“We don’t have to be smarter than the rest, we have to be more disciplined than the rest.”

-Warren Buffet

As investors, we generally don’t have a system in place to decide what stocks to invest in. We generally rely on what stock is in the news, what brokers are saying to buy/sell, and what stock your friend invested in and made big money. We are always on the lookout for investing opportunities on a daily basis. But following this rarely results in the creation of long-term wealth for us. Are these stocks really the best to invest in?

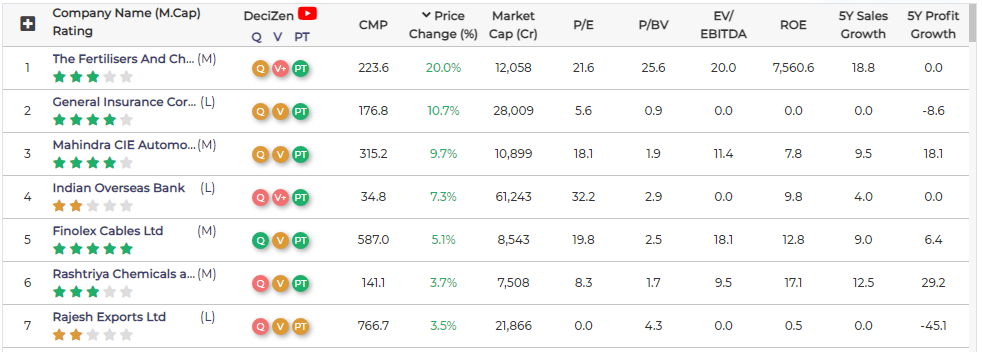

With MoneyWorks4Me Alpha, we have devised a tool for retail investors to filter out stocks on the basis of DeciZen ratings on Quality, Valuation, and Price Trend and identify opportunities that truly are the best today. Whatever your strategy- buying momentum stocks or undervalued stocks, it is now possible to create a system around them and have a more disciplined approach to your investing.

How do you decide the best stocks to buy today? At MoneyWorks4Me, we first insist on investing only in very good quality companies because they make the safest investments and when you buy them at the right price they make the best investments more often than other investing criteria. In contrast, poor quality companies are not cheap enough at any price.

So, the investing universe for our best stocks to buy today is the Nifty 500, as it contains only the largest companies in India. The best among the biggest tend to get bigger and more profitable. So by applying a rigorous filter on quality, we identify which among them are the best quality.

From this list, filter companies that are undervalued, somewhat undervalued, or fairly valued. This ensures that you don’t end up paying too much even for a good quality company. And there you go – you have a shorter list of the best stocks to buy. But this still does not fully answer the question ‘Which are the best stocks to buy today?’

We see investors approaching this in two different ways:

1. Prefer upward trending stocks:

These investors want stocks that are likely to rise in the short or medium term. Use the Price Trend Filter to identify the stocks with price strength i.e. are more likely to rise in the near future. You can do this by selecting Price Trend as Strong in the DeciZen Filter. Or you can click on Best Stocks to Buy Today. As the Price Trend is strong, we expect the prices to rise, and hence buying them today is justified. While individual stock prices may increase or decrease, we expect an equally weighted portfolio to rise in value. This requires investors to act on the recommendations with discipline and avoid picking and choosing too much.

For a complete and updated list for 2023 click here.

For a complete and updated list for 2023 click here.

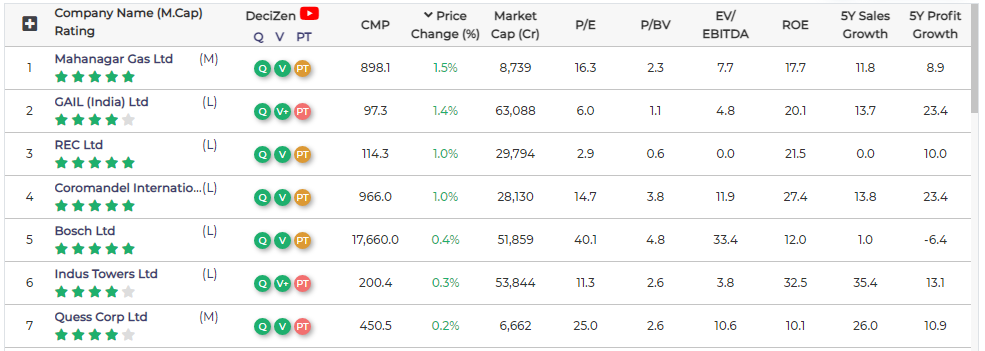

2. Prefer only Undervalued stocks:

These investors are willing to wait but want stocks that are undervalued and have a higher upside. Click on Best From Nifty 500 to find Very Good quality stocks that are undervalued or somewhat under-valued today. This selection does not filter stocks on Price Trend and hence will contain a mix of stocks with varying price strength. However, since all the stocks are undervalued, it has a higher upside potential albeit it may take longer for it to materialize. And this too requires investors to have the discipline to wait and act even though prices may be falling.

