Crompton Greaves Ltd.: Competition is ‘hotting up’ ; What lies ahead now, and in the future?

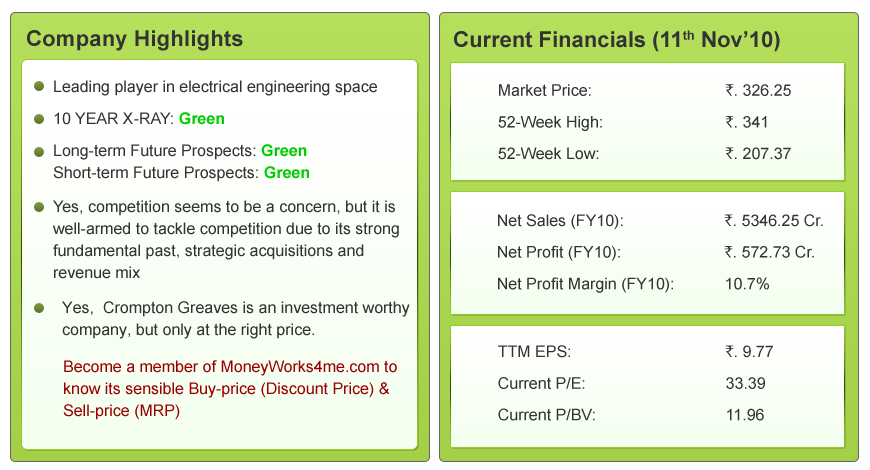

Crompton Greaves’ 10 YEAR X-RAY: Green (Very Good)

Crompton Greaves’ 10 YEAR X-RAY: Green (Very Good)

Crompton Greaves in Brief:

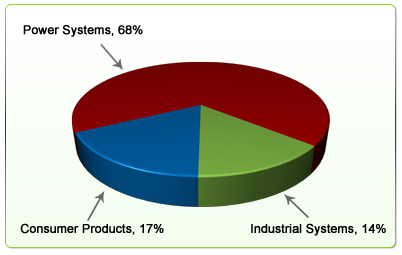

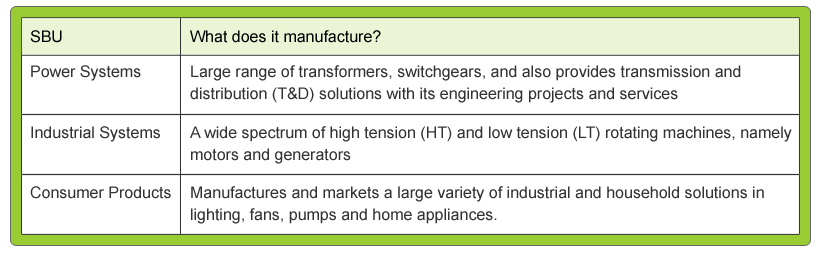

Crompton Greaves, an Avantha Group company, is a leading player engaged in designing, manufacturing and marketing high-technology electrical products and services related to power generation, transmission & distribution and execution of turnkey projects. It has the largest market share in 765 kv. transformers and is among the top 10 transformer manufacturers in the world. The company also manufacturers consumer durable products like fans, lighting, domestic appliances etc. The company’s operations have been structured into 3 SBU’s (Strategic Business Units) viz. Power Systems, Industrial Systems and Consumer Products.

The Company has 22 manufacturing divisions spread across the Country. It is a leading supplier to the Indian market. It also exports its products to more than 60 countries worldwide, which include USA, UK, EU, Australia and New Zealand etc. More than 10 % of the company’s consolidated revenues come from exports.

Shareholding Pattern:

The promoter shareholding in the company as on 30th Sept 2010 is 40.92% whereas 58.82% is the non-promoter holding. Foreign Institutional Investors holding stands at 20.36% and Mutual Funds hold 15.56%.

What does Crompton Greaves’ Past Say?

The figures are on a standalone basis and give 6 Year CAGR

Good growth rates in all parameters:

The company has clocked a good CAGR of 21.2% in Net Sales over the last 6 years mainly due to 19% volume growth; it has shown consistent demand for its products and services. A strong re-investment has helped the company clock a 6 year EPS CAGR of 39.2%. Its BVPS has registered a robust CAGR of 34.8% over the same period.

Higher profitability fuelled by operating profit margin improvement and reduction in interest cost: The Company’s Earnings Per Share (EPS) growth (39.2%) is higher as compared to the Sales growth (21.2%).

Continuous improvement in the operating profit margins:

This is a result of high growth in Other Income (34.4% CAGR) and fluctuating Stock Adjustments. This along with a comparatively lower growth of only 19.75% in total expenditure has helped the company register higher operating profit growth of 38.6% and consequently led to growth in EPS.

Though the tax and extra-ordinary income have increased significantly in the last 6 years (93% & 56% respectively), the reduction in debt from Rs. 314.5 Cr. in FY05 to Rs. 26.8 Cr. in FY10. As a result, the interest cost has decreased significantly and has helped the company increase its Net Profit after extra-ordinary item by 39%.

ROE & ROIC:

The company has maintained good ROE and ROIC averages of 36.4% and 32.1% respectively. This has been enhanced due to the good growth in profits and lower debt levels. Crompton Greaves had debt of only Rs. 27 Cr. on its books, hence leading to an almost nil Debt-to- Net profit ratio.

Crompton Greaves has performed well in all its parameters, especially over the last 6 years.. This forms a strong base for its future. Hence, the 10 YEAR X-RAY of Crompton Greaves is Green (Very Good).

Crompton Greaves on a Consolidated basis:

On a consolidated basis too, the company has performed robustly in its financials. Its Net Sales have registered an impressive CAGR of 35% and its profits have grown by 39% CAGR over the same period. Its debt stands at is Rs. 500 Cr. leading to an almost nil Debt-to-Net Profit ratio.

To view the company’s 10 YEAR X-RAY on a standalone basis, visit www.MoneyWorks4me.com

What is Crompton Greaves short-term outlook?

Slowdown in the global economy has shifted focus of many players including multinational companies such as ABB, Siemens and Areva T&D to the domestic T&D market leading to price competition. Also, active participation by Korean and Chinese players for orders placed by Power Grid Corporation (PGCIL) (one of the largest transmission utilities in the world) has resulted in severe pricing pressure.

In this context, how did the company perform in the recent past and what lies in store for it in the next few quarters?

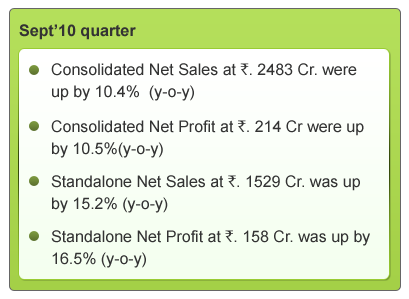

Good performance on the back of robust growth in consumer products, improvement in power systems and overseas subsidiaries:

Good performance on the back of robust growth in consumer products, improvement in power systems and overseas subsidiaries:

On the back of strong domestic market the consolidated segment revenue of consumer products was higher by 24%. The power systems business of the company which was affected by delivery related issues in the first quarter ended June 2010 is back on track with both standalone as well as overseas entities registering steady single digit growth. Also, the company’s overseas subsidiaries which were posing a problem till some time back have started registering positive growth. The company has faced pricing pressure in the last year (Realization for transformers fell by 11%). This pressure due to competition may affect margins but the company has maintained stable margins and expects the same to continue in the coming quarters

Thus, Crompton Greaves has registered a decent performance at a time when competitors like ABB have performed dismally

So, what lies ahead?

Amalgamation with Brook Crompton Greaves:

Crompton Greaves has recently approved the scheme of amalgamation with its wholly owned subsidiary – Brook Crompton Greaves. This has been done with the aim to reduce overall cost of the company

Company to spend Rs. 400 Cr. on capex:

The company will be spending about Rs 400 Cr. mostly on technology and quality up-gradation. The company has decided not to go for capacity expansion as it already has sufficient capacity and it also witnessed a 7% fall in its overseas operation in FY 2010.

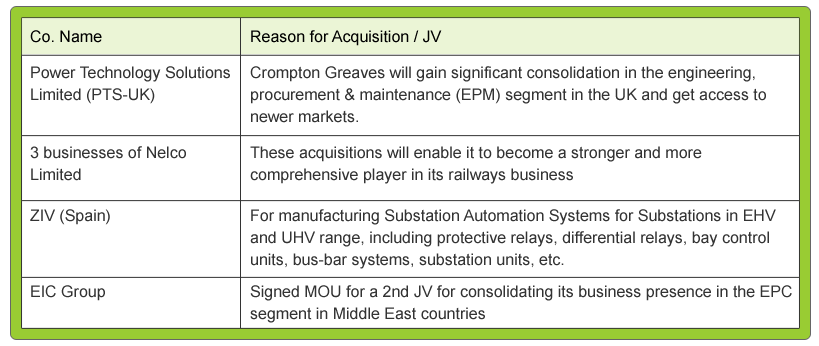