MoneyWorks4Me Alpha makes Systematic Stock-investing Super Easy…in one click; you are all set to do it successfully.

On MoneyWorks4Me Screener under ‘Best From’ you choose the universe to invest in, save it, and you are set.

- You will get a shortlist of the best stocks from your chosen universe that you can invest in right now i.e. High-quality stocks that are undervalued.

- Once you save this screen you will get smart alerts when;

- New stocks pass the criteria; so, you can add them to your portfolio

- Existing qualified stocks no longer pass the criteria eg become over-valued so you can consider selling partly or fully.

- You can use the Execute Trade feature available on the site to buy or sell through your broking account using the smallcase gateway and your portfolio manager gets auto-updated.

Amazing isn’t it!

Read on to find out more about Systematic Stock-investing and why you can rely on Alpha to do it successfully.

What is Systematic Stock-investing and why is it necessary for your success?

The mantra for success in stock investing is to Stay invested, earn inflation-beating returns and let the power of compounding work for you. Why? Because One lac invested will grow to 30 lacs in 30 years at 12% returns while kept in a Fixed Deposit giving 6% interest it will become less than 6 lacs.

How?

By building a diversified portfolio of quality stocks bought at reasonable prices…systematically!

The success mantra and the way to make it work is simple to understand. But success requires a disciplined way of making and implementing sock-investing decisions and not being driven by emotions. How do you do this when the market itself is ever-changing and dynamic and you are exposed to so much news, events, opinions, and influence?

The answer is to follow a systematic way of investing. Systematic means methodical, orderly, organized, and efficient. Its root is System which means a way of working, organizing, or doing something which follows a set of rules. So, a systematic way of investing means you follow a set of rules to take these decisions:

- How do you construct your portfolio?

- Which stocks are worth investing in and which ones to avoid?

- Is the current price of a stock attractive for long-term investment?

- Is the current price of a stock you own over-valued and unattractive to hold on to?

- Should you act now or wait?

Alpha enables you to answer these questions and make informed decisions with ease.

How to construct your portfolio?

This is answered by selecting the universe of stock that you invest in. A properly diversified portfolio enables you to enjoy strong stable performance and also earn high returns. A good thumb rule is to have a mix of large, mid, and small-cap stocks. You can do this by selecting Best From Nifty 50 for the top large-cap stocks and Mid/Small caps separately or Best From Nifty 200. If you have more stock investing experience you can consider investing in different sectors, industry, styles of investing, and themes.

Whatever universe you choose, Alpha enables you to answer questions 2 to 5 above using the DeciZen rating system of Quality, Valuation, and Price Trend i.e. QVPT in short.

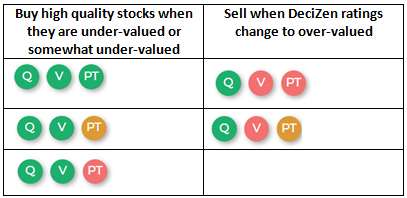

Alpha’s Best-From screens stocks using DeciZen ratings on Quality and Valuation to identify very good quality (green) and undervalued (green) stocks. These are the best ones to buy and build your portfolio. When the rating changes Alpha alerts you so you can take action. The table below summarizes how you make the buy and sell decisions using the QVPT ratings.

See the below video to get a quick summary of the rating system:

You can also read The Ultimate Guide to Stock Investing for an in-depth understanding.

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463