Glaxosmithkline Consumer Healthcare Ltd. : Will brand Horlicks continue to boost its growth?

GSKCH s 10 YEAR X-RAY: Orange (‘Somewhat Good’)

GSKCH in Brief:

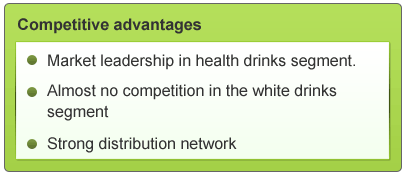

GlaxoSmithKline Consumer Healthcare Ltd. (GSKCH), the Indian associate of Glaxosmithkline plc, U.K., is a market leader in the Health Food Drinks industry in India with around 70% market share. Its flagship product is Horlicks which is over 100 years old. The Company also manufactures Boost, Viva Maltova, Biscuits. It promotes and distributes prominent brands in diverse categories such as Eno, Crocin and Iodex.

GSKCH exports to more than 37 countries across the globe and around 8% of its sales comes from exports. The company has a strong marketing and distribution network in India comprising over 1800 wholesalers and direct coverage of around 6 Lakh retail outlets. It was incorporated in 1948 and went public in 1978. Its manufacturing facilities are located at Nabha in Punjab, Rajahmundry in Andhra Pradesh and Sonepat in Haryana.

Shareholding Pattern:

The promoter shareholding in the company as on 30th June 2010 is 43.16 % whereas 30.75% is the non-promoter holding. Foreign Institutional Investors holding stands at 10.24%, Mutual Funds hold 9.51%.

What Does GSKCH’s past say?

The company’s financial year end is December

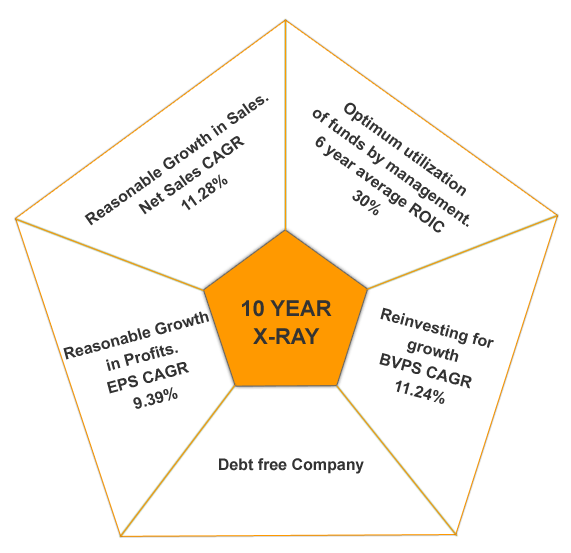

GSKCH has had a mixed performance in its financial parameters over the years. From 2002 to 2005 the company witnessed poor growth registering low or negative growth rates. However, this was not a company specific problem. During this period, the entire FMCG industry was battling a slowdown and even items of everyday use like soaps, shampoos suffered lower growth rates. The probable cause for this was a combination of both industrial slowdown and problems plaguing the agricultural sector which forced consumers to cut back on spending. This is reflected in the company’s lower 10 Year CAGRs of 11.28% in Net Sales, 9.39% in EPS and 11.24% in BVPS.

The FMCG sector recovered from 2005 onwards. GSKCH has also performed well over the last 5 years. Its Net Sales and EPS have clocked impressive 5 yr CAGR’s of 17.44% and 27.97%.

The company has clocked an impressive 6 year ROIC average of 30.19% which indicates excellent management of funds. Also, it is a debt-free company which is remarkable.

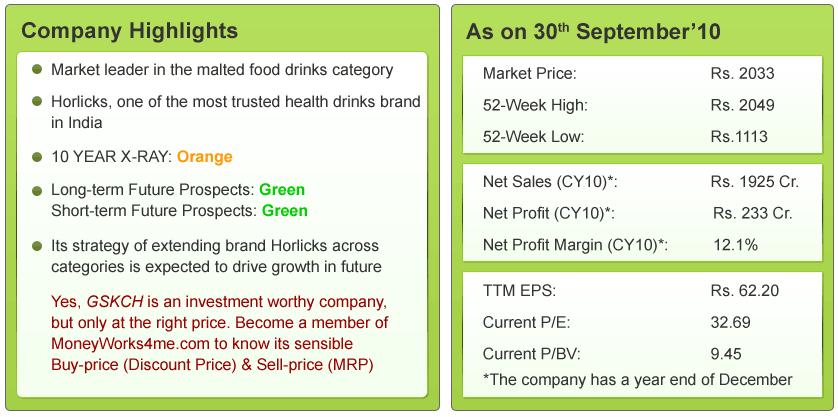

Hence, if you consider the overall performance in the past 10 years, its 10 YEAR X-RAY is Orange (‘Somewhat Good’).

To view its past 10 year performance in a simple color-coded 10 Year X-Ray, visit Moneyworks4me.com

What is GSKCH’s Short-term Outlook?

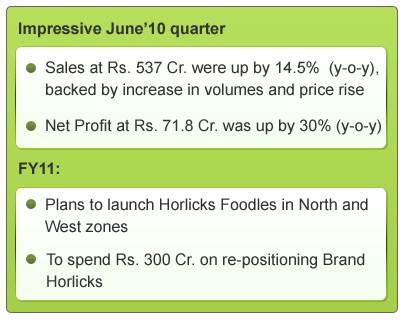

Double-digit growth in key-brands & new products boost sales growth: GSKCHL witnessed robust double digit volume growth of 17% in Boost, 10% in Horlicks & 15% in biscuits.

Double-digit growth in key-brands & new products boost sales growth: GSKCHL witnessed robust double digit volume growth of 17% in Boost, 10% in Horlicks & 15% in biscuits.

Horlicks ‘Foodles’ which was launched in Dec’09 has posted a strong performance with a market share of 5% & 4% in south & east zones respectively. Going forward, the company is planning to launch Foodles in the north & west zones in FY11 itself, expected to further help topline growth.

Re-positioning of Horlicks: GSKCH is planning to invest over Rs 300 crore on repositioning original milk food drink as the company’s umbrella brand. Recent category extensions of Horlicks include biscuits, cereal bars and instant noodles. It is now planning to foray into other categories like breakfast and mid-day meals. Re-positioning may cost the company a lot, but it is expected to help grow its revenues.

Increasing raw material prices may affect margins: The company’s major raw materials like milk and wheat are expected to rise in the short-term. This is likely to affect its margins in the short-term.

Looking at the overall factors, we can expect the short-term future prospects of the company to be Green (Very Good).

What is GSKCH’s Long-term Outlook?

GSKCH is a market leader in the health drinks segment with brands like Horlicks, Boost etc. The company recently launched category extensions of Horlicks and is planning to spend a huge sum of money to re-position Horlicks as its umbrella brand.

In this light, will its brand Horlicks continue to boost its growth?

Horlicks(health drink) a key-driver for GSKCH: The malted drinks segment is divided into white drinks segment (70%) and brown drinks segment (30%). Horlicks dominates the white drinks segment, having a total of 50-55% market share and brands like Boost, Maltova and Viva(brown malted drinks) account for 15% of the market. With Horlicks,

- Company is targeting various consumers such as women, mothers and children aged between 2 and 10 years with products specifically catered for them like Women’s Horlicks, Mother Horlicks, Junior Horlicks respectively. Women’s Horlicks is the first health drink tailor-made for women.

- GSK has test launched Horlicks Asha priced very low at Rs.80 for 500gm in Andra Pradesh and Karnataka in the month of December to tap the opportunity at the bottom of the pyramid. The new offering is priced 40% lower than Horlicks malted beverage and is targeted at the semi-urban and rural segment.

- The company has also started with LUP (low unit packs) of Rs20/90gm SKUs to stimulate trials by non-users

All these efforts have helped the company clock a 20% CAGR in Sales over the last 3 years. Going forward Horlicks as a health drink is expected to further drive growth.

Changing trends expected in the malted food drinks segment: Rising affordability and awareness will increase penetration as less than 20% of the population consumes MFD; frequency of purchase is usually 4 times a year. There is a huge opportunity existing at the bottom of pyramid (BOP) to expand the category among the lower middle class, through the launch of lower priced variants- something GSKCH has already attempted with Horlciks Asha. Also, 80% of the market is in South and East India. In the North and West, the market has not developed significantly, which offers a huge growth opportunity for GSKCH. With the efforts that the company is taking, it is well-placed to take advantage of the opportunities available in the malted drinks segment.

Changing trends expected in the malted food drinks segment: Rising affordability and awareness will increase penetration as less than 20% of the population consumes MFD; frequency of purchase is usually 4 times a year. There is a huge opportunity existing at the bottom of pyramid (BOP) to expand the category among the lower middle class, through the launch of lower priced variants- something GSKCH has already attempted with Horlciks Asha. Also, 80% of the market is in South and East India. In the North and West, the market has not developed significantly, which offers a huge growth opportunity for GSKCH. With the efforts that the company is taking, it is well-placed to take advantage of the opportunities available in the malted drinks segment.

Extension of brand Horlicks into other categories to enhance revenues in future: The company has extended the brand Horlicks into different categories like noodles, biscuits, nutribars etc.

- Horlicks’ Foodles instant noodles brand has been able to capture 5% share within six months of launch.

- Horlicks Biscuits which was re-launched with a new strategy and packaging during CY09 , posted a growth of close to 28.0% registering sales of almost Rs. 80 Cr. The company aims to achieve a 4-5% market share in the Rs. 8 Cr. biscuit market in the next 2-3 years. In the same category, it has also launched Junior Horlicks Biscuit It also launched a ready to drink flavored milk product branded Horlicks Chill Doodh in competition with Amul’s Kool drink.

- The company has also entered the nutrition bars segment with Horlicks Nutribar.

Going forward, the company is planning to launch a new product almost every quarter in the health and wellness space. The company is planning to invest around Rs 300 Cr. on repositioning its original milk food brand, Horlicks as the company’s umbrella brand. Apart from re-launching Horlicks with a new look and promoting it, it is also looking at foraying into other categories like breakfast and mid-day meals. Though this may seem like a huge amount of expenditure, in the long-run it is expected to enhance the company’s growth. With the above products the company plans to achieve sales of Rs 300 Cr. over the next 18-24 months and expects these products to contribute 25% to the company’s total revenues.

Robust growth expected by the FMCG-Food Processing industry: The food processing industry in India is currently growing at 14% and is expected to grow at around 30% in the next 6 years. Also, rising household incomes, increasing urbanization, changing lifestyles, growth in working women’s population is expected to lead to greater demand for processed foods. GSKCH, being a successful player and the market leader in the health drinks segment, is expected to take advantage of the opportunities in this segment.

Horlicks along with its brand extensions is thus expected to help the company register good growth in future. It appears that it is moving from being just a health drink brand to being a complete health & wellness brands in foods segment. But, does the company have any concerns?

The company’s only concern is the fluctuations in the raw material prices. Prices of wheat, milk etc are expected to rise in future. This rise is likely to affect the margins of the company.

Looking at, its market leadership, strong brand in Horlicks, strategic brand extensions, company is expected to register good growth in the future. Hence, we can expect the long-term future of the company to be Green (Very Good).

Conclusion:

Glaxosmithkline Consumer Healthcare is a market leader in the malted food drinks segment with brands like Horlicks & Boost. It is has also launched many category extensions under its brand Horlicks. This, along with the growth expected in the FMCG- Food Processing industry is expected to help it register good growth in future.

Yes, GSKCH is an investment-worthy company, but is it at a good price to buy? Or is the market overvaluing it? To find out what investment decision you must take on the company right now, become a member of www.MoneyWorks4me.com to find its right value.

So, what do you think? Will Horlicks along with extensions across categories like noodles, biscuits, nutrition bars and breakfast/mid-day meals help it boost its growth?

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

Reading for the 1st time & v.simple read n good analysis. Ya Horlicks as a big brnd for the co. will work for the co, i feel…….

I bought twenty shares some 5 years back around I think 500 a peace. What shud I do? Buy some more now or dispose

off present holding n collecgt money? – Borkar

Thanks for letting me no the registation process…Saying it again… excellent anaalysis. really teaches a learner a lot. Who knew glaxo was getting into so many products….. And in my opinion later maybe after 5 yrs or so it will be a gr8 heath food brand…. though yet shod not leave focus from on the white drink…. Great work….

Good article.. keep it up…..

Thanks a lot

@rajeev @Rsareen

Thanks a lot for your appreciation and do keep reading posting your feedback

Hi Rohini,

Thanks a lot for your appreciation. Yes, GlaxoSmith will have to continue its focus on Horlicks as its white malted drink brand and at the same time, expand with the extensions across categories.

We will certainly consider your suggestions about the choice of companies. In fact,soon we are going to ask our readers to select a company of their choice. Will be coming up this soon and will keep you informed.

Thank you.

Very Good Article …Let It Continue Forever…

Thanks a lot for your appreciation. Do keep reading and posting your feedback. Hope you have also voted for the company you want us to analyse. If not you can click on this link and register your vote. http://bit.ly/aTVmny