Investing in a high dividend paying company is a mouth watering prospect for many. The reason for this is you feel you are guaranteed a fixed amount of return in the form of dividends every year. Fixed income plus the price appreciation in the stocks! We can’t go wrong with these companies, can we? The logic that you might come across for investing in such companies is- “The companies paying high dividends are a safer bet. They command a higher premium in the market and hence will generate greater total return”. It sounds like a sure winner. But is it really so? No. It is nothing but a myth.

So, why are we calling it a myth?

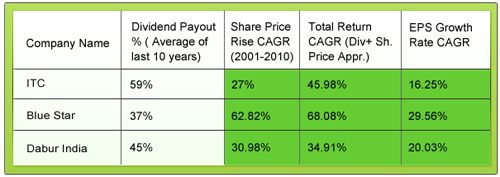

To get a better understanding of this market myth let us compare two companies- Hindustan Unilever Limited (HUL) – which has constantly been paying very high dividends & Infosys- which also pays dividends but much lower than HUL.

Going by the market rule of thumb, we should have invested in Hindustan Unilever which had a higher dividend payout ratio in 2001. So, what would your total return be after 10 years? A disappointing 6% every year. Though HUL continued to pay out high dividends, its price has not gone up much over the years. The returns by investing in HUL would be even lower than the returns on a Government bond or fixed deposits!

On the other hand, Infosys despite paying lower dividends has performed remarkably well giving a total return of 33.7% CAGR. What was the reason behind this? Infosys invested 71% of the profits, back into its business and increased its EPS by an impressive 26.85%. This resulted in a 29% CAGR share price appreciation. Whereas, HUL invested only 22% of its profits back into its business and grew its EPS by a meager 5.38%. This resulted in a price appreciation of only 6% CAGR. Thus, contrary to the market rule of thumb, Infosys was a better investment than the high dividend paying HUL.

In a developing economy like India, most companies are in a high growth stage; and hence rather than paying out dividends, prefer to reinvest the profits back into the business. However, some companies yet pay out majority of their profits as dividends.

So, let’s understand why companies pay dividends?

A company pays dividend to its shareholders in the following scenario:

-

- It has sufficient funds to continue its growth process, so it’s paying the excess funds to the shareholders

- The management of the company thinks that since the business has reached a mature stage and growth prospects are low, hence the returns it would get on reinvestment would not be significant. In this case it gives out dividends, so that its shareholders can earn higher return on the money by investing in other investment option.

- During the downturn, as price doesn’t appreciate, dividend is the only source of income for its shareholders.

But, are high dividends paying companies actually a safe bet?

The perception is that since these companies pay high dividends, they give a form of fixed income to the shareholders. But this may not be the always the case.

You must have heard the news of companies declaring dividends to the extent of 100%, 200% and sometimes even over 1000%. The important point here is to understand that though these figures sound very high, the dividend is paid on the face value and not the market price of the stock. For e.g. in the case of HUL the face value is just Re. 1 and the market price is Rs. 300. So a declaration of 400% dividend means you get just Rs. 4 per stock as dividend. Doesn’t sound very high now, does it? Not only are the dividends as attractive as they seem to be, there are also some risks involved in investing in dividend paying companies.

The Risks involved in investing in such companies:

Reinvestment Risk – When a company pays back the dividends to its shareholder’s, it actually becomes the responsibility of the shareholders rather than of the company to invest the money. So, with the risk of investing shifting to the shareholders, they would be left with choice to invest in stocks or put their money in fixed deposits scheme. Owing to the high inflation rate in India, the real return of the shareholders would be much lower.

Discontinuance of Dividend Payments – The companies are not legally bound to pay any form of dividend unlike say interest payments on fixed deposits. They may choose to increase, reduce or even stop the dividend payment citing reasons like downturn, lack of demand, low profitability etc. So, it’s important to note that the companies are not liable to pay dividends and they can stop paying it anytime they want.

Therefore it is important to analyze, whether the dividends paid by the companies are sustainable or not.

So, how can you do this?

- You must analyze the dividend payout ratio of the company for past 6 years and check for its consistency. Actually, there are also cases when a company pays extraordinarily high dividends in a particular year. For e.g. In March 2010 Hero Honda declared a dividend of Rs. 80 which was a Silver Jubilee Special Dividend. This must be taken as an exception rather than a norm, as the company is not likely to continue with such high dividend payout in the future.

