This article covers the following:

Equity investing is often summarised as buying good companies and holding them for the long term. As companies grow, equity value also grows in line with occasional lead or lag.

But it is not uncommon to find investors who challenge this dictum and try to make a profit faster and avoid temporary losses. Everyone wishes to exit their investments at a perfect time and buy it back at the right time.

However, it’s hardly possible to time the entry and exit without the benefit of hindsight. Even if we really did embark on this painstaking exercise with available data, would you make any superior return? We doubt it.

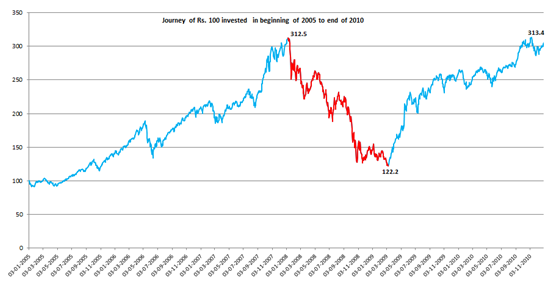

Indian markets had experienced a strong bull run after its recovery from the dot com bubble burst of 2000-01. The markets made their peak by the end of 2007 and 2008 saw a deep correction of 60% from the peak.

One could have taken two different approaches to invest in these markets. Let’s understand this with a story of two friends A & B.

After seeing 2 good years of equity return in 2003 and 2004, two friends A & B decided to participate in equity markets starting in 2005. Both decided to invest a modest sum of Rs. 100,000 each which they were willing to spare for a long term of 5-10 years and had an appetite to bear volatility on the same. Both the friends made an investment into BSE Sensex at the same time.

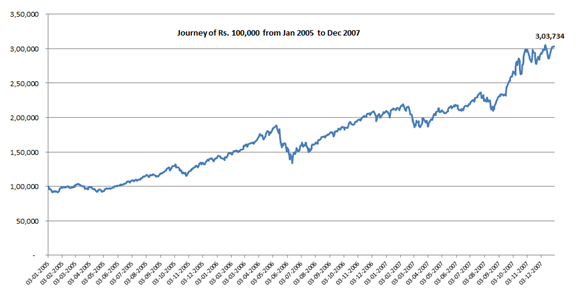

First phase- From 2005 to the end of 2007

During the first phase, both the friends invested in the same buy-and-hold fashion. The market experienced a bull run and both of them tripled their money in a matter of 3 years implying 45% CAGR.

The above chart shows the value moved during this time period. By the end of 2007, their investment had ballooned to an astounding sum of Rs. 3.03 lakhs.

This experience felt like a cakewalk and made both the friends quite confident about equity investing. Little did they know what’s about to unfold over the next 2 years.

Second phase- From 2008 to the end of 2010

The year 2007 started with bad news of the sub-prime crisis in the US. The fear of a financial system clogged with huge bad loans and its linkage across the world made global stock markets more jittery.

The start of 2008 saw real capitulation as the market tanked 30% in less than 1 month. This was the phase when Mr. B got restless to protect his profits and jumped in and out based on market movements. He thought he could further improve his returns if he could predict the dips and rise in the markets and invest accordingly.

Mr. A, on the other hand, decided to stay put with his strategy and remain passive. Now let us see how each of them performed in the crisis period of 2008-10.

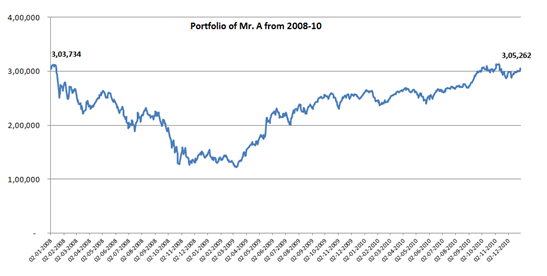

Investment of Mr. A

Mr. A simply continued with his buy and hold strategy and stayed invested in the market with his already earned Rs. 3.03 lakh. Now let us look at how the investment portfolio of Mr. A looks like.

