‘This is my sales target and I don’t care how we achieve it!’– a common motto for many marketing managers, branch heads and CEOs just before a quarter or financial year ends. The motive – To show a rosy picture of the company’s financial position so that it can have a positive effect on the company’s stock price. All analysts and investors eagerly await the company’s quarterly results. If the company meets its sales guidance the company is rewarded and the stock price rises; if it fails to meet the guidance, the price is hammered. Very often this motivates the companies to manipulate their sales. Infact, sales or the top line is one of the easiest figures to manipulate with a number of techniques available to the manipulators.

‘This is my sales target and I don’t care how we achieve it!’– a common motto for many marketing managers, branch heads and CEOs just before a quarter or financial year ends. The motive – To show a rosy picture of the company’s financial position so that it can have a positive effect on the company’s stock price. All analysts and investors eagerly await the company’s quarterly results. If the company meets its sales guidance the company is rewarded and the stock price rises; if it fails to meet the guidance, the price is hammered. Very often this motivates the companies to manipulate their sales. Infact, sales or the top line is one of the easiest figures to manipulate with a number of techniques available to the manipulators.

So, what are these techniques? And is it possible to find out such companies through some early signs or red flags? Let’s have a look.

The different techniques for manipulating sales…

There are four different techniques available to companies:

1. Premature revenues

2. Fictitious Revenues

3. Recording revenues when buyers payment remains uncertain

4. Unsustainable activities

Let’s have a look at how exactly these techniques work.

1. Premature revenues

One of the most common techniques that companies employ to manipulate sales is to record revenues early, when they clearly belong to a subsequent period. For e.g. Consider a Software company ABC that suddenly decides to record license sales in the current year when actually the revenue would be earned over a period of say 5 years. Or consider company XYZ that changes its revenue recognition policy to record the entire value of a five-year customer contract in the current year. The effect in both cases is an inflated top-line.

2. Fictitious Revenues

Recording fictitious revenues is another way to manipulate sales. This is infact worse and more abusive than recording premature revenues where atleast actual sales do exist. There are 2 ways in which companies can record fictitious revenues.

- Fake Invoices – faking invoices is one of the easiest ways used by companies to inflate sales. Infact the Satyam scandal was based on this method of manipulation. The financial numbers were manipulated through fraudulent sales generated by fake invoices. In the period from April 2003 to December 2008, as many as 7,561 fake invoices were created by a set of people close to Raju, who had access to the system. These invoices generated without purchase orders were shown as “hidden” and could only be accessed by a chosen group of people. The CBI has alleged that Mr. Raju even asked his software team to develop certain products for seven non-existent customers.

- Bogus Products – As if faking invoices wasn’t enough, the next step that companies can adopt is cook up fake products in an attempt to inflate revenues! As far-fetched as it sounds, this was actually done by the insurance major AIG which introduced a product called ‘Finite Insurance’ which insured companies to cover up quarterly blemishes. So, AIG would insure companies against an earnings shortfall. So far so good, but things turned murky when it turned out that some of these “insurance” contracts were not really legitimate insurance arrangements at all. There was a case in which Brightpoint Inc. (a wireless company) suffered an earnings shortfall of around $15 million and then entered into a retroactive insurance arrangement with AIG. This was like insuring your car after the accident has happened. The result was that Brightpoint recorded $15 million “insurance recovery” as income. All went well till the fraud came out and both Brightpoint and AIG got into trouble.

- Related party transactions – Another common method to inflate sales is to have transactions with related parties for e.g. sales to a vendor, a relative, a corporate director, a majority owner or a business partner. While such transactions may sometimes be appropriate, most related party transactions may lack an arm’s length process produce inflated revenues and raise doubts regarding the legitimacy of the sale.

3. Recording revenues when buyers payment remains uncertain

One of the most important things to look for is the ability of a company’s customers to payback the company.

- Buyer lacks Ability to pay – The seller may be accelerating revenue by recording sales to a buyer who lacks the ability to pay. E.g. imagine sale of software made by a company to government universities which can help the universities better manage their admissions. The university actually relies outside (i.e. government funding) for making payments for the software. It would thus not be prudent for the software company to book revenues before any such funding is received because of the uncertainty involved with government grants and funding.

- Extended or flexible payment terms – Companies sometimes offer better or flexible payment terms in order to entice their customers to buy additional products and generate higher sales. While such arrangements definitely prep up revenues for the time being, they pose an increased risk of the payment never being realized!

- Seller provided Financing – While customer financing is a very good selling technique, it can be dangerous when abused. Like the earlier arrangement, this one also has an inherent risk of customers not making the payment at all.

4. Unsustainable activities

- Using onetime events to boost revenues – Companies are usually in possession of several fixed assets used in the production of their goods and services. At times, some of these fixed assets may be surplus to the requirement. And at times, the business might be in desperate need of cash and decide to sell some of its fixed assets. When inappropriately accounted for, these onetime gains can be used by companies to artificially boost revenues. Investors thus need to check these accounting entries thoroughly.

