Tata Steel Ltd. : 3 consecutive quarters of loss; what lies in store for its future?

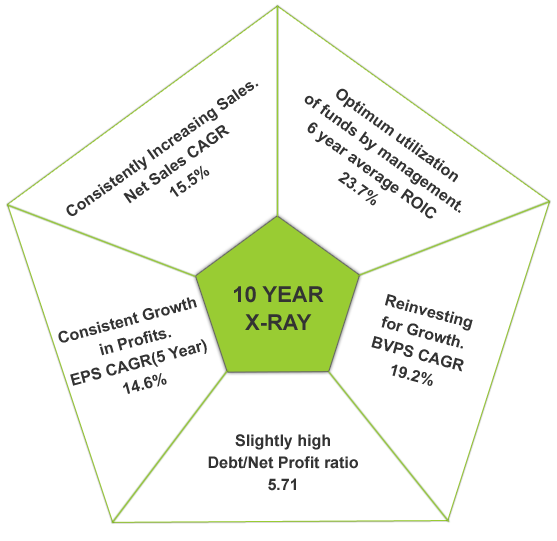

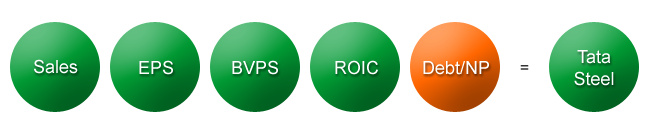

Tata Steel’s 10 YEAR X-RAY: Green (Very Good)*

* The company’s debt is slight high and its Debt to Net Profit ratio stands at 5.71

Tata Steel in Brief:

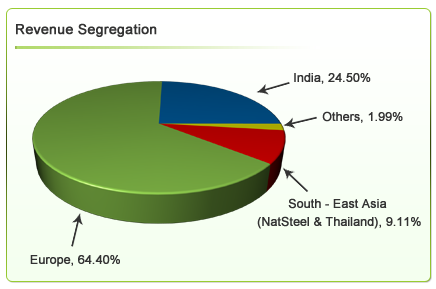

Tata Steel Ltd, a Tata Group company, is India’s largest steel integrated player in the private sector. It manufactures hot and cold rolled coils and sheets, galvanized sheets, tubes, wire rods, construction rebars, rings and bearings. With the acquisition of Corus in 2007, it is the 10th largest steel producer in the world. Apart from India, the company operates through its major subsidiaries on a consolidated basis – Europe (Corus) and South-East Asia (NatSteel & Thailand)

Tata Steel Ltd, a Tata Group company, is India’s largest steel integrated player in the private sector. It manufactures hot and cold rolled coils and sheets, galvanized sheets, tubes, wire rods, construction rebars, rings and bearings. With the acquisition of Corus in 2007, it is the 10th largest steel producer in the world. Apart from India, the company operates through its major subsidiaries on a consolidated basis – Europe (Corus) and South-East Asia (NatSteel & Thailand)

In India the company has manufacturing facilities at Jharkhand, Chattisgarh, Orissa, West Bengal and Tamil Nadu. It has operations in 24 countries and commercial presence in over 50 countries with over 80,000 employees

Shareholding Pattern:

The promoter shareholding in the company as on 30th June 2010 is 32.48 % whereas 66.88% is the non-promoter holding. Foreign Institutional Investors holding stands at 15.77% and Insurance companies hold 22.26%

What does Tata Steel’s past say?

Figure is on standalone basis

Good growth rates in key parameters:

Tata Steel (standalone basis), which mainly constitutes Tata Steel India has performed robustly in all its parameters in the last 10 years. Its Net Sales has grown by 15.5% CAGR showing consistent demand for its products. Also, a strong re-investment into the business along with an improvement in margins has helped the company grow its Earnings Per Share (EPS) by 14.6% over the years

Fall in Earings Per Share (EPS- FY10):

The company’s Earnings Per Share (EPS) has fallen in the last year by 27%. The reason for this is the fall in Net Profit margins which have fallen from 20.5% to 17.7% in the last year due to the increase in interest cost

ROE & ROIC – Decreasing trend:

The company’s ROE has fallen from 21% in 2009 to 14% in FY10, due to the substantial increase in interest costs and also a slight fall in sales turnover.

Though the company has maintained an average of 23% ROIC, the figures have shown a decreasing trend in the last 6 years. From a high of 44% in FY05, ROIC was around 12% in the last year. This is because of the continuous increase of debt on books. The company’s debt has increased from Rs. 9600 Cr. in 2007 to Rs. 25000 Cr. right now(mainly due to Corus acquisition). This has led to a Debt-to Net Profit ratio of 5.71 which is slightly high, indicating it will take more than 5 years to pay off its debt

Hence, we can see that the company has performed well in most of its parameters, with high debt being the only cause for concern. Looking at the overall performance over a 10 year period, we can say that its 10 YEAR X-RAY is Green (Very Good)

Tata Steel’s past on a Consolidated basis:

Tata Steel’s consolidated figures from 2008 (acquired Corus in FY08): The acquisition of Corus took Tata Steel’s revenues from Rs. 25117 Cr.(FY07) to Rs. 131498 Cr.(FY08). It’s profits too increased from Rs. 4174 Cr. to Rs. 7359 Cr. in the same period. Further in FY09 the company registered a good sales growth of 12% and a profit growth of 3.5%. But, in FY10 the company’s sales fell and it registered losses of Rs. 2009 Cr. as a result of the slowdown in the European markets and lower sales from Corus. The company’s debt on a consolidated basis is very high at Rs. 53000 Cr. which includes a major chunk of Corus’ debt burden

To view the company’s 10 YEAR X-RAY on a standalone basis, visit www.MoneyWorks4me.com

What is Tata Steel’s Short-term Outlook?

During the first half of FY10, the European operations (Corus) of Tata Steel were significantly affected by European market conditions. The capacity utilisation of the plant fell to as low as 53% and the company had to shut down 3 Blast Furnaces. In addition the Company faced serious challenges at its Teesside facility due to the sudden termination of a 10-year Off take Agreement by 4 international customers of the slab produced in Teesside. This led to the company reporting losses for 3 consecutive quarters (March09 to Sept09) on a consolidated basis

So, has Tata Steel (Europe) recovered and what lies in store for the company in the next few quarters?

Tata Steel Europe: The company’s consolidated results which were in losses till Dec(due to Tata Steel Europe) have now registered good profits in March’10 and June’10. This was a combined result of the gradual improvement in European steel market and the company’s turnaround initiatives of cost saving and customer first program which were implemented for Corus. With this, the company expects capacity utilization to rise to 85% in the first half of FY11 and save cost of over Rs.1500 Cr due to the cost-saving initiatives. Also, in August’10, Tata Steel Europe sold off its Teesside unit for $ 500 mn to Thailand’s SSI. While, the valuation of Teesside may seem on the lower side, considering Teesside structurally high costs and loss-making operations, this appears to be a positive for the long-term

Inspite of this turn-around, the company expects to register a luke-warm performance in the next few months due to higher raw material costs (coal and iron-ore). and lower global steel prices. It appears that the current slowdown in China has contributed to a decrease in commodity prices

Tata Steel India: Has registered a healthy performance with good growth in sales and profits. The company expects the demand in India to remain robust on the back of strong demand coming from auto, construction and infrastructure sector. Going forward the company expects overall steel demand to rise by 11-12% in FY11.

Tata Steel South-East Asia(NatSteel): The turnover was up by 27% and profits by over 100%. NatSteel sold its entire 27.03% stake in Southern Steel Berhad, Malaysia for a total consideration of around Rs. 320 Cr. The sale is part of Tata Steel’s strategy of restructuring its portfolio and reconsidering its position in geographies where it does not have majority control.

High Debt- a cause for concern: On a standalone and consolidated basis, the company has a high debt of Rs. 25,240 Cr. and Rs. 53,100 Cr. This high debt is on account of Corus’s acquisition. The interest cost on this debt is eating up a huge chunk of its profits, especially on a consolidated basis. In FY10, interest costs were 43% of operating profit. Hence, going forward this is likely to affect the profitability of the company. Recently, Tata Steel signed an agreement to refinance a part of these loans(approx Rs.20000 Cr.). This refinancing is expected to give the company some relief as it has minimized the payment obligations for a 5year period. .

Also, Europe is yet to recover completely from the slowdown. Hence, we can expect the short-term outlook of the company to be Orange (‘Somewhat Good’)

What is Tata Steel’s long-term outlook?

Thus with the company back in the green with respect to profitability and Tata Steel Europe on the path to recovery, what is in store for the company’s long-term future?

Largest integrated player-hence support for margins:

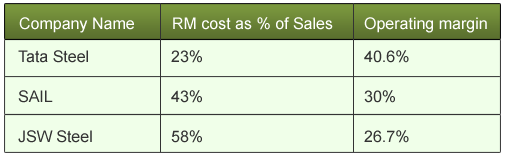

Tata Steel is one of the lowest cost producers of steel (especially on a standalone basis). It is one of the largest integrated players getting its raw material (coking coal and iron-ore) from captive sources. Tata Steel has full captive sources for iron-ore and relies on external sources to the extent of 40% for coking coal. Hence, a 70-90% price hike in coal results only in a 12-15% rise for Tata Steel. Given below is the comparison of the a) the raw material costs as a % of sales and b) operating margins of Tata Steel with its competitors.

As seen in the above table, Tata Steel has been able to back integrate in the best possible manner, as the raw material costs as % of sales is much lower than its its competitors. Also, its operating margins are the highest.

This along with higher pricing power has helped the company improve its margins (average margins have improved from 24% till FY04 to 42% in the last 6 years) and this will continue to help improve them in future. On a consolidated basis the company has planned acquisitions of iron-ore and coal resources to feed its UK and European plants. It has already started with 2 raw material projects to feed its Europe operations. Those are:

a) The Tata-Riversdale Joint Venture (JV) in Mozambique to supply the hard coking coal from this project to its facilities in Europe

b) Direct Shipping Ore Project in Canada to supply iron-ore from this project to Europe facilities

Thus, it seems that the company is quite self-sufficient as far as the Indian operations are considered and is one of the lowest cost producers of Steel in India. With Corus it is aiming to make itself self-sufficient gradually.

Capacity expansion at Jamshedpur plant to cater to future demand and increase efficiency:

Tata Steel along with Centennial Steel Company Ltd., (a 100% subsidiary of Tata Steel) are jointly implementing a 2.9 mtpa (mn tone per annum) expansion, taking Tata Steel’s (Jamshedpur plant) total capacity to 9.7 mtpa of crude steel. This is expected to be completed by 2011-2012. The expansion project will involve setting up new facilities with the following advantages:

a) the largest blast furnace at Jamshedpur for higher efficiency

b) Its in-house coke making capacity, which will further protect the company from rising coke prices

c) A 6 mtpa pellet plant which will enable the company to use extra-fine iron ore, rather than depend on other forms

Also, to reduce the cost of the increased power requirements due this expansion, the company has started Industrial Energy Limited, a 24:76 joint venture (JV) between Tata Steel and Tata Power that ensures the expanded facilities will have a reliable, low-cost supply of power.

Hence each facility of this expansion is strategically placed to increase efficiency as well cater to future increase in demand

Diverse user-industry base to protect from slowdown in particular industry:

Tata Steel has a strong clientele base across diverse industries. It caters to industries like automotive, construction, aerospace, consumer goods, rail, engineering, material & power, packaging, ship-building etc. Having such a diverse user-industry base off-sets the impact of a slowdown in any particular industry. Also, industries like auto, construction, infrastructure and power are poised for great growth in future, hence leading to a higher demand for steel

Corus to be a revenue driver in future:

Tata Steel Europe – the 2nd largest steel company in Europe is a result of the acquisition of Tata Steel and Corus in 2007. Then, Tata Steel paid a hefty sum of US $ 12 Bn, which seemed a high price considering the market situation. This also resulted in a high debt load on Tata Steel’s books. Also, looking at the company’s performance in the last year, it seemed to become more of a concern. But now, Tata Steel Europe seems to be on a turnaround phase and has taken many cost-cutting initiatives, to maintain profitability levels and now the capacity utilization has increased significantly.

Tata Steel had taken over Corus to strategically place Tata Steel as a global player and to build strong operations in Europe. The main aim was to combine the low-cost manufacturing set up in India and to get access to the high-end European markets. It has steelmaking operations in UK and Netherlands, and supplies steel to the construction, automotive, packaging markets worldwide. Right now, on a consolidated basis, Corus contributes 65% to the company’s revenues. Looking at its huge contribution and recent recovery, we can expect this subsidiary to be a future revenue driver(on a consolidated basis).

Steel industry poised for growth:

Steel is the basic foundation material for many construction activities, equipments, goods etc. The Steel sector has grown by 22% CAGR in Sales and Net Profit over the last 6 years. (considering the steel companies in the BSE 500-FY09). The sector is poised for great growth in future especially considering economic recovery and is expected to grow with robust double digits in future. Tata Steel, being one of the largest and most successful players in this industry, is expected to take advantage of all the opportunities available in the industry.

So, is there anything you should be concerned about?

a) On a consolidated basis the company received around 65% from its Europe operations. A slowdown in this geography will impact the company to a great extent.

b) The company has a high debt of Rs. 53000 Cr. (consolidated) on its books, the interest cost of which is eating up a chunk of profits

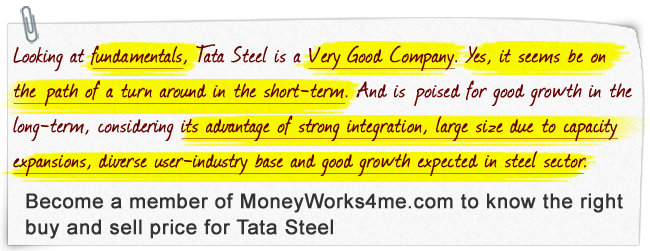

Despite this concern, the company is well-poised for growth, considering high captive resources, capacity expansions to cater to future demand, diverse user-industry base and strong growth expected in the steel industry. Hence, the long-term future of the company can be expected to be Green (Very Good)

Conclusion:

Tata Steel is the largest integrated steel company in the private sector in India. Though the company has had a bleak performance in the recent past, it seems to be on the turn-around path now. In the long-term its competitive advantage of strong integration, large size due to planned capacity expansions, diverse user-industry base is expected to drive the growth.

Yes, Tata Steel is an investment-worthy company, but is its share at a good price to buy? Or is the market overvaluing it? To find out what investment decision you must take on Tata Steel’s stock right now, become a member of www.MoneyWorks4me.com to find its right value.

Disclaimer: This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while taking investment decisions.

Disclaimer: This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while taking investment decisions.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

ok so whats the price to buy

Simple enter in sip fashion.

Awesome post….thanks(a big one) for sharing!

tata steel is good stock but in current scenario what is perfect level of buying the stock ..

plz tell us level …

Regards,

Ronak

Hi,

Tata Steel is indeed an investment-worthy stock considering a long-term perspective. To know the right level to buy the stock, become a member of http://www.MoneyWorks4me.com. The site gives you the MRP (right value) and discount price of every company, hence helping you to take the right buy and sell decisions on any stock. Please do visit the website and let us know your feedback.

Thanks

TATA STEEL IS AN EXCELLENT STOCK FOR LONG TERM INVESTORS

@Sunny Sodday @ Anilmorarka – Thanks a lot. Yes, indeed Tata Steel is an investment-worthy company, with a long-term perspective.