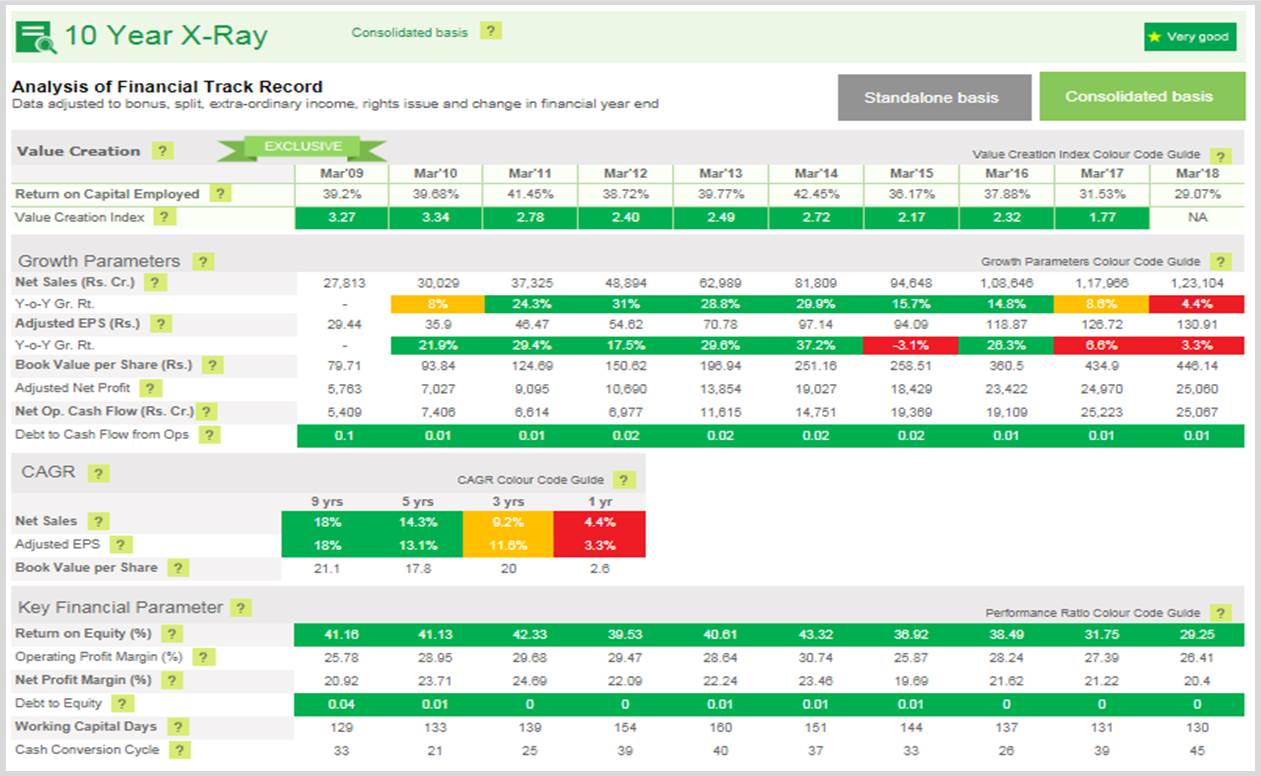

In the first part of the series, ‘How to identify a right stock’, we spoke about the ‘Value Creation Index’, how it is calculated and why it holds so much importance in identifying the right stock, consequently leading to a good investment decision. Apart from VCI, there are various financial parameters, which come handy in gauging the financial strength of the company. This part of the series deals with a set of financial parameters that you must evaluate to know whether a stock is really ‘Right’ or not.

Why are Financials so important?

But, before we proceed, let’s try to find out why we need to look at financials at all.

Financials have been and will continue to form the biggest chunk of a company’s evaluation as, all said and done, what makes or breaks any business is the bottom-line. That, in the end, is truly indicative of the company’s ability to do business and sustain itself.

A consistent historical financial performance over the past 5-10 years indicates a company’s ability to do business in both – an up-cycle and a down-cycle. Needless to say, a good business will also be impacted during a down cycle, however, its inherent financial strength as measured by the key financial parameters in the down cycle will make it better equipped to sail through difficult times, when compared with other businesses.

Key Financial Parameters

But surely, not all the numbers that companies release need to be analysed to check the company’s performance, isn’t it?

Absolutely not! In fact there are only a few selected numbers that can give you a good understanding on whether the company is fundamentally strong or not. These key financial parameters and their rationale are listed below:

- Net Sales: Looking for increasing net sales is quite a no-brainer. For a company to have a sustainable business model, it is important that their offerings have demand in the market. And not just demand, but an increasing demand. This demand, coupled with the company’s ability to market itself well, gets reflected in increasing Net Sales figures.

- EPS: There is no debating that the company’s ability to produce and offer products and services that have demand – and produce demand for those – are important. But equally important is the company’s ability to do it within its means. EPS shows what is left on the table, after production and sales are recorded, and the costs associated with these are fulfilled.

- Cash Flow from Operations (CFO): Credit transactions are often a major part of most companies’ operations. But are they translating into hard cash? The important thing is the working capital should not be too high, otherwise the company can have a poor cash position in spite of good profits. This is reflected in Cash Flow from Operations. Looking at Cash Flow from operations also helps validate the profit numbers of the company. If the difference between Net Profits and Cash Flow from Operations is too high, it might demand further investigation!

- Debt to CFO: Taking debt is often very beneficial for companies that need on-demand, short-term cash to shore up their operations. But the debt needs to be at a serviceable level. Where the debt is too high, the company runs the risk of paying most of its operating profits as interest, and in extreme circumstances, it may lead to bankruptcy. Hence, it is important to know if a company’s debt is in serviceable limits based on the cash generated from its operations – a number which is reflected through the Debt-to-Cash Flow from Operations ratio.

Looking at these few key parameters is just enough. By understanding these parameters an investor can have a fair view on how the company is performing and also gain some insight into its medium term (1-3 years) future prospects.

A free registration on MoneyWorks4me.com gives you analysis for 250+ companies on these key financial parameters individually and how they impact the fortunes of a company in tandem with each other. By checking out the colour codes for these key financial parameters (Green/Orange/Red), you will know whether a company you’re looking for is the Right Stock!

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463