“I like to say success carries within itself the seeds of failure, and failure the seeds of success.”

Way back in 2006, I had watched a movie named “Gafla” and since then, stock investing fascinated me. The thought of stock investing has always been at the back of my mind. But things aren’t that easy and simple in real life as they are portrayed in movies. I was left with an open ended sack of questions, like: How do I invest and which stocks should I go for? How do I decide the time to enter and exit the stocks? What are the dos and don’ts? How should I evaluate my portfolio?

I started surfing the net to find solutions to my problems. This is where a review on ‘The most important thing’ by Howard Marks, chairman of Oaktree Capital Management, caught my eye. Well, the book doesn’t require praise from my end when it is highly spoken of by Warren Buffett, who called the book a rarity in its usefulness.

The reason why this book interested me was that, apart from being written by a renowned investor, the title suggested the key to investing. After all, many of us like short cuts in life. Be it study, career or success, we seek ways, steps, keys or secrets which eases our path. With these thoughts, I started the book thinking now stock investing will be a cake walk.

Well, I was wrong…

There is no such thing as one single important thing in investing, rather there are many aspects of a company (and a stock) that need to be considered and analysed in order to be successful and beat the average investor. This is the key highlight of the book.

Before moving to my personal notes on “The most important thing”, let’s know who Howard Marks is. Howard Marks, the chairman of Oaktree Capital Management ($77 billion under investment), is the world’s largest distressed debt investor who is known for his insightful assessments of market opportunity and risk. Now for the first time, all readers can benefit from Marks’ wisdom, concentrated into a single volume which caters to both the amateur and seasoned investor. Howard Marks also pens down and shares his investment wisdom surrounding key investing themes through memos; published regularly on Oaktree capital management since 1990. These memos are widely read and referred in investment community.

So here comes my personal note:

The gist of the book is that to be a successful investor, one should beat the market and other investors on a continuous basis. For this to happen, either you have to be very lucky or have superior insight. Since luck is fickle, so a great insight is a must. For a great insight, one can take courses in finance or be mentored by an intelligent finance guru. However, out of all those who do so, only few of them achieve the required superior insight, for delivering consistently above average results. Thus, in Marks’ words, we must have a ‘second level thinking’ within ourselves and try to be different and better than rest of the crowd.

The simplest way to succeed in stock investing is ‘Buy low and sell high’ but what is low and what is high?

Marks, in his book pointed two basic approaches of investing:

- Invest in company having strong fundamentals, and

- Invest depending on price behaviour

The latter is dependent on luck factor, the reason being, even if a coin turns head all twenty times it is tossed in the air, the probability of a tail in the next throw is still 50:50. So, fundamentals should be the basis for investment decision, which can be measured through value creation and growth orientation.

“Investment success doesn’t come from buying good things but rather from buying things well.”

So, how one can choose company and what price should be paid? We must go for a company which has value but does this mean you overpay to buy them? Definitely not! Rather, one should try to measure the value of company and buy the stock whenever the price is below the value and vice versa. Marks says ‘buying below value isn’t infallible but it’s the best chance one can have’.

Marks focused on minimizing downside risk on investments and being defensive. It’s better to avoid loss when markets are down than to gain when markets are prospering. Risk is the key point of discussion.

“You can’t predict. You can prepare.”

According to Marks, one should understand, realise and mitigate risk. Risk is related to future events which itself are uncertain and unpredictable. Hence, it is impossible to predict risk.

“People generally feel that riskier investment provides higher returns but if this was the case they wouldn’t be risky!”

Risk is directly related to the relationship of price paid and their value worth. Risk inherently comes when the price is high. In fact, recognizing risk is the most difficult when emotions are running very high. Risk gives rise to loss only when things go wrong. But this doesn’t mean when things are good, there is no risk. For example, a good builder is able to avoid construction flaws whereas poor builder incorporates construction flaws. Unless, there is no earthquake you will not realise the difference. But, does this mean both are risk free or have same risk?

Generally, we have a tendency to believe in things which we can see, or say, what we can imagine. We strongly believe that what can’t be seen can never exist. This is termed as Black Swan theory. This is the reason of our trust that nothing can ever go wrong with blue chip companies and buy at whatever high price. But, always remember once in a while Black swan will materialize.

“Nothing goes in one direction forever.”

