TTK Prestige Ltd. – With the cooker market under pressure, does it have enough steam for the future?

TTK’s 10 YEAR X-RAY: Green (Very Good)

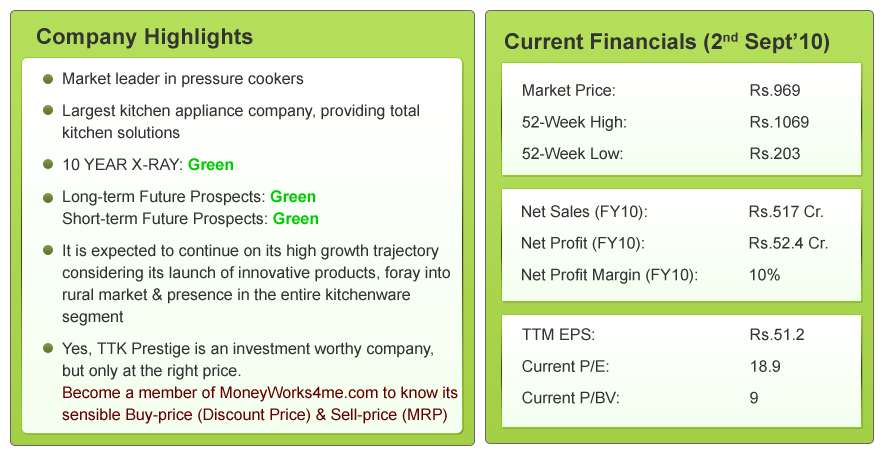

TTK In Brief:

TTK Prestige has become a household name and is a market leader in the kitchen appliance segment. Let’s see what the company is really about?

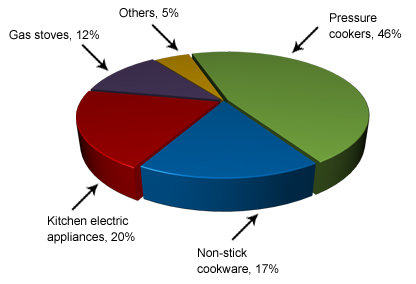

TTK prestige originally started with manufacturing of pressure cookers. Today, it has matured into the largest kitchen appliance company in India. It has a wide product portfolio which includes pressure cookers, non-stick cookware, kitchen electric appliances, gas stoves etc. It is a market leader in a very nascent segment which is mainly categorized by unorganized players. In fact 50% of the pressure cooker segment is unorganized.

TTK prestige originally started with manufacturing of pressure cookers. Today, it has matured into the largest kitchen appliance company in India. It has a wide product portfolio which includes pressure cookers, non-stick cookware, kitchen electric appliances, gas stoves etc. It is a market leader in a very nascent segment which is mainly categorized by unorganized players. In fact 50% of the pressure cooker segment is unorganized.

It has a wide distribution network in which sales happen through direct dealers, authorised re-sellers, network of showrooms through 3 retail formats – ‘Prestige Smart Kitchen’ (offering all its products & solutions), Prestige Kitchen Boutique (for its foray into modular kitchens) and Prestige Life Style Store. It has 228 Prestige Smart Kitchen retail formats spanning 19 states and 136 towns.

TTK Prestige is also the first Kitchenware Company in India to receive the ISO 9001 Certification and the PED/CE Certification by TUV, Germany. It is predominantly present in South India which is a outer lid pressure cooker market. TTK Prestige exports its products to USA, Europe, South Africa, Kenya, Australia, Singapore, Middle East, Sri Lanka and many other countries.

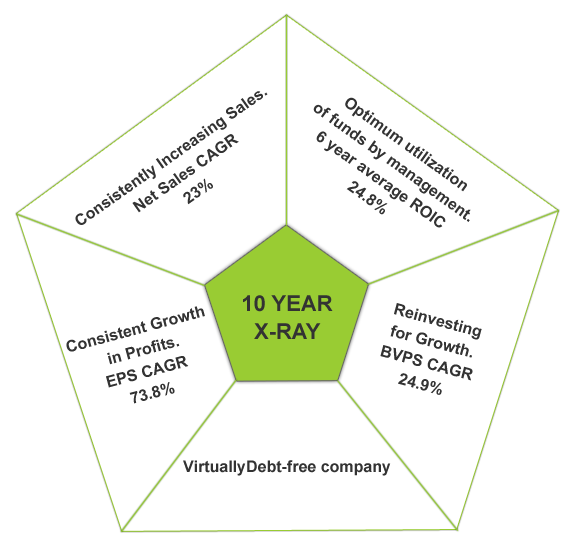

What Does TTK’s Past Say?*

*CAGR’s have been calculated over a 6 yr period due to the turnaround in this segment around FY04-05.

TTK Prestige has performed robustly in all its parameters over the last 6 years. Its impressive fundamentals in the past form a strong base for its future.

The company has grown its Net sales with a robust CAGR of 23% over the last 6 years, showing a consistent increase in demand. The company has improved its margins over the years from an average of 8% to an average of 12% now. This, along with a strong re-investment into business has helped it clock an impressive EPS CAGR of 73.8% over the years.

The company has an average ROIC of 24.8% indicating efficient management of funds. In fact its ROIC has been witnessing an increasing trend over the years because of the company’s constant effort to reduce its debt. In fact, in FY 10 the company moved to being an almost debt-free company with a meager amount of Rs. 2 Cr. as debt.

Hence, the 10 YEAR X-RAY of TTK Prestige is Green (Very Good).

To view its past 10 year performance in a simple color-coded 10 Year X-Ray, visit Moneyworks4me.com

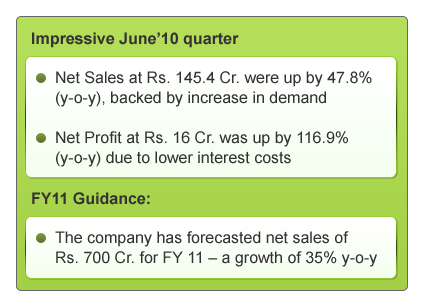

What is TTK’s short-term outlook?

Looking forward (FY11), what is in store for the company?

1) Capacity expansions to cater to future demand:

The company has planned to double the manufacturing capacity at its plant in Tamil Nadu costing almost Rs. 100 Cr. This will be funded by internal reserves.

TTK which has been predominantly present in the southern region is now taking all steps to tap northern & western India. For this it is planning a plant to manufacture cookware in this region to tap that market.

2) New & Innovative Product Launches to drive FY11 revenues:

TTK Prestige launched 3 new products in the last quarter:

- Apple range of Inner-lid Pressure Cookers to tap the inner-lid market and attract young households who look for stylish options to suit their modern kitchens with its unique design

- Microwave Pressure Cookers to tap the wide penetration of microwave ovens especially in the domestic & international markets

- Fresh range of Induction Cook Tops that run on electricity; saves energy and reduces the cooking time

All these launches are expected to drive revenues in the short-term.

3) Fall in input costs:

Aluminum and steel which constitute a major chunk of its input costs are on a downtrend right now. This will lead to a reduction in its raw material costs and hence is expected to improve profitability.

With the economy recovering, consumption expenditure has also increased. Also, the company had given a good guidance for FY11 revenues. Hence, we can expect the short-term outlook of the company to be Green (Very Good)

What is TTK’s Long-term outlook?

TTK Prestige has had an impressive performance in the past, clocking excellent growth rates in the last 6 years. It is the market leader in its segment and in fact is the one player providing complete kitchen solutions. But, now the urban market for pressure cooker has almost matured. In the wake of this, its competition with Hawkins becomes further cause for concern. So, how is the company combating these issues and will it remain on the top position in future, too?

1) TTK’s increasing presence in every segment of kitchenware:

TTK Prestige is the only player who straddles the entire kitchen space. Pressure cookers account for only one sixth of the kitchenware market, whereas kitchen appliances and modular kitchens account for around 20% each and TTK is a major player in these 2 segments.

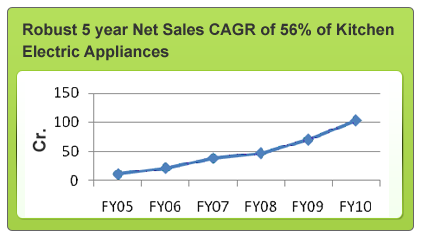

TTK Prestige is witnessing a shift in its revenue segregation and is increasing its presence in the kitchen appliance segment. Its Kitchen electrical appliance segment has increased from 7% in 2005 to 20% right now, whereas Pressure cookers has decreased from 60% to 46%. This shift is expected to enhance its presence in the whole kitchen space and contribute to revenues significantly.

2) Focus on Untapped Potential in rural India:

90% of urban India already owns a pressure cooker whilst barely 22% of rural India owns a pressure cooker. Now, the demand from urban India is expected to be predominantly from upgrading. Looking at this, TTK Prestige has decided to tap the rural market.

To tap the rural market, TTK Prestige has formed a new business model involving NGOs and self-help groups to sell pressure cookers to rural India. The initial investment will be by the company while the management will be by NGOs. The company hopes to boost its revenues from the rural market with the help of this model.

