How does it work?

Different people have different ways of investing in the market. People following a particular method have a rationale that supports it and seldom do they verify whether it holds true over a period of time. More often they find data to support their preferences. However, it is important to stress-test our beliefs about how we should invest.

Story of 3 brothers

Let’s understand this from the story of 3 brothers A, B & C. In 2006, they have given Rs 10 lakh each by their father. Their father runs a successful business and is generating lots of profits. He told them that they had the freedom to invest in any which way they want over the next 10+ years and depending on who grows the money the most will be in charge of the entire family wealth when he retires. The three brothers had very different temperament and chose very different ways of investing.

Mr. A believed in a backing winner and hence invested all the money in an asset class that earned the highest returns in the preceding year. He understood that all asset classes and funds underperform from time to time and hence it made sense to move money into that class that was performing the best and not simply buys and holds. Here’s how he performed in the 13 years period:-

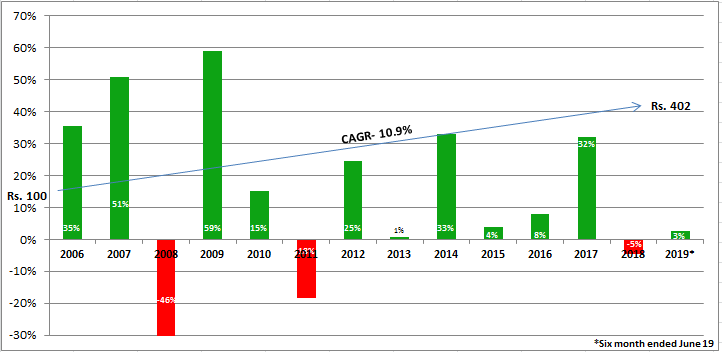

Annual Portfolio Returns of Mr. A

After following his “Back Winners” investment process for 13 years, he has left with only Rs. 14 lakh. Also in these 13 years, there have been many times when Mr. A felt had sleepless nights since his portfolio value went to as low as Rs 4.7 lakh, well below Rs 10 lakh. And after facing this level of anxiety, money didn’t even grow with inflation. This is perhaps the most common way in which individual investors invest in Mutual Funds-buying funds that have given the highest past returns. Many exits when they see a steep fall and actually incur losses and perhaps even stop investing in equity which helps generate wealth in the long run.

B. Back Potential Multi-Baggers

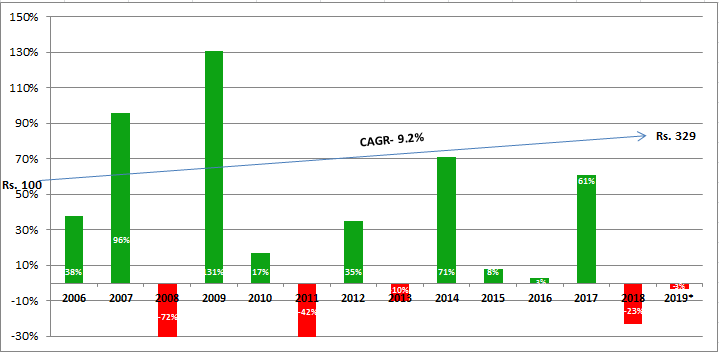

Mr. B was the youngest of all and the most aggressive. He was less worried about risks and downsides and wanted the maximum possible return. He invested all his money in small cap equities assuming this would give the highest returns amongst all classes and he would find some multibagger giving him 10x return. Figure 2 below shows the return for Mr. B and the drawdowns in his portfolio value:-

Annual Portfolio Returns of Mr. B

His portfolio value after 13 years was about Rs. 33 lakh earning a 9.2% CAGR. However, to earn this, he had to face his own set of challenges. The magnitude of change in his portfolio value was substantial and the highest. This was accompanied by loss of principal value in 2008. In his pursuit for multi bagger, he found a few but the majority of his other stocks did not contribute enough for aggregate portfolio return. Moreover, the sleepless nights that he had during 2008 when his portfolio went down to 7.6 lakh from 27 lakhs in 2007, cannot be quantified. It took straight 8 years to i.e. 2008-2016 to reach back to 2007 level. After looking at volatile moves on large savings, investors tend to book losses and encash their portfolios at wrong times. Very few manage to sail through. It can be said that Mr. B was very committed and unemotional to stay invested despite high volatility.

