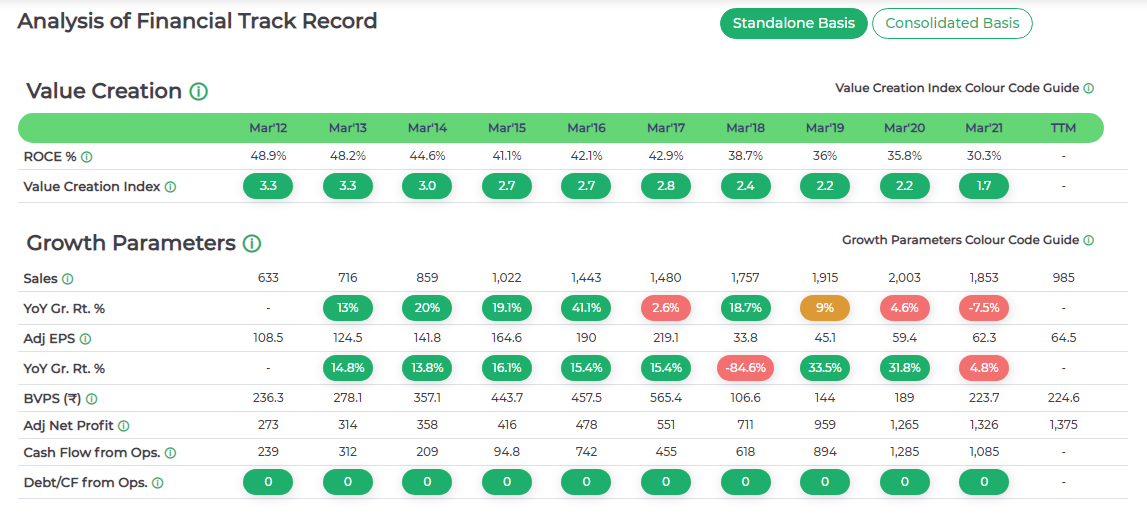

Company Performance on key parameters over 10 years

Assess Management

Check important latest numbers

Calculator & Charts that help access right price

Be guided by Equity Research + Intelligent System to Make Informed stock-investing decisions to reach your goals

Get your ‘fundas’ right on how to invest successfully. How the Heck to Invest and Reach Nirvana?, Guide to Investing, blogs, videos, Investment Shastra.

Follow Quality-at-Reasonable-Price way of investing – best way to make the magic of compounding work wonders for you.

All the tools you will need to identify opportunities and make sensible decisions with amazing ease. Covers 3500+ stocks.

Quality research on top 200 stocks so your major investments are made with higher conviction.

To signal buy and sell opportunities that you need to consider and act on.

You are fully equipped with knowledge, information, our insights, tools and recommendations through our Platform to make informed decisions anytime, every time.

The best opportunities for long term investing arise in times of uncertainty and most people are unable to take advantage of it.

Clarity and conviction on your way of investing and the decision-enabling Expert System enables you to make informed decisions and act on them with confidence.