- Compare a company’s dividend with some of its peer companies in the same industry. If your company is paying very high dividends than its competitors than it is compromising on its growth prospects (which is exactly what we don’t want!!).

Hence before investing in a high dividend company, the first step should always be to check whether the company is fundamentally strong and has performed well in its 5 key parameters over the past. After, that we must check whether the dividend paid by the company is sustainable or not. If a company does well on both fronts, you are more likely to earn great returns by investing in it.

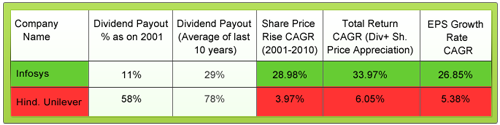

Have a look at the table below.

The table shows that companies like ITC, Blue Star & Dabur India have managed to pay high dividends and have been able to grow their earnings consistently as well. No wonder, the total returns you would have got by investing in these companies in 2001 are good! This also suggests that the business models of these companies are such that they do not require a lot of money to continue to grow.

So, before investing in a high dividend company it is important that you check whether the company is fundamentally strong or not; and also if the dividends are sustainable or not.

Do you know of any such high dividend stocks with good fundamentals and growth prospects?

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

boss, companies paying high dividend should command respect. most of them believe that they have the ability to earn and then willingness to share. Don’t blow your onesided trumpet. enlarge your vision and understand the view point of many so called original thinkers on the topic.

have you heard the concept of more for less. read nestle annual report for the last ten years and do your calculations and then tell us what you find. boss be sincere. it will help you and us both. give a try. all the best.

Dinesh kotecha/vasai/

We appreciate your feedback. As you have rightly mentioned, it is important for companies to have the ability to earn and then the willingness to share. And there are such companies which have grown their earnings well and paid out dividends. These are the companies you should be looking to invest in. However, some companies pay out a large chunk of their profits without having consistent growth in profits year on year, thus compromising on growth. What we are saying is that you need to differentiate between dividend paying companies which have good fundamentals and growth prospects and those which don’t. Companies like ITC, Blue Star – which we have mentioned above, or for that matter Nestle, have not only given high dividends but have also had good financials and shown good growth over the years. Nestle has witnessed a 20.65% CAGR in EPS over the years – an impressive performance. This has led to consistent dividend payout as well as good price appreciation leading to around 25% total returns over the last 10 years (CAGR). If you have bought Nestle at attractive valuations, you have indeed made a good choice.

However, be vary of companies that are known for high dividend payout, but have not grown their earnings much over the years. For e.g. HUL’s EPS has grown at a CAGR of just 5.38% over the last 10 years as compared to Nestle’s 20.65%. Hope this clarifies. Thanks.

remarkable well written articles, thnx

Thanks for your appreciation.

I love to read your e-journal and believe me it has changed my views,way of investing and my personal analysis.I specially like to read when u critically express your views on company fundamentals Because i always follow a rule ” Critics must be around yourself so dat you can fly like eagle !” Well-done and really eye-opener for new as well old n expert investors who have small money who can’t move price of stock as per their choice !

Thanks for your great feedback. It’s great to know that Stock Shastra has had a positive impact on your personal analysis and decision making. We look forward to more of your feedback.

Excellent. But the market price may not be based on dividend alone as you can see some shares do not pay dividend but actively traded in the market. Take Suzlon energy which is not paying any dividend and having a low PE ratio. So why the share is attractively priced? Your opinion about MTNL that the market price is so low but I think the assets are not valued at the market price has s strong based infrastructure. The main problem is the management with lack of service condition to their clients lagging the business. What is your opinion on this? How can we count this in the balance sheet?

They can’t always pay High dividends.. One thing which is possible is that if the company doesn’t want to expand its operation and so distributes its cash flow as dividends.

Thanks for sharing your views. You are correct in saying that companies can’t pay high dividends continuously. During a downturn or year of poor performance companies try to consolidate their position by not distributing dividends. Ideally if the company cannot generate sufficient returns on the shareholders funds, it is better off distributing the funds as dividends.