Blue Star Ltd. : Will it record a stellar performance in the future, after a lukewarm last year?

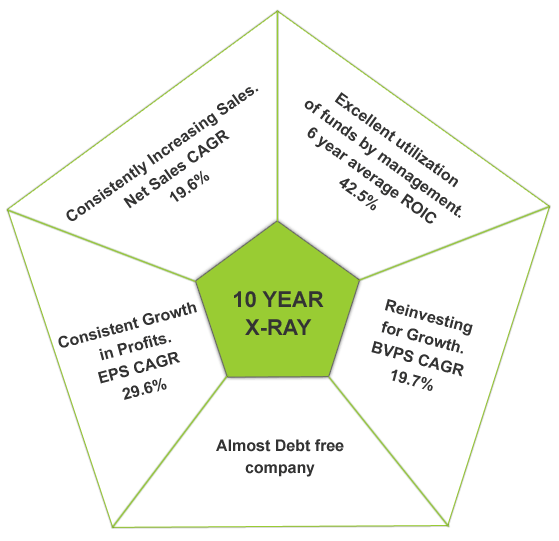

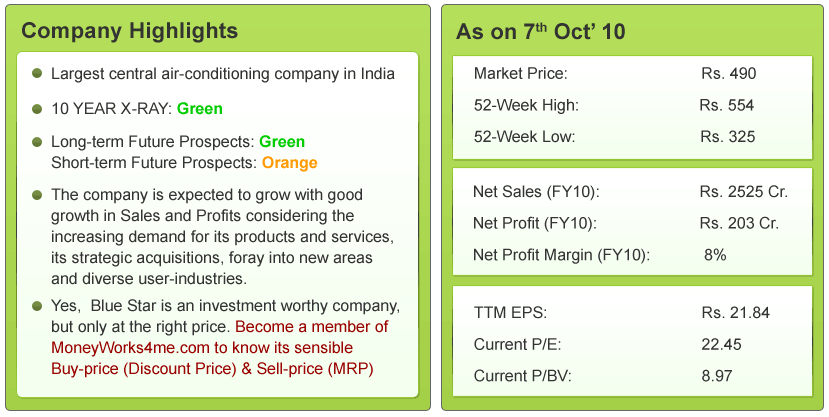

Blue Star’s 10 YEAR X-RAY: Green (Very Good)

Blue Star in brief:

Blue Star is a famous name in the air conditioning segment. Let’s see what the company is really about?

Blue Star is India’s largest central air-conditioning company and a leader in commercial refrigeration, fulfilling the requirements of a large number of corporate and commercial customers. Its business is divided into 3 segments

Its clients include institutional, industrial and government organizations as well as commercial establishments such as showrooms, restaurants, banks, hospitals, theatres, shopping malls and boutiques. The company has a network of 29 offices, 5 modern manufacturing facilities (Thane, Dadra, Bharuch, Himachal & Wada) and 700 dealers over the country. It is mainly a domestic player

Share-Holding Pattern:

The promoter shareholding in the company as on 30th June 2010 is 40.13 % whereas 59.87% is the non-promoter holding. Foreign Institutional Investors holding stands at 5.85%, Mutual Funds hold 7.85% and Insurance companies 2.05%

What does Blue Star’s past say?

Blue Star has performed robustly in all its parameters over the last 10 years. Its impressive fundamentals in the past form a strong base for its future.

Its Net Sales have clocked an impressive 19.6% showing consistent growth in demand. The company has improved its margins over the years from an average of 8% till 2007, to 12% over the last 3 years. This efficiency along with a good re-investment of almost 20% into the business, has helped the company register a robust EPS CAGR of almost 30% over the last 10 years.

The company has an excellent management of funds, evident from its 42.5% ROIC average over the last 6 years. It is an almost debt-free company having a debt of only Rs. 8 Cr. on its books.

Hence, the 10 YEAR X-RAY of the company is Green (Very Good)

To view the company’s financials in a simple color-coded x-ray, visit MoneyWorks4me.com

What is Blue Star’s Short-term outlook?

