Why do retail investors earn returns lower than the market returns? What do they under-estimate that leads to this? How do you prevent your emotions from disrupting your investing strategy? Can you train it to support it instead? How?

You have covered a lot of ground to reach here. Four most important things you now have or can have in a short time:

-

Clarity of what you need and want and why; your bucket list, your dream job, work, stuff that define financial freedom for you

-

A detailed Financial Plan and the systematic investing strategy to get there; the mix of equity and debt you need to have to ensure you are protected even when shit happens and you stay invested in equity and earn inflation-beating returns for long, really long.

-

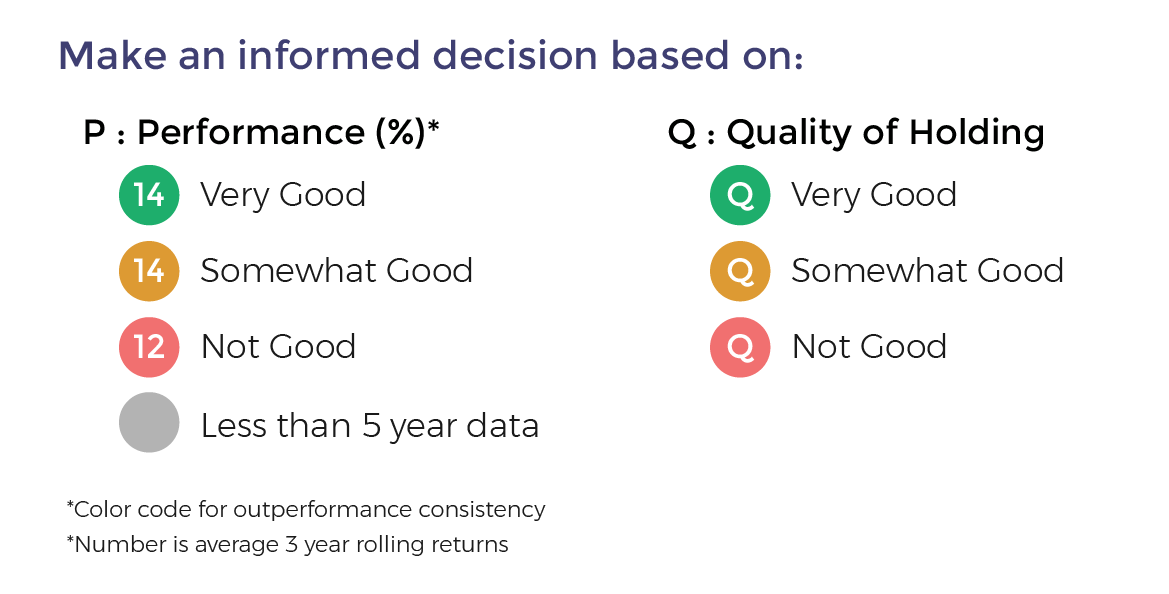

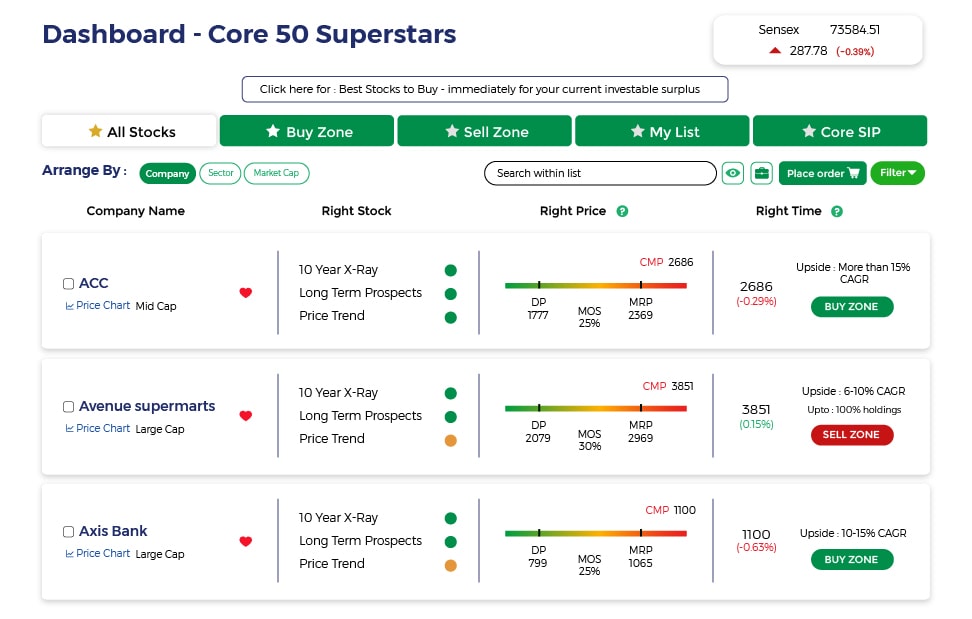

The Process to make informed investing decisions to invest in equity successfully.

-

The System - data, information, insights, tools and recommendations all working together in an integrated way to enable you to implement the Process successfully.

If you are sort of concluding that this should be sufficient to invest successfully and reach your goals, I wouldn’t blame you. It is pretty comprehensive, but there is something critical missing. Despite having covered so much ground and having the resources to invest successfully you can and probably will still miss achieving the success you are looking for. Why?

Research indicates that returns earned by investors are much lower than the long-term market returns. Many expert Fund Managers and Research Advisories may have a stellar track record since inception but their investors haven’t earned equally good returns. Why?

Because retail Investors often join the party late and leave it early. They usually buy high, after the recent good performance of equity and sell low, usually after a drop in the market. Or if they did buy at low prices, they sell far too early booking small gains.

Retail investors are less diversified (even those with far too many stocks in their portfolio), usually more small-cap, and own recent performing stocks that may have run their course. This leads to poor returns, or worse, loss of capital. One bad decision, a one-off unwise bet can derail your financial planning. Managing your investing poorly will cost you your goals.

Investors like marathon runners need to make two journeys -the external one and the inner one. You have made progress on both and more so if you did the actions mentioned in last three chapters. To get experiential knowledge you will need to invest using this knowledge,

...........Read More

Download APP

Download APP

Comment Your Thoughts: