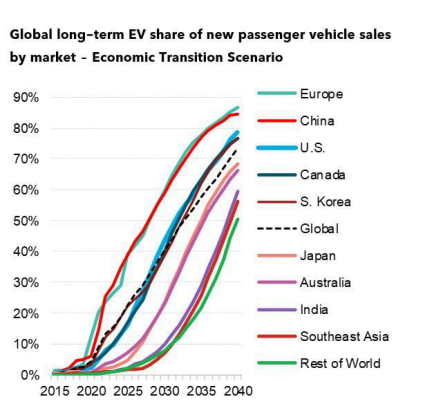

Global Scenario: The auto industry on a global level is undergoing a radical shift from the traditional Internal Combustion Engine (ICE) to Electric Vehicles (EV). This has been happening at a rapid pace with the rise of awareness among consumers.

The rising cost of batteries does not derail near-term EV adoption. War, Inflation, and trade tensions are some of the factors that are driving high battery raw material costs. However, these factors are also pushing the price of Petrol and diesel to record highs, which are driving more consumer interest in EVs.

A traditional ICE vehicle contains about 2000 moving parts, for an EV these numbers come down to just 20, thus it is very easy for new players to enter this market. ICE vehicles are also becoming more expensive to produce. Lesser moving parts in these vehicles will also mean less demand for lubricants.

Indian Electric Vehicles (EV) Industry:

The EV segment in India is seeing continuous traction from consumers. Data as per Vahan shows the registration of 1,19,281 EV units in November 2022. However, this is still below 5% of the total vehicle registrations for the month. For the year 2022 too, EV sales are 6.24% of total vehicle sales. This shows there is still significant headroom for the EV space to grow. CRISIL analysis of the total cost of ownership suggests electric 2Ws and 3Ws attained parity with ICE vehicles last fiscal even when running a mere 6,000 km and 20,000 km, respectively, annually. Considering this along with the government’s focus on the electrification of vehicles, we should not be surprised if EV penetration reaches 10-15% in the coming years in terms of vehicle sales.

Benefits:

The Central government has been keen on shifting the Auto Industry in India to an EV-dominated place thus reducing dependence on external sources for its Crude Oil supplies. EV will also help India achieve the commitment to reduce net carbon emissions to zero by the year 2070.

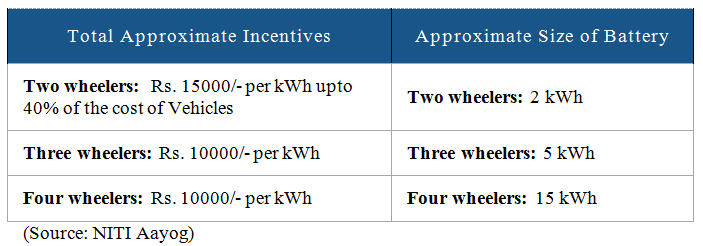

A comprehensive program for the development of the semiconductors and display manufacturing ecosystem in India (PLI Scheme) was approved by the Government of India with an outlay of Rs. 76,000 Cr (~$10Bn). This program will further enhance the EV manufacturing ecosystem n India. The government has provided various benefits to incentivize consumers to purchase EVs rather than ICE vehicles. Some of them are as mentioned below:

Besides this, there are various incentives from state governments too. Such as in Maharashtra, there is a capital subsidy of Rs. 5,000/kWh up to INR 10,000 for the first 1 lakh electric 2-wheelers. On top of this, there is an exemption for Registration fees and Road Tax. These incentives have reduced upfront costs for consumers. However, in the coming years, the adoption of 2Ws and 3Ws will rise even without the subsidy due to the parity of ownership cost with ICE vehicles.

The EV adoption will also have its negatives for some industries. Traditional Auto component manufacturers may not find their place in this evolving space. Pivot or Perish seem to be the only two options left with the manufacturers. In the 4-wheeler segment, while Tata Motors has leaped ahead in EV sales with the flagship EV Nexon, market leader Maruti Suzuki has yet not shown significant aggression to enter the same. Change is the only constant. Only the coming time will tell us whether the existing industry leaders improvise and come up with better EV options and maintain their market share or new dynamic players make their way to consumers’ homes.

Best Stocks From:

Undervalued Nifty 50 Nifty 500 – Quality with Price Strength Screener Alpha Cases 5 Stars Rated Stocks from Nifty 500 Business Houses Group

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463