For a complete and updated list for 2023 click here.

For a complete and updated list for 2023 click here.

3. AlphaCases: Intelligent Data-driven Systematic Investing

Here are the AlphaCase Investing Strategies;

Best Undervalued:

MoneyWorks4Me’s Best Undervalued strategy focuses only on very good quality companies that are undervalued or somewhat undervalued. However, these stocks are available at lower than their historical valuations during overall market corrections or for some stock-specific reasons. Both are opportunities for long-term investors. The high standard of consistent performance on key parameters required to qualify as a Very Good Quality, Green stock gives the comfort that the chances of buying value traps is limited. However, patience is required to see the strategy play out.

This strategy is best suited for investors who are comfortable going contrarian to the market, prefer paying a price lower than historical valuation, and waiting for the tide to turn. When that happens, the returns are likely to be very attractive since it comes with improved company performance and the market re-rating. However, since this cannot be predicted it is critical to have a portfolio and not limit to only a couple of stocks. At the same time if there is authentic news of poor governance it is recommended to exit the stock, as such risks are not factored in.

When a stock is Overvalued V+, its current valuation ratios are substantially higher than its long-term historical median and the strategy indicates it is in the sell zone. Investors can take a sell decision based on this. Experienced investors can use the Price Trend rating and the Price chart before taking the final decision to sell. Following this strategy in a disciplined manner is critical to success.

A portfolio built with this strategy is likely to correct less than the Index and the upside in the longer term likely to be higher.

Best Fair Valued:

MoneyWorks4Me’s Best Fair Valued strategy focuses only on very good quality companies that are currently available at or around their fair value. This strategy prefers to buy at prices close to the historical valuations-fair value for a number or reasons.

- It eliminates stocks that could be undervalued for a reason and/or could take time to recover.

- In a bear market when other stocks are trading below their fair value, companies that are part of this strategy are the ones which are showing resilience.

- In a bullish market instead of waiting for stocks to be undervalued which could be a test of patience, an investor can invest in good quality stocks at reasonable prices and still enjoy good returns; even high returns should the market go into a sustained bull rally and not miss this opportunity.

This strategy is best suited for investors who are uncomfortable being contrarian and investing against the market but prefer to be invested in good quality stocks at reasonable prices and benefit from the company’s growth.

When a stock is Overvalued V+, its current valuation ratios are substantially higher than its long-term historical median and the strategy indicates it is in the sell zone. Investors can take a sell decision based on this. Experienced investors can use the Price Trend rating and the Price chart before taking the final decision to sell. Following this strategy in a disciplined manner is critical to success.

5 Stars and Above:

MoneyWorks4Me’s 5 Star is an investing strategy that is optimised to give you the best possible combination between Quality, Valuation, and Price Trend. The list will contain stocks which are excellent (green) on all 3 parameters Q, V PT represented as

Apart from these stocks, it will also include the following:

- Somewhat good quality companies (orange) which are undervalued/somewhat undervalued (green) showcasing strong price trend (green).

- Very good quality companies (green) which are fairly valued (orange) showcasing strong price trend (green).

- Very good quality companies (green) which are undervalued/somewhat undervalued (green) showcasing semi-strong price trend (orange).

The essence of our optimisation is that if you are compromising on any one parameter, the other 2 parameters should compensate for it.

These are represented as

This strategy is best suited for investors want to invest when the combined tailwind of Quality, Valuation, and Price Trend is working in favour of the stock.

When a stock is Overvalued V+, its current valuation ratios are substantially higher than its long-term historical median and the strategy indicates it is in the sell zone. Investors can take a sell decision based on this. Experienced investors can use the Price Trend rating and the Price chart before taking the final decision to sell. Following this strategy in a disciplined manner is critical to success.

However, you don’t need to choose to approach one and discard the other. As you would have seen from the above that both perspectives have their merits and require being disciplined about acting on the chosen strategy. You can benefit from both these investing processes. Here’s how-

- To invest in the Upward trending best quality, not over-valued stocks invest in stocks recommended by the Best Stocks to Buy Today

- Select the best quality and most undervalued V+ stocks from the Best From Nifty 500 by deselecting somewhat undervalued in DeciZen Filters.

The list is dynamic and the parameters are updated on a daily basis. You will be sent a SmartAlert whenever a stock is added or removed from the list, saving you from the hassle of sitting in front of your screen and searching for opportunities all day long.

Subscribe now to Alpha – Systematic Simplified Investing, Delivered!

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463