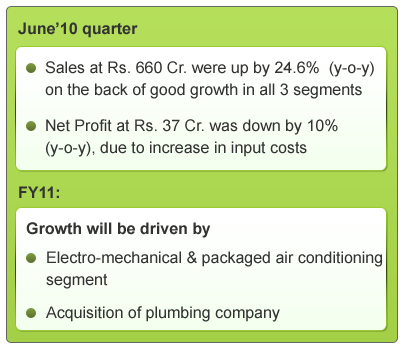

FY 10 saw a lukewarm performance from the company as far as its sales is concerned; as it registered a marginal 0.89% growth in Net sales. This was mainly due to slowdown in orders as a result of the economic downturn.

Let’s see, whether things have improved for Blue Star now and what is its short-term outlook?

1) Electro-mechanical & packaged air conditioning segment to drive growth:

1) Electro-mechanical & packaged air conditioning segment to drive growth:

After a sluggish FY10, the last 2 quarters have witnessed good growth in sales for the company. Blue Star is expecting a robust growth of 20-25% (Rs.2200 Cr.) in its electromechanical projects business, this fiscal. Out of this, it expects Rs. 1600 Cr. to come from its core commercial building projects and the rest from relatively new markets like power and water segments. The company has already started witnessing order visibility in this segment for e.g.- the recent Rs. 130 Cr. order win for air conditioning and plumbing of the new integrated Terminal Building (Terminal 2) of the Chhatrapati Shivaji International Airport (CSIA), Mumbai. Thus this segment is expected to drive the growth of revenues in the next year.

2) Acquisition of plumbing firm to enhance service portfolio:

Recently, Blue Star acquired D S Gupta Constructions Pvt. Ltd for Rs. 80 Cr. which is amongst the largest independent plumbing and fire fighting contracting companies in India. This acquisition was done with the aim of providing plumbing services for commercial buildings. The funding for this will be done through internal accruals. The company, renamed as Blue Star Electro Mechanical, clocked a turnover of Rs. 130 Cr (FY10) and has an order book of Rs. 300 Cr for FY11. This acquisition is in line with the company’s aim to enhance its services in the MEP (mechanical, electrical and plumbing) segments and the robust order book gives good revenue visibility for FY11.

3) Increasing copper prices:

The company’s major raw material costs include steel & copper. Copper prices have witnessed a 100% jump in the last few months. This has increased the company’s raw material costs and is likely to affect the company’s profitability in the near future, too. These rising input costs were the main reason for the fall in profits in the June quarter. To combat this impact, the company is planning to increase the prices of its central plant equipment (air conditioning for the whole building) by 3-5%.

Hence, the robust order inflow expected in the electro-mechanical segment is likely to support the company’s revenue growth in the next few quarters. But, the profitability is likely to be hampered due to increasing input costs.

Hence, we can expect the short-term future prospects of the company to be Orange (‘Somewhat Good’).

What is Blue Star’s long-term outlook?

Blue Star, the largest air-conditioning company & a leader in commercial refrigeration, has a great fundamental past. In FY10, the company witnessed stagnant growth rates, due to slowdown in orders as a result of the economic downturn. In the short-term the company is likely to have good growth in sales but profits may witness stagnancy due to increasing input costs.

So, let’s see what is in store for the company for the long-term future?

1) Increasing demand for company’s products & services gives revenue visibility for the future:

The 2 main segments of the company are expected to drive its revenue growth in future:

- Electro-mechanical & packaged air conditioning segment: The demand for central and packaged air conditioning is expected to grow by robust growth rates in future. Also, nowadays customers are looking for a complete MEP solution; this is an area where Blue star is aiming to make its presence large. The whole segment contributes 70% to the company’s revenues and has grown at a robust 23% CAGR over the last 6 years.

- Commercial Refrigeration: As far as commercial refrigeration (products like cold storages, water coolers, deep freezers, etc.) is concerned, it is driven by the robust demand in the Indian food and grocery vertical. Also, the distribution and storage for perishable items like fruits, vegetables is critical in a country like India which is the largest producer of fruits and 2nd largest of vegetables in the world.

2) Strategic acquisitions to enhance service offerings in the MEP (mechanical, electrical & plumbing) segment:

In the last few years, Blue Star has acquired a few companies with the main aim to enhance its product and services portfolio. For example:

- Naseer Electricals: In 2008, Blue Star took over Naseer Electricals, a Bangalore-based electrical contracting firm with a strong presence in South India. This company was taken over to foray into electrical contracting work for commercial buildings and infrastructure segments.