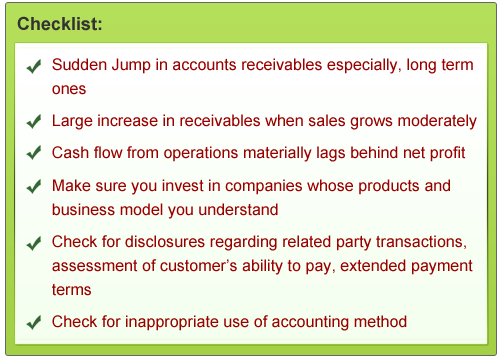

As mentioned before, there are many ways in which companies can manipulate revenues. History has provided us with numerous examples of highly innovative and incredulous ways of manipulating revenues. However, more often than not, it is possible to find some signs of doubtful practices. Here is a list of some common red-flags that can be used to analyse companies and their financials and avoid investing in dubious ones

1. Premature revenues – One of the most common techniques that companies employ to manipulate sales is to record revenues early, when they clearly belong to a subsequent period. For e.g. Consider a Software company ABC that suddenly decides to record license sales in the current year when actually the revenue would be earned over a period of say 5 years. Or consider company XYZ that changes its revenue recognition policy to record the entire value of a five-year customer contract in the current year. The effect in both cases is an inflated top-line.

Red Flag (use Symbol)

Sudden Jump in accounts receivables especially, long term ones

Cash flow from operations materially lags behind net profit

2. Fictitious Revenues

Recording fictitious revenues is another way to manipulate sales. This is infact worse and more abusive than recording premature revenues where atleast actual sales do exist. There are 2 ways in which companies can record fictitious revenues.

• Fake Invoices – faking invoices is one of the easiest ways used by companies to inflate sales. Infact the Satyam scandal was based on this method of manipulation. The financial numbers were manipulated through fraudulent sales generated by fake invoices. In the period from April 2003 to December 2008, as many as 7,561 fake invoices were created by a set of people close to Raju, who had access to the system. These invoices generated without purchase orders were shown as “hidden” and could only be accessed by a chosen group of people. The CBI has alleged that Mr. Raju even asked his software team to develop certain products for seven non-existent customers.

• Bogus Products – As if faking invoices wasn’t enough, the next step that companies can adopt is cook up fake products in an attempt to inflate revenues! As far-fetched as it sounds, this was actually done by the insurance major AIG which introduced a product called ‘Finite Insurance’ which insured companies to cover up quarterly blemishes. So, AIG would insure companies against an earnings shortfall. So far so good, but things turned murky when it turned out that some of these “insurance” contracts were not really legitimate insurance arrangements at all. There was a case in which Brightpoint Inc. (a wireless company) suffered an earnings shortfall of around $15 million and then entered into a retroactive insurance arrangement with AIG. This was like insuring your car after the accident has happened. The result was that Brightpoint recorded $15 million “insurance recovery” as income. All went well till the fraud came out and both Brightpoint and AIG got into trouble.

• Related party transactions – Another common method to inflate sales is to have transactions with related parties for e.g. sales to a vendor, a relative, a corporate director, a majority owner or a business partner. While such transactions may sometimes be appropriate, most related party transactions may lack an arm’s length process produce inflated revenues and raise doubts regarding the legitimacy of the sale. Make sure you invest in companies whose products and business model you understand. Check for disclosures regarding related party transactions

3. Recording revenues when buyers payment remains uncertain

• Buyer lacks Ability to pay – The seller may be accelerating revenue by recording sales to a buyer who lacks the ability to pay. E.g. imagine sale of software made by a company to government universities which can help the universities better manage their admissions. The university actually relies outside (i.e. government funding) for making payments for the software. It would thus not be prudent for the software company to book revenues before any such funding is received because of the uncertainty involved with government grants and funding.

• Extended or flexible payment terms – Companies sometimes offer better or flexible payment terms in order to entice their customers to buy additional products and generate higher sales. While such arrangements definitely prep up revenues for the time being, they pose an increased risk of the payment never being realized!

• Seller provided Financing – While customer financing is a very good selling technique, it can be dangerous when abused. Like the earlier arrangement, this one also has an inherent risk of customers not making the payment at all. Check for Company disclosures related to change in assessment of customer’s ability to pay, extended payment terms, etc.

4. Unsustainable activities

• Using onetime events to boost revenues – Companies are usually in possession of several fixed assets used in the production of their goods and services. At times, some of these fixed assets may be surplus to the requirement. And at times, the business might be in desperate need of cash and decide to sell some of its fixed assets. When inappropriately accounted for, these onetime gains can be used by companies to artificially boost revenues. Investors thus need to check these accounting entries thoroughly.

As mentioned before, there are many ways in which companies can manipulate revenues. History has provided us with numerous examples of highly innovative and incredulous ways of manipulating revenues. However, more often than not, it is possible to find some signs of doubtful practices. Here is a list of some common red-flags that can be used to analyse companies and their financials and avoid investing in dubious ones

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

Thanks a lot for the appreciation. We believe that understanding how companies can manipulate their accounts is important for all investors.

Unfortunately, to get more detailed results or financials of a company, investors have no option but to go through the Annual Report of the company. Alongwith the numbers, you will also have to go through the Accounting policies which reveal important information.