: Fisher did not believe that current and forecast P/E ratios were predictors of future market returns; reason being that this ratio is based on two things – the ability of the company to increase its earnings and the willingness of investors to bid up the company’s price, and in the short-term, even though you might be able to get an estimate for the former, judging the latter is an impossible task.

The 3 Don’ts:

Fisher has identified the 3 don’ts to follow while investing in stocks:

1. Don’t over-diversify

2. Don’t follow the crowd

3. Don’t keep waiting if the stock is already at a reasonable price, but just missing your estimate by a rupee or two.

Reasons to SELL:

“If the job has been correctly done when a common stock is purchased, the time to sell it is – almost never.” – Philip Fisher

However, in any of the following situations, Fisher would recommend a SELL:

1. If you have made a serious mistake in your assessment of the company.

2. If the company no longer passes the 15 tests as clearly as it did earlier.

3. If you could re-invest your money in another, far more attractive company.

The Return on your (time) Investment…

All in all, Philip Fisher has been an inspiration, and a great contributor to the world of investing. His notions and beliefs in the context of growth stock investing, have always delivered, and continue to do so.

His methods were so convincing that Warren Buffett incorporated a good deal of Fisher’s methods into his own stock selection process. Buffett has described his strategy as 15% Fisher and 85% Benjamin Graham.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463