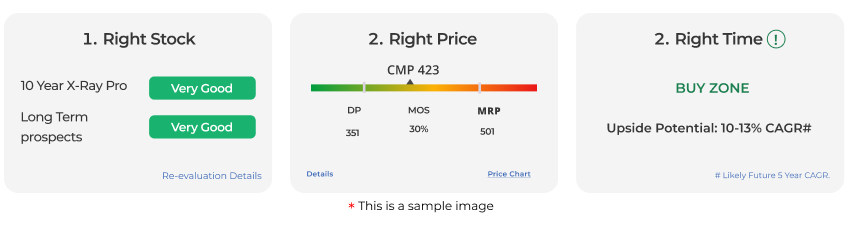

DeciZen Maker

Get to know the Stock’s MRP- it’s full and fair price, likely upside potential from CMP over a 5-year period, and it’s Long-Term Prospect before you get into details on our unique 10-year company X-Ray.

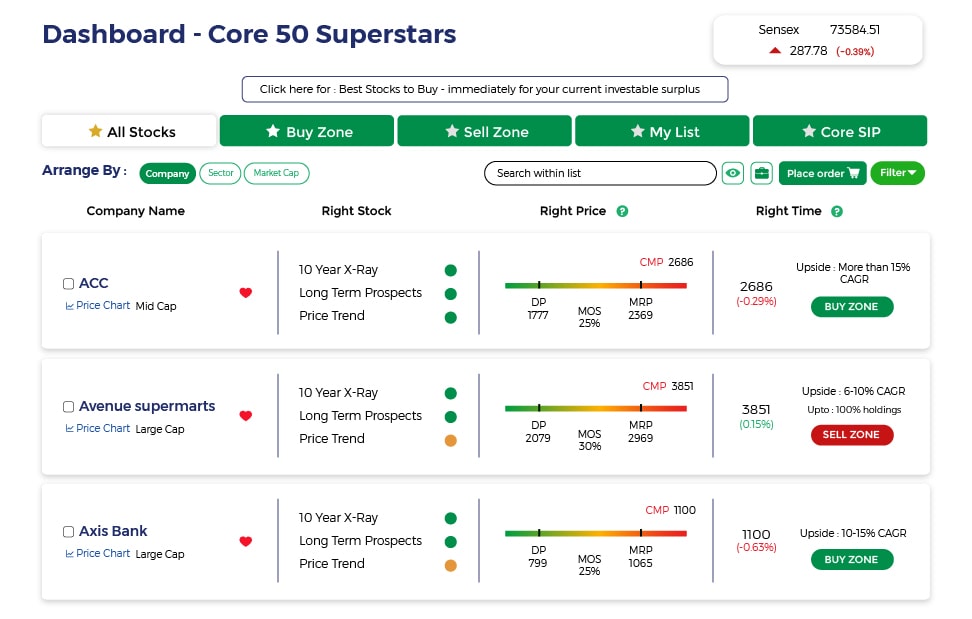

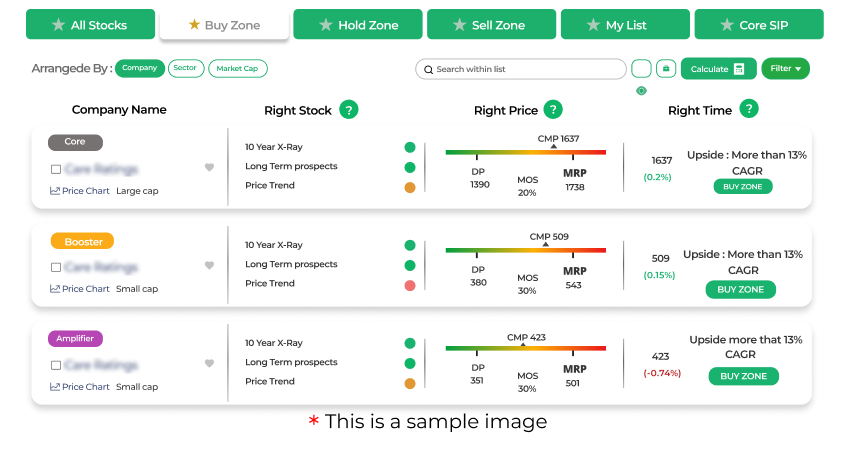

The Superstar Dashboard

Take informed decisions to build and manage your portfolio just from this one screen. See buy opportunities and our hold and sell recommendations. Explore now

Analyst Corner

Be connected to the minds of our analysts with their well-researched notes and reports. Get buy/sell/hold and MRP update alert mails and sms straight from their desk. Explore now

Q&A with Investment Counsellor

Get direct contact of our investment counsellors to sort out all your queries through call, WhatsApp or Email.

Download APP

Download APP