3) Innovative Product Launches to tap certain targeted segments with wide penetration:

a) TTK is the first to produce a microwave pressure cooker in India and is the world’s first CE marked microwave pressure cooker. In fact the company has applied for worldwide patent for this product. This product is expected to make cooking faster by around 30-40% than any other vessel in a microwave. Right now the penetration of microwave ovens in domestic markets 30-is very low. With the % of working women growing, increasing urbanization and nuclearization, this product is expected to have great demand in future. It is expected that the microwave ovens segment will grow by around 30% over the next few years. Also, in international markets the demand for microwaves exists. This product is expected to drive the growth of its revenues in the coming years, if it captures the market in a big way.

b) Unique-shaped Apple range of Inner-lid Pressure Cookers to specifically target the north and east t markets(predominantly inner lid markets) and to attract modern, young households.

c) Launched induction cookers to tap the rural market i.e they run on electricity and saves energy and cooking time. But again, the viability of this project is questionable looking at the availability of electricity in most villages; where electricity is available only for a certain time period and most of the times is erratic.

4) Competitive Advantage over Hawkins:

- TTK & Hawkins compete mainly in the pressure cooker segment. TTK is present mainly in South India and caters to the outer-lid market, whereas Hawkins is predominantly present in north catering to the inner-lid market. Let’s have a look at the areas in which TTK scores over Hawkins

- Though the market share of both cannot be ascertained precisely, TTK Prestige has a market share of over 50%(approx) in the branded market.

- TTK has been enhancing its presence in the kitchen value chain, whereas Hawkins is only into pressure cookers and cookware. Due to this Hawkins is a much smaller player (in term of sales) in comparison with TTK.

- TTK has a distribution network which includes direct dealers, authorized retailers and its own retail outlets in 3 formats; one for housing all its solutions & the others for modular kitchens. This increases its brand presence in the eyes of the consumer. Hawkins does not have any retail outlets

Coming up with innovative products like microwave pressure cookers, apple shaped cookers etc.

So, is there anything you should be concerned about?

a) The fluctuation in the raw material prices of steel and aluminum which constitute around 50-60% of cost.

b) Also, the company has plans of entering into the construction business, where it is planning to build a combination of residential and office space as its first plan. The company is expected to come out with more clarity on this business venture in FY11. The real estate industry is yet recovering from recession and usually this industry recovers a lot of debt. Also, this is a completely different business line the company is venturing into, which is a cause for concern.

The segment that the company operates in i.e. Pressure cookers and kitchen appliances makes cooking faster and simpler. Increasing consumption expenditure, growing % of working women, and a shift from non-branded to branded products and a shift from joint to nuclear households is expected to drive the demand for kitchen appliances and pressure cookers. Also, every household has multiple pressure cookers with variance in sizes. With rising incomes, people prefer branded over unbranded products. This will further drive demand.

Hence, we can expect the long-term future of TTK Prestige to be Green (Very Good)

Conclusion:

TTK Prestige is a market leader in pressure cookers and the only complete kitchen solutions provider. Considering increasing consumption expenditure and % of working women, a shift from joint families to nuclear families, TTK is expected to have good growth in Sales and Profits

Yes, TTK Prestige is an investment-worthy company, but is it at a good price to buy? Or is the market overvaluing it? To find out what investment decision you must take on TTK right now, become a member of www.MoneyWorks4me.com to find its right value.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

impressive analysis.. surely all women reading will like it… the way u present the report is helpful for all readers.

Thanks a lot for your appreciation.

Excellent insight and analysis on a good company – TTK prestige!

I would like that you include a section on historic Earnings growth and PE over the last 5 years say Dec 31 of every year, a graphical representation would be fine for benefit of the investor readers.

Please carry on the good work.

Regards

doubtlessly, companies performace is very good, but at a p.e ratiob of 20, stock seems to be expensive.

it is value buying around 14-15 p e multiple. being a small/mid segment company, overall appreciation is limited at present rates.

Kudos to the team for presenting the company financials in easily digestible manner 🙂

I would like to add one suggestion. I would be great if u include the shareholding pattern like promoter holding, institutional investors holding and public holding etc of each company which you are analyzing.

am also awaiting Nifty-MRP soon……thanks

Thanks a lot for your appreciation.

Your suggestion about including promoter’s shareholding is very good, and we are working on including this in our company shastra very soon.

As for Nifty 50 @ MRP it will be out by next week. So keep reading and posting your feedback.

Exellent analysis. Would appreciate if you allow PRINT option also.

Hi,

Thanks a lot for your appreciation.

The Company Shastra and Stock Shastra are best viewed online and we would recommend reading it in the above format.

Do keep reading and posting your feedback.