Hero Honda Motors Ltd. – The World’s No.1 Two-Wheeler Maker

Hero Honda’s 10 YEAR X-RAY*: Green (Very Good)

(* 10 YEAR X-RAY shows the financial performance of a company in the last 10 years.)Hero Honda, in brief

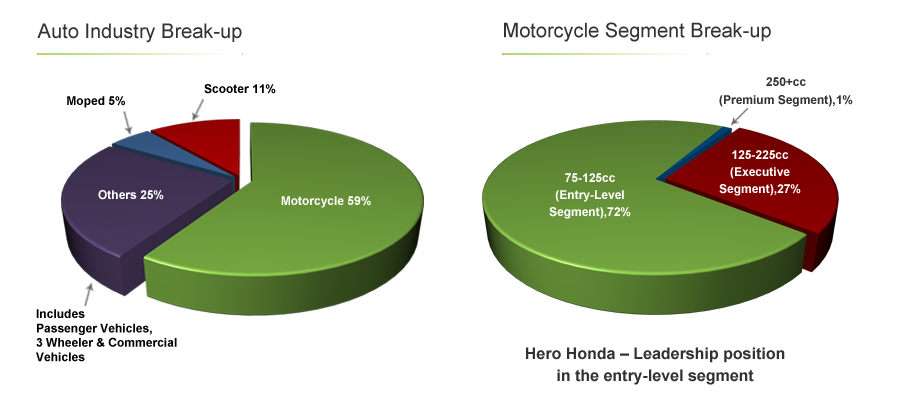

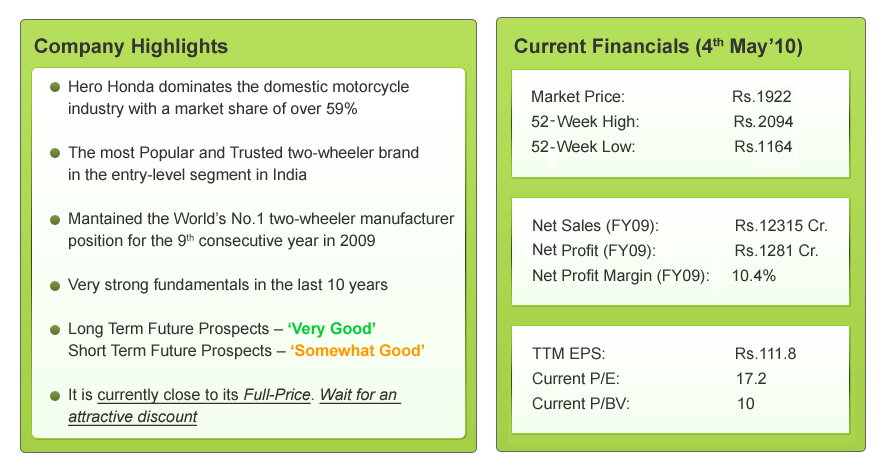

Hero Honda Motors Ltd, a joint-venture between India’s Hero Group and Honda Motor Company of Japan, is the world’s largest two-wheeler manufacturing company. Motorcycles contribute around 95% of its total sales. The Company’s motorcycles are known for efficiency, quality and longevity, and they set industry benchmarks for fuel mileage and low emission. Hero Honda has over 59% market share in the motorcycle segment in India with leadership position in the entry-level segment (75-125 CC). Splendor, a 100-CC Motorcycle by Hero Honda, is one of the largest selling motorcycles in the world. More than 90% of its revenues come from the domestic market. The Company has maintained the World’s No.1 two-wheeler manufacturer position for the 9th consecutive year in 2009

What does Hero Honda’s Past Say?

Hero Honda has performed robustly in all its parameters over the last 10 years. Its impressive fundamental past forms a strong base for its future. Hence, the 10 YEAR X-RAY of Hero Honda is Green (Very Good)

What is Hero Honda’s Short Term Outlook?

Higher Net Profit due to lower tax outgo: Hero Honda’s Haridwar plant accounted for 30% of its total production in FY10 and is going to complete its one year very soon. It is currently enjoying 5 years income tax exemption and 10 years excise duty exemption. Due to this, the Company’s effective tax rate fell to 18.8% in FY10 from 26.4% in FY09. Without this tax benefit, the Profit growth rate in the March quarter is around 30%.

High raw material prices, increase in petrol prices, excise duty hike and high interest rates are causes for concern: Steel (70% of raw-material cost) price is at a higher level. Also, in the Budget 2010-11, the Government has increased excise duty from 8% to 10%. Both will increase cost of production in the short term. The purchase of two-wheelers in India is heavily dependent on bank loans. Looking at the high CRR, we expect that banks will hike the interest rate in the near future. This, along with the increase in petrol prices may affect its demand adversely. At the same time, we expect the increasing purchasing power to drive demand in the short term

While the immediate past has been great, the immediate future has a few challenges. Hence, we can expect the short term outlook of Hero Honda to be Orange (Somewhat Good)

What is Hero Honda’s Long Term Outlook?

- Dominates the Motorcycle segment with a 59% market share. Splendor, a 100-CC Motorcycle by Hero Honda, is one of the largest selling motorcycles in the world

- Extensive reach of 3500 Sales & Service Points; well-positioned as it is closer to the Potential Customer

- With increasing income in rural India & Hero Honda’s dominance in the entry-level segment, it is well-poised to achieve successful penetration in the Indian rural market with its ‘Har Gaon, Har Aangan’ approach

- With demand increasing, Hero Honda, which is already at 90% capacity utilization; is planning the addition of a 4th manufacturing unit

Heavy Reliance on Partner (Honda Motor Company) for Technology and Export Restriction are causes for concern: Hero Honda has heavy reliance on its partner Honda Motor Company (Japan) for technology. The new agreement between Honda Japan and Hero Honda does not have a ‘no-compete clause’. This means increased competition from its own collaborator & technology-provider. The agreement restricts exports of bikes by Hero Honda to those markets where the Japanese auto firm has a presence. Its exports constitute a very insignificant proportion of the entire revenue portfolio of the company

Low Cost Cars expected to increase competition: The imminent introduction of low cost cars like Tata Nano (priced in the range of Rs. 1 Lakh) is a potential threat. Bajaj Auto – Hero Honda’s closest competitor, recently entered into a joint-venture with Nissan-Renault to launch a low cost car ($2500) by 2012. This may hamper the demand for Hero Honda’s premium-segment bikes

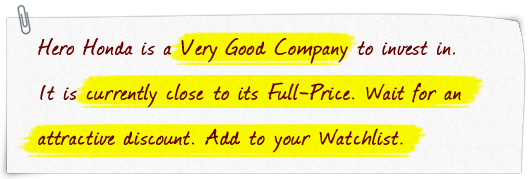

Considering all the above factors, we can expect the long term outlook of Hero Honda to be Green (Very Good)

Conclusion:

Hero Honda is well-positioned in the growing motorcycle market, has the competitive advantage of its market share, its financial performance, extensive network & its production capacity

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

What would be an ideal rate to enter & take a long position?

Hey shamshuddin,

As we said in the Shastra, Hero Honda is trading close to its Full-Price (Intrinsic value). To avoid risk, always keep a margin of safety. It is always advisable to wait for a 50% discount to its Full- Price & then invest.

thank 4 share