Invest in stocks and earn great returns…safely, with Superstars!

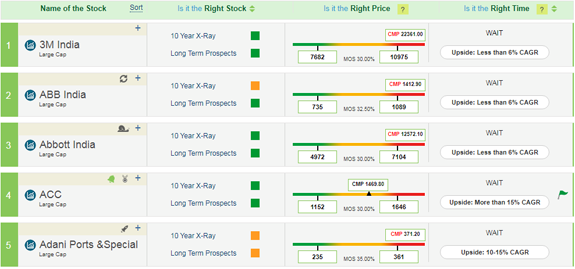

- Each DM will provide the answer to the 3 essential questions

- Click on the Buy Zone tab to get a list of all the stocks in this zone. Check Upside potential and mouse over on any green flag to read our comment.

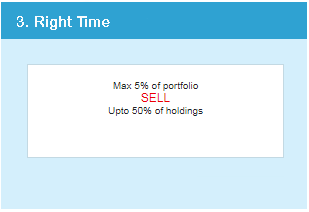

- Click on the Sell Zone to get a list of stocks in this zone

Yes it works!

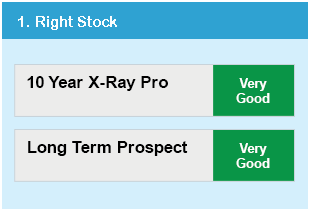

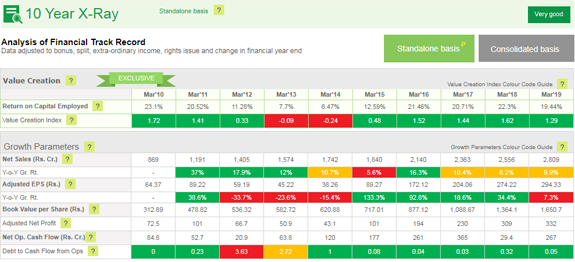

Invest in quality stocks with future upside potential

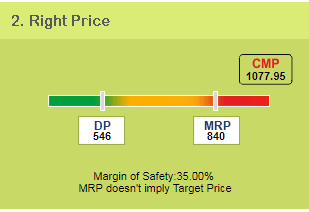

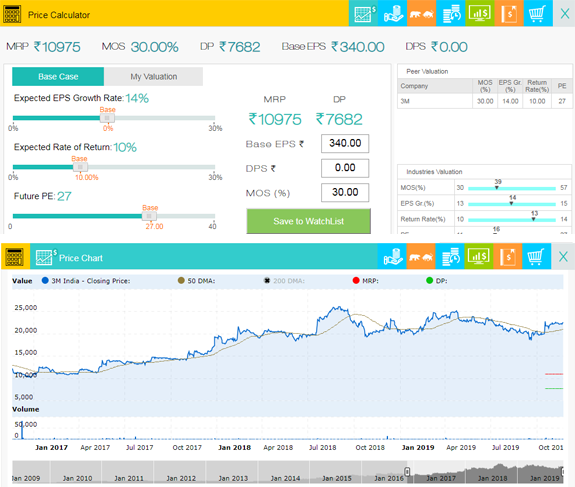

Knowing the stock's MRP enables us to spot and exploit opportunities:

When Mr. Market is bearish he offers high quality stock below/close to its fair value

Mr. Market over-reacts to short term problems and offers stock at attractively low prices

Manage Risk and Returns on our Portfolio Manager with ease

Some risks help earn risk-adjusted returns, manage them.

Eliminate the rest!

Putting all or most of your investable surplus in the equity basket exposes you to high risk and putting too much in safe, fixed-income asset reduces your returns drastically.