Investment of Mr. B

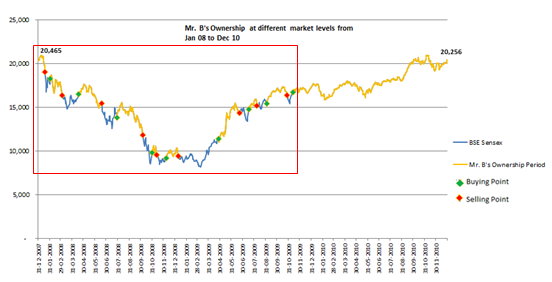

Mr. B as we discussed decided to change his style to active and make the most out of a crisis. As we know, no one can predict future market movements. But just to be fair with Mr. B, let’s assume that he participated halfway in every fall or rally.

In every dip, he sells in the middle of the entire dip thinking that markets might fall further. In every rise, he invests in the middle of the entire rise thinking that markets might rise further.

Here we are giving the benefit of the doubt to Mr. B that each of his predictions was right.

The above chart shows the attempt of Mr. B to predict the dips and rises in the market levels and time his investment accordingly. The highlighted portion is the time period during which Mr. B’s investment strategy differed from Mr. A.

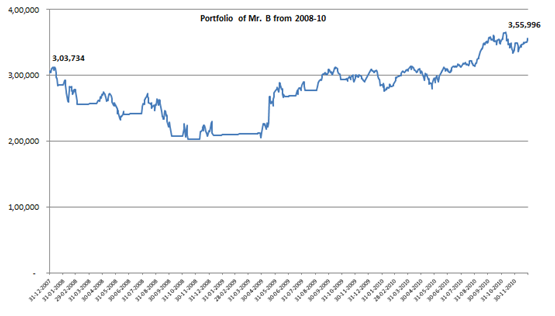

After this hectic exercise by Mr. B, let’s see how his portfolio performed.

As seen in the above graph, the portfolio of Mr. B increased 3.5 fold in a matter of 3 years. Hence from 2005-2010, his CAGR returns are 23.5% CAGR.

Is this strenuous exercise worth it, for a mere 3% extra returns?

Now we know that Mr. B clearly outperformed Mr. A and generated an additional 3% CAGR. But rather than looking at the cases of both A & B in black and white, let us consider a few important points.

When we conclude that Mr. B is a winner and he made 23.5% CAGR vs 20.4% CAGR of Mr. A, we are ignoring certain things that could actually lower the returns. These are:-

- A very bold assumption that Mr. B was always able to successfully predict the dips and rises in the markets.

- Assuming that he paid no short-term capital gains tax each time he sold his investments.

- Assuming that he incurred no transaction costs.

Comparison of investment journeys

The two friends had very different investment journeys in the same investment horizon and market conditions.

Mr. A did this investment passively and did not bother to time it. He actually spent no time looking at his investments and his money worked for him in the true sense. He utilized this time towards other productive things like his profession, family, etc.

On the other hand, Mr. B spent most of his time in anxiety trying to predict the future market movement. He came from a different profession but he ended up spending most of the time in predictions. Hence, the additional 3.5% CAGR cost him his time and peace of mind.

Time to make a decision

Currently, we are in the same (or rather enhanced) crisis situation as in 2008. The decision that we need to make here is to step into the shoe of Mr. A or Mr. B. If the decision is Mr. B, there is a small disclaimer as we live in a real life.

The disclaimer is that-

- You don’t know the future market movements and your predictions are bound to go wrong some or the other time.

- You will incur transaction costs and tax implications.

If your decision is Mr. A, you might be one of many who want to spend time on other things such as your profession, family, and hobbies.

You want the money to work for you then you working for money by spending a lot of time and looking at the daily moves of the market.

Conclusion

Most of us would fall into ‘Mr. A’ category who cannot predict the future and have other obligations in life. The wise way of participating in the equity markets is putting your risk capital into it and letting that money work for itself. Monitoring the daily moves of the market after committing the risk capital becomes a futile exercise.

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463