The ultimate aim of any investor is to get returns by investing in stocks. While the end result is obviously important, what is more important is to get the process right; the process of picking the right stocks which will ensure that the possibility of you losing your money is reduced considerably. And one of the first steps towards this is to understand the industry you want to invest in. Understanding the industry in which a company operates provides an essential framework for the analysis of the individual company.

The ultimate aim of any investor is to get returns by investing in stocks. While the end result is obviously important, what is more important is to get the process right; the process of picking the right stocks which will ensure that the possibility of you losing your money is reduced considerably. And one of the first steps towards this is to understand the industry you want to invest in. Understanding the industry in which a company operates provides an essential framework for the analysis of the individual company.

In the next few weeks, we will be giving you in-depth insights about the various industries which will help you get a better understanding of the companies you want to invest in. But before we move on to this, here are 5 ‘Must-Knows’ before you analyze an industry.

1) The industry composition and how it functions

One of the most important things when analyzing an industry is to get the industry composition right i.e. which companies actually form and fit correctly into the industry. Take for example Maruti Suzuki and Hero Honda. While Maruti is into the manufacturing of passenger cars, Hero Honda manufactures two-wheelers. Both these companies are part of the Auto sector but comparing these companies against each other is not the way to go. To get the most appropriate and comparable companies in the industry, you need to look at factors such as what products do the companies manufacture, what is the segmentation of revenues by products, geography etc. Why is it so important to get this right? To ensure that you compare the financials and other fundamental factors for appropriate companies and not end up comparing ‘apples and oranges’.

Once you get the industry composition right, you can then look at the input factors (raw material, labour, research and development etc.), the products and user industries. This will help you understand how the industry broadly functions. Further, look at how the industry has grown in the past. Analysis of the revenues, profitability and net margins over the last few years can help you understand what drives the growth of the company.

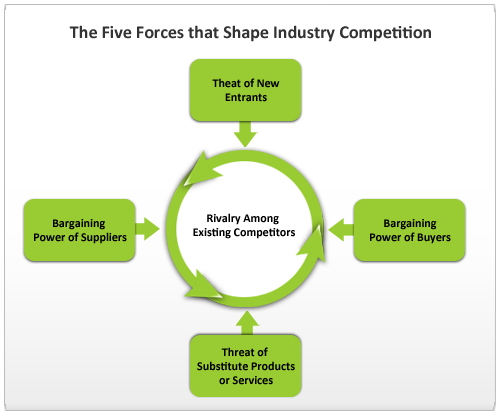

2) Porter’s 5 forces model for strategic analysis

One of the widely used tools by analysts to analyse a company’s industry structure and its corporate strategy is the ‘5 forces model’ given by Michael E. Porter. Porter identified five competitive forces that shape every single industry and market. These forces help us to analyze everything from the intensity of competition to the profitability and attractiveness of an industry. Figure 1 shows the relationship between the different competitive forces.

- Threat of New Entrants – This can be assessed by evaluating how easy it is to start a business in a particular industry. The easier it is for new companies to enter the industry, the more cutthroat competition there will be. Factors that can limit the threat of new entrants are known as barriers to entry. For e.g. Government restrictions or legislation, high fixed costs etc.

- Power of Suppliers – If you had an airline company and wanted to buy new planes, you would have very few options for airplane suppliers; America’s Boeing and Europe’s Airbus being at the forefront. It would be difficult for you to bargain by playing one against the other and get a low-cost deal. This is nothing but the power of suppliers. This factors assesses how much pressure suppliers can place on a business. If one supplier has a large enough impact to affect a company’s margins and volumes, then it holds substantial power. Few reasons that suppliers might have power are there are very few suppliers of a particular product, there are no substitutes, switching is difficult etc.