|

Core Superstrs |

MOST POPULAR

Superstrs 100 Multicap |

BEST VALUE

Superstrs 200 Multicap |

|

|---|---|---|---|

| No. of stocks covered ⓘ | 50 | 100 | 200 |

| Market Cap | Large | Large, Mid & Small | Large, Mid & Small |

| Stock type | Core ⓘ | Core ⓘ + Booster ⓘ | Core ⓘ + Booster ⓘ |

| Best stocks to buy today ⓘ | |||

| Stock SIP Recommendation ⓘ | |||

|

New Buy Opportunities & Sell alerts ⓘ |

|||

| Access to Research & Valuation ⓘ | |||

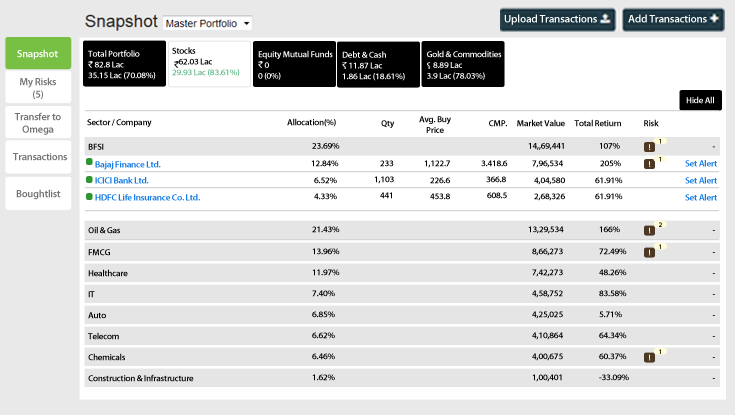

| Multi-asset Portfolio Manager ⓘ | |||

| Customer Connect ⓘ | |||

| Screener ⓘ | |||

| Access to Investing in Themes ⓘ | (For Limited Period) |

(Limited Themes) |

All |

| Emerging Opportunities ⓘ | No | No | |

| How the Heck to Invest and Reach Nirvana ⓘ New ! |

Core Superstars enables you to build a strong stocks portfolio of high quality large sized companies through a Model Core Portfolio and also through additional buy recommendations from the top 50 Core Superstars.

Portfolio built with Core Superstars provides robust returns in long term and has a stable foundation to withstand economic and market down turns and recover faster.

That’s because Core Superstars covers the best quality companies. Companies that are in good financial shape, have pricing power over its peers, and sell products that people buy even during deep recessions. These strong companies are structured and operate in such a way that they can withstand the economic downturns.

Bluechip companies are well known, but having this list doesn’t translate into good investments unless they are bought at a right price. And very often prices of such stocks are high to very high, making it difficult to invest in them. Some ‘stable’ bluechip companies are at times so highly priced that future returns are likely to be mediocre for a few years.

From time-to-time good companies are available at a reasonable price but this is accompanied by some ‘bad’ news and most people avoid investing in them out of fear. Such opportunities don’t feature in most model portfolios. Then again even if one does own such companies, one may lose conviction to hold on to them when they run into a tough situation.

And lastly figuring out at what price should one reduce or exit a stock and invest in another opportunity when there are no obvious performance-related triggers?

Core Superstars helps you build a strong portfolio using multiple methods

Superstars Multicap helps you build a strong portfolio using multiple methods

It is true that multi-cap approach tends to earn higher returns than large cap companies. But as a beginner in stocks or with smaller portfolio, succeeding is more important than earning a higher return because that ensures you becomes a committed stock investor. A poor experience at this stage can put off people from investing in stocks and that is a major loss. It is wise to own predominantly large cap portfolio as you can concentrate and learn about few stocks and experience lower volatility versus a multi-cap portfolio. As your portfolio and experience grows you can upgrade to a multicap portfolio.

