Most successful strategy in equity investing is buying good companies at cheap prices. This philosophy is called as Value Investing. However, cheap prices do not come without temporary negative news. One has to buy when stock market is correcting. So value investing often leads to catching falling knives. Stocks keeping correcting for some time after the purchase.

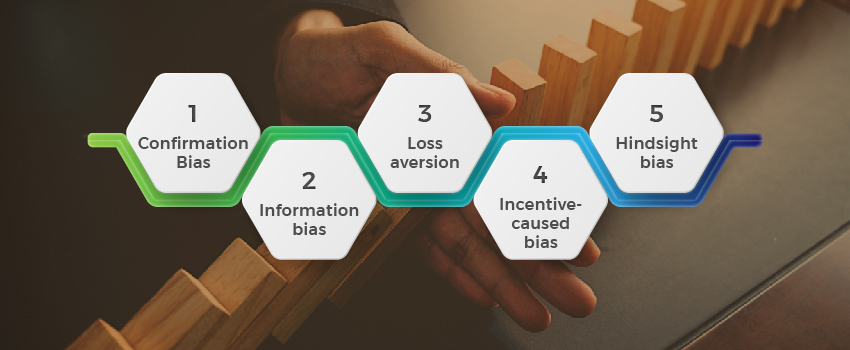

It was identified by two Israeli psychologists, Daniel Kahneman and Amos Tversky. In Decision Theory, loss aversion refers to people’s tendency to prefer avoiding losses over acquiring equivalent gains: it’s better to not lose Rs. 100 than to find Rs. 100. Studies conducted by above mentioned academicians suggest that psychologically, losses are twice as impactful as gains.

This is the exact reason not many are comfortable practicing value investing. Most often individual investors end up making losses by buying high and selling low.

This behaviour due to human’s intense focus on the short term. If humans think slightly long term, they would probably not get perturbed by short term losses.

“The ability to discipline yourself to delay gratification in the short term in order to enjoy greater rewards in the long term, is the indispensable prerequisite for success.” – Brian Tracy

By nature, humans find it tough to imagine future and we often get trapped assuming short term outcome to be the final outcome.

Often due to economic/business cycles we get good stocks at decent bargain. However, downcycle doesn’t end as soon as we make a purchase. It may continue to do badly for some time. But over long term most good businesses reach equilibrium and profits revert to the mean.

We believe if only we focus on value 3 Years in the future we will get better at making an investment decision. In short term, Murphy’s law is almost always true, “Anything that can go wrong will go wrong”. But we have enough evidence over long term equities give phenomenal returns.

We recommend some suggestions to tackle pitfalls of short term thinking:

- Think longer term. Focus on price 3 Years hence

- After purchase don’t check stock prices often. Once in 3/6 months is more than enough

- Remember that mistakes will happen. But a portfolio approach of buying and holding atleast 20 stocks will ensure mistakes won’t cost a lot

- Stock sensitive news is mostly focused on near term outcome. Unless you are intending to sell in short term, news means nothing to you – ignore news.

- Focus more on business and not on stock prices. We have 10 Yr Financial X-ray laid out on every company for this very reason. Falling stock will not give you nightmares if you see fundamentals of a company are quite good.

- Feel free to talk/mail your advisor if you need conviction for holding onto short term losing position.

Top Picks For You:

Best Nifty 50 Stocks at Fair Value Best Stocks from Nifty 500 Best Dividend Stocks Nifty SmallCap 250 Undervalued Stocks

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463