C. Prudent Asset Allocation

Mr. C was a rational man who understood that asset classes gave higher returns because it came with some risks. He knew that it was impossible to predict how the equity market would perform except that it would be volatile and could give him sleepless nights. Considering volatility returns potential and investment horizon, he invested 60% in equities (50% in large cap and 50% in small & mid cap equally), 35% in Debt and 5% in Gold. Figure 4 below shows the return and the downside in his portfolio value. This is the classical asset allocation method and staying true to it throughout the investment period.

Annual Portfolio Returns of Mr. C

The value of a portfolio of Mr. C was Rs. 40 lakhs earning a 10.9% CAGR over 13 years. His portfolio provided returns with low volatility and less downside (evident by the minimum red color in the chart). At no point in time did Mr. C have sleepless nights, since he had consistent returns with minimum downfall (even during tough situations like 2008 market turmoil).

Finally, Mr. C proved to be the best in managing his wealth and was awarded the charge of the entire family wealth.

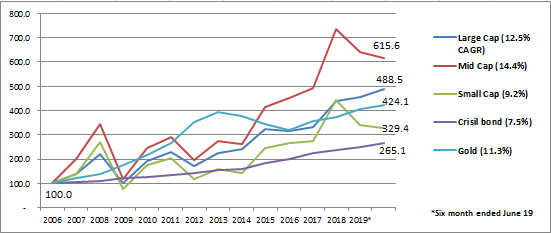

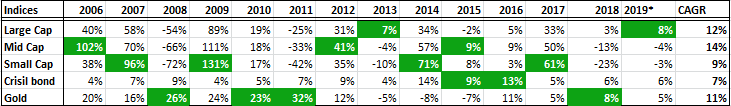

Performance of Asset Classes during the period

Now let’s have a look at how each asset class performed in these 13 years from 2006 to 2019.

As seen in the above figure, Rs. 100 invested in any asset class would give a return higher than Bank FD rate if stayed invested over the period. The higher return is accompanied with volatility where the value Rs. 100 keeps on fluctuating which is not the case with Bank FD. This creates fear among investors and they generally tend to exit accepting a low return or even a loss at times. However, the key is to earn at a healthy rate of compounded return is to diversify among asset class and stay invested for the long term.

Comparison between performances of each brother

Comparison between performances of each brother

From a risk perspective, Mr. B certainly took a lot of risk by heavily concentrating in small cap. Despite this, his returns fell below Bank FD (7%) rate multiple times. Also, his CAGR at the end of 13 years was not very high in comparison to Crisil bond which is the least volatile asset class out of all. Mr. A saw the maximum fall (72%) in the value of his portfolio. This could have been a very depressing experience (especially because he invested looking at the winner). On the other hand, Mr. C who had balanced positions in all asset class did not suffer from sleepless nights since his portfolio was in a much better state than others. Due to disciplined diversification he followed, fall in one asset class was supported by a rise in another, thereby keeping a balance in overall return.

Why C performed better?

The success of Mr. C came due to 2 things- diversification and patience. He understood that every asset class deserved a place in his portfolio and its contribution could be justified only if it is given sufficient time for compounding. The proportion of each asset class in the portfolio would vary for every investor according to his/her return requirements and risk appetite but these two factors should stay the same. In a nutshell, one can achieve his goals following a process and sticking to it. The focus shouldn’t be on achieving the highest returns. It is prudent to focus on reasonable returns by diversifying into non-correlated asset class to achieve financial goals.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463