- D S Gupta Constructions: As mentioned before D S Gupta Constructions is one of the largest independent plumbing firms in India.

These acquisitions have been done with the company’s aim to become an integrated MEP player and offer its customers a single window turnkey MEP solution. Also, in order to be able to build a strong presence in the new areas that it is planning to foray into (power, water etc), the company intends to acquire 2-3 more entities. These strategic acquisitions are expected to drive the company’s orders in the MEP segment, hence giving more revenue visibility. It appears that the company is moving from being only an air conditioning & refrigeration company to offer other engineering services.

3) Innovative Products to meet customer requirement:

Blue Star has always been the first to come up with new products so as to meet customer requirements: For eg:

a) Precision-control packaged air conditioners for applications where accurate control of temperature is necessary

b) Its portfolio of telepac air conditioners specially designed and customized for the telecom industry; in the last year it went further ahead and introduced emergency free cooling telepacs to save the operating cost of the user

These innovative launches have always helped the company meet its customer requirements in time, and hence increase customer satisfaction in turn enhancing sales growth.

4) Diversification into newer areas:

Blue Star has identified Infrastructure (airport and metro), power (electrification and T&D) as the new growth drivers over the next 5 years. It is also eyeing diversification into water and water treatment systems and oil & gas(mechanical services) for carrying out its electro -mechanical projects. In the last year the company saw 10% of its project revenues coming from these new areas and hopes to increase it to 40% in the next few years.

5) User-industries well-poised for growth:

For air-conditioning the company has a diverse user-industry base of banks, hotels, malls, infrastructure, IT/IT ES, Cinemas/Multiplexes, Telecom, PSUs, Pharma etc. For commercial refrigeration its user-industries include hospitality, dairy & ice-cream parlors, super-markets, pharma, research institutes, horticulture etc. All these industries are well-poised for growth in the future. Also, the effect of a slowdown in any of these industries is off-set by the uptrend in the others.

So, after looking at the company’s positive points, is there anything you need to be concerned about?

a) The fluctuations in the raw material prices (copper and steel) are likely to hamper the margins of the company

b) Though the company’s inventories and debtors (40 days & 86 days respectively) is not a major cause for concern, it holds creditors/suppliers cash for around 150 days. It appears that probably the company is funding its debtors and inventories through its creditors. Also, the company could improve its profit margins by lowering the cost attached with the high creditor/supplier days.

Hence, looking at the company’s leadership position, its strategic acquisitions and growth expected in user-industries, the company is expected to recover soon in the short-term and its’s long-term future can be expected to be Green (Very Good).

Conclusion:

Blue Star is India’s largest central air-conditioning company and is well-poised for growth considering the increasing demand for its products and services, its strategic acquisitions with the aim to become an integrated MEP player and robust user-industries.

Yes, Blue Star is an investment-worthy company, but is it at a good price to buy? Or is the market overvaluing it? To find out what investment decision you must take on the company right now, become a member of www.MoneyWorks4me.com to find its right value.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

An interesting analysis of Blue star…..with precision an a good conclusion. hats of to u guys for coming up with such great analsis reports every week.

Thanks a lot.

Blue Star is Bluest STAR. I bought 50 shares in 1979 I think at Rs.45-50 range. It has grown into 450 last week I sold 50 shares at 430/- Do u think I shud sell some more now? Just for sake of profit booking?- Arthachakra

Yes, Blue Star is indeed a good company. For knowing what action you need to take on your investment in Blue Star, log on to http://www.MoneyWorks4me.com. You will get the Disocunt Price and MRP for the stock which will help you take the right decision on the stock.

Thank You.

u r fantastically searching good companies,but shareprice of that company should be affordable.i mean,low priced scrip should be dealt.

Hi,

Thanks a lot for the appreciation. Yes, agreed that the share price of some of the companies we are analyzing is on the high side, but they are fundamentally sound companies and if bought at a discount they will prove to be value-buys. So, it is always advisable to buy such companies, even if you can invest only in a small number. In any case, your % of returns will always depend on the investment amount and not on the number of shares.

good. But this share is not seems to be not moving with the market trend. why ? Some few shares are especially in the A group are moving fast even though they are comparatively low in yield with Blue star