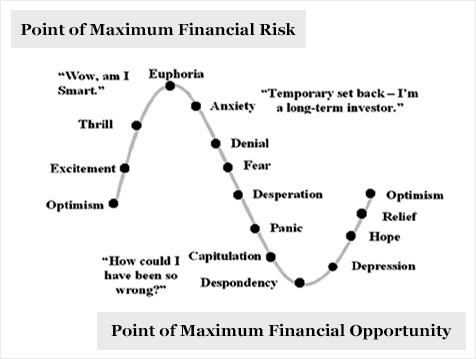

Howard has strong faith in the recurrence of cycles. Pendulum swings due to greed and fear associated with investing. When one side of the pendulum swings reflecting positivity in the market, people out of greed are inclined to expect higher returns irrespective of risk incorporated. The pendulum swings to the opposite when uncertainty is everywhere. In this condition, people say things like ‘I am staying out of the market until the dust settles.’ But if you wait until the dust settles, there won’t be luring prices anymore.

This recaps my memory of a chart which was very popular during housing bubbles:

“Those who believe that the pendulum will move in one direction forever – or reside at an extreme forever – eventually will lose huge sums. Those who understand the pendulum’s behaviour can benefit enormously.”

Most of the investors are trend followers, who simply follow the crowd because they feel safe in herd. But, Marks insists on doing the opposite of what crowd does: to be contrarian. When the market is booming and everyone is buying, it’s time to sell at high price and vice versa. One must not just do things because it is the opposite of what the crowd is doing but because one knows why the crowd is wrong.

“What the wise man does in the beginning, the fool does in the end.”

In both, economic forecasting and investment management, it’s worth noting that there’s usually someone who gets it exactly right. But, it’s rarely the same person twice unless he has precise insight. For this, it is very essential to have several years of data before judging an investor’s ability as luck cannot favour him each time.

As mentioned earlier, Marks is more focused on minimizing downside risk and playing safe thus propagating defensive investing. Defensive investor’s emphasis is on ‘Not doing the wrong things rather than doing the right thing’. He says one should be prepared for bad days, but how bad is the real question.

The critical element in defensive investing is margin of safety.

Let’s understand through an example. Suppose you find something worth Rs. 100. If you buy it at Rs. 90, you have a good chance of gain, as well as, a moderate chance of loss if, in case, your assumption turns too optimistic. But, instead if you buy it for Rs. 70 instead of Rs. 90, your chance of loss is minimized. This reduction of Rs. 20 provides additional room to be wrong and still come out okay/fine. Low relative price is the ultimate source of margin of safety.

To recap, Marks believes in concepts of ‘second-level thinking’, the price/value relationship, margin of safety and defensive investing. He provides valuable lessons for critical thinking, risk assessment, and investment strategy. Encouraging investors to be ‘contrarian’, Marks wisely judges market cycles, occurrence of pendulum and achieves returns through aggressive yet measured action.

So finally, which element is the most essential?

Remember, there is no one thing that can be ‘the most important thing’. Successful investing requires thoughtful attention to many separate aspects, and each of Marks’ subjects proves to be the most important thing(s) which represents a checklist for investing. My sharing hasn’t even touched the surface in terms of what Marks conveys through his valuable writing. Anyone who is interested in investing but does not know what and where to start with, like me, can gain a lot from his valuable insights. I hope to get fruitful results by keeping these most important things in mind. Are you ready to put these time tested principles into action too?

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

good.let us know more about Howard Marks observations.

@2ef60eb98703259a03103ae2e6bfe13a:disqus Thanks for your feedback. Do keep reading!

AS STATED IN THE ARTICLE, IT IS VERY IMPORTANT TO BUY GOOD THINGS WELL. GEORGE SOROS WAS KNOWN FOR HIS HUGE POSITIONS IN TRADING BUT HE WOULD ALWAYS TEST THE WATERS FIRST BY SMALLER TRADES. AS AN INVESTOR WE SHOULD DO THE SAME. GENERALLY, WE CAN BUY LOW ONLY DURING A DOWNTREND AND SOMETIMES THE TREND NEVER SEEMS TO STOP. AS AN INVESTOR WE HAVE TIME IN OUR FAVOUR BECAUSE WE ARE NOT PLAYING FUTURES AND OPTIONS WHICH EXPIRE. THIS MEANS WE CAN WAIT AFTER OUR FIRST SMALL INVESTMENT AND CHECK THINGS OUT-THE SAME AS ADVISED BY MONEYWORKS4ME – INVEST AND SELL IN TRANCHES.

@SJN We appreciate your feedback. We believe and propogate principle of investing rather than trading. Thus, good stocks(based on its 10yr X ray and long term prospects) should be bought at reasonable prices. Buying in tranches is a good approach for averaging the position as well as it limits the downside risk. Keep sharing your thoughts!!