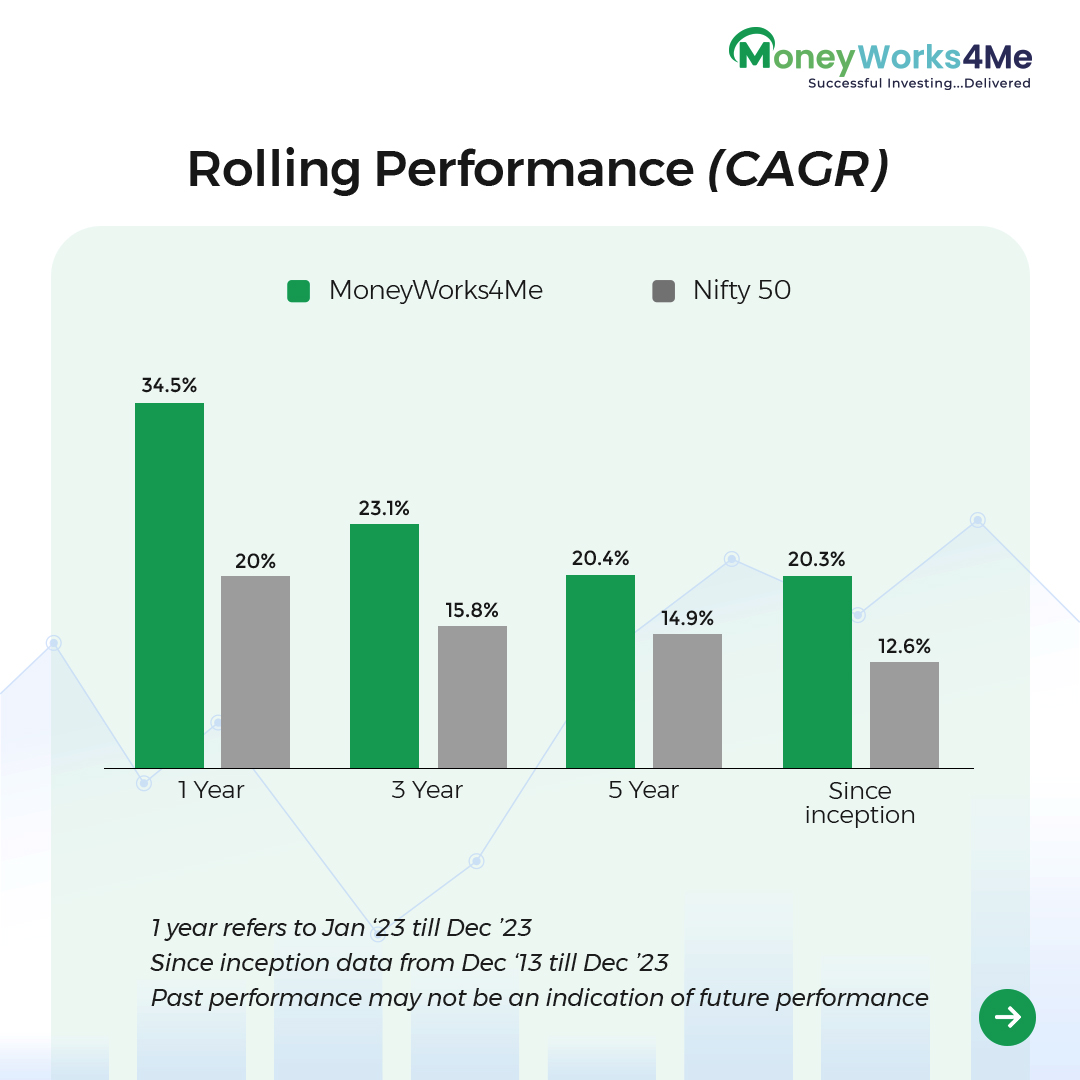

Large cap performance has been substantially higher than inflation and fixed income options in all periods. The consistency in returns is much higher with more than 85% chance of a positive return over any 3 year period. Large cap generate returns in range of 7-12-15% and with an average of 12%+ p.a. in past. At 12% CAGR, your investment quadruples (4X) every 12 years. With Core Superstars philosophy of buying companies at right price can further add to returns. These are very good returns to meet your goals.

At MoneyWorks4Me, we believe that multi-cap approach, mix of Core and Booster stocks, helps to achieve consistent performance with relatively less volatility. There is no point investing in an asset that is so volatile and inconsistent that you cannot stay invested in it to realize those high returns.

A mix of Core and Booster stocks helps you stay invested and recover faster from correction with help Core stocks and realise healthy returns.

The portfolio will comprise of mix of stable companies with high profitability and companies that are at the cusp of upcycle with strong medium term prospects. Most of the companies will be high quality when measured in Return on Capital Employed and high free cash flows. We do not participate in highly cyclical sectors like mining, metals or commodities as they do not deliver consistent returns.

Market levels or single valuation metric of a broad market doesn’t tell much about return potential of all stocks in the market. It is market of stocks and not one stock market. What it means is, there are 100s of companies listed that might be at different stage in cycle. Individual stocks may have more upside potential than narrow index like Nifty 50 or Sensex 30.

A stock price moves in lines with earning growth. Even though all stocks move in same direction in short term, their trajectories vary over longer timeframe.

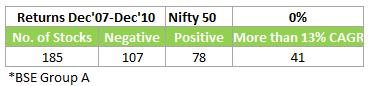

Let’s assume the worst period with the benefit of hindsight when Nifty peaked in Dec’07 and 3 years after that.

If we observe individual stocks, we can see that markets made high in Dec’07, went through correction of 50%, and recovered in Dec’10. During this period Nifty was flat but more than 40% of stocks earned positive returns. Out of 185 large and mid-cap stocks (BSE Group A), 78 were positive, and more than half earned >13% CAGR. Together these 78 stocks earned >17% CAGR.

This proves a point that market levels must be used only in context of asset allocation to reduce equity and add to debt. If one can find enough bargains with good future prospects, he can remain invested.

We have developed a unique measure Nifty@MRP and Sensex@MRP, which is a hypothetical value of the Nifty/Sensex if all the 50/30 stocks were fairly valued. We have analyzed the actual movement of the market vis-à-vis Nifty@MRP and Sensex@MRP for more than 5 years (real time) and back-tested our hypothesis over more than a decade. This has enabled us to confidently assess whether the market is over-valued or under-valued at any point of time.

Investors often focus on price rather than looking at upside potential. We always suggest making decision based on upside potential of an opportunity set. Our Upside Potential is evaluated based on current price. You may have missed the stock at Rs. 100 but even at Rs. 200 the same stock might be offering ‘More than 15% CAGR’ or ‘10-15% CAGR’. Instead of worrying about buying high, focus on upside potential even from the current price on fresh investment. Upside Potential is given for all stocks that we cover and it is on the basis of next 5 years. Remember this is not a precise tool, but surely a very good elimination process.

Low upside potential: With our proprietary price calculator and future estimates, we update valuation of best 200 stocks across large, mid and small cap. Using the same, we compute upside potential of stocks over 3- 5 year period from current price. While one cannot be 100% confident about future upside, if the upside is significantly lower than liquid fund returns based on valuation, we choose to exit. One doesn’t have to earn the last nickel out of every investment. Our aim is to earn reasonable returns on overall portfolio, not necessarily own stocks till they peak out.

Change in future prospects: Capitalism is very competitive. As soon as a company does well, competition can come in either with similar products or disruptive one to ruin the profitability. This leads to deterioration of profits and company’s downfall. In such cases, we would like to exit the investment. Other situations we exit is when the management of the company may treat minority shareholders unfairly which can lead to steeper loss over long term.

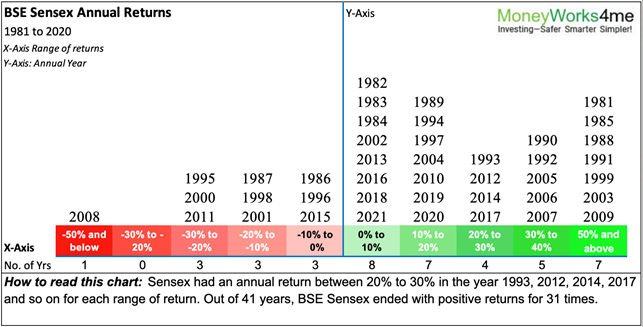

Equity returns are not linear like Fixed Deposits. They are erratic and returns can be concentrated in few years. So even equity does not earn positive returns every year, longer term investing is highly in our favour.

Past data shows equity returns are positive in 31 out of 41 years. There will be only one year out of four years of negative return. Out of 31 positive years, Equity earned more than 20% returns in 16 years. However, the returns were quite volatile during the year. It is advised to review equity return on annual basis versus monthly/quarterly. Longer investment period of 5 years or more has very high chances to earn healthy absolute returns.

Investing is a probabilistic field where you win or lose with no guaranteed outcome. Probabilistically, if you own a portfolio of good quality stocks, bought at reasonable prices and held for long term it is fair to assume you will definitely profit from stock investing.

Historically we had 85% calls turned into profits and 70% calls beat Index return. Investing is very rewarding as the calls that deliver positive returns ranged from 100-800% returns more than compensate for losses of 10-30-50%. Winners far FAR outweigh losers. So one has to consciously avoid looking at individual stock performance and focus on portfolio returns.

Focus on long term: Equity returns are erratic; do not get impatient in down years. Even if you invested just before correction (it can happen because no one can anticipate correction) stick with equity for 3 years minimum. Add more in form of SIP during correction phase with whatever amount you can afford and lower your purchase cost. Markets tend to recover eventually which will recover your older investments and also earn handsome returns on investments made during correction.

Diversify: Most investors do not diversify adequately, instead concentrate in just 3-4 favourite stocks. Future is uncertain and you do not have all the information today. Do not leave investing to luck and get hurt concentrating in few stocks. Diversify as instructed, upto Maximum recommended allocation. While there are no guarantees on individual stocks, portfolio of stocks will deliver very good returns over time.

Ensure you act on our calls: It is not possible to develop high confidence immediately on BUY recommendation; buy the stock partially and add more, upto recommended allocation, as your understanding improves. If you miss any big winner, you will start lagging our overall performance.

Use only surplus available for 5 years+: Do not invest funds that you may need before 5 years. It is true that stocks will reward in 3 out of 4 years, but one bad year in stock market should not coincide with your goal that will make you sell your investments at loss. Set aside funds for short term goals and emergency in ultra-safe assets like Fixed Deposits or Liquid Funds.