- Power of Buyers – This is the impact that customers have on a producing industry and how much pressure they can place on a business. If one customer has a large enough impact to affect a company’s margins and volumes, then the customer hold substantial power. A few reasons that customers might have power are : there are small number of buyers, buyers purchase large volumes, customers are price sensitive etc.

- Availability of Substitutes – What is the likelihood that someone will switch to a competitive product or service? If the cost of switching is low, then this poses a serious threat. he main issue is the similarity of substitutes. For example, if the price of coffee rises substantially, a coffee drinker may switch over to a beverage like tea.

- Competitive Rivalry – This describes the intensity of competition between existing firms in an industry. The more competitive an industry is, the more likely you are to have price wars and reduced profitability. For e.g. the Indian telecom industry has seen a lot of competition and price wars over the last year or so.

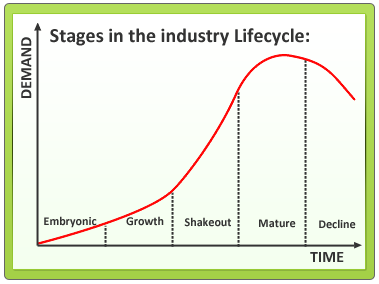

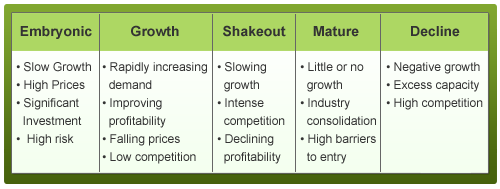

3) Industry life cycle:

Industries tend to evolve over time and usually experience significant changes in the rate of growth and levels of profitability along the way. A framework to analyse this evolution of an industry is an industry life-cycle model which identifies the sequential stages that an industry typically goes through. We can categorize 5 different stages in the industry life-cycle model viz. embryonic, growth, shakeout, mature and decline. Each stage is characterized by different opportunities and threats.

4) The growth drivers and roadblocks:

The last thing that you must know is what is it that drives the growth of the company and what could be the roadblocks. Various factors determine how the company will grow its revenues and profits. This can include macroeconomic technological, demographic, governmental and social influences. When these factors are positive they will drive growth of the company however if they turn negative, they can become roadblocks for the company. For e.g. Sugar industry in India is regulated by the Government. Recently there have been talks about de-regulating the industry which would stimulate the growth of the sugar companies. Thus a positive Government policy will be a growth driver for the company whereas a restrictive policy would be a concern. Concluding, a thorough analysis of the industry will enable you to get an idea about what lies ahead for the industry and whether you should go ahead and invest in it. If all the indications point towards a bright future for the industry, you can further move to finding the top players in the industry and analyzing them to get the best company to invest in.

5) Is it an industry you understand and will follow?

Finally, after going through all these factors, you will get an idea whether it is an industry you understand and have an inclination for. If you feel that you are facing difficulties in understanding a particular industry, you would be best advised to stay away and avoid investing in companies from this industry. The reason for this is that the more you understand an industry, the more likely you are to track the industry and its happenings. Being on top of things happening in the industry will help you make better investment decisions which can determine whether you make or lose money in the stock market.

The ultimate aim of any investor is to get returns by investing in stocks. While the end result is obviously important, what is more important is to get the process right; the process of picking the right stocks which will ensure that the possibility of you losing your money is reduced considerably. And one of the first steps towards this is to understand the industry you want to invest in. Understanding the industry in which a company operates provides an essential framework for the analysis of the individual company.

In the next few weeks, we will be giving you in-depth insights about the various industries which will help you get a better understanding of the companies you want to invest in. But before we move on to this, here are 5 ‘Must-Knows’ before you analyze an industry.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

Hi,

Thanks a lot for the appreciation. We are glad that you liked the article so much. Do keep reading and let us know your feedback.

Hi,

Thanks a lot for the appreciation. We are glad that you liked the article so much. Do keep reading and let us know your feedback.

Thanks a lot for the appreciation. Do keep reading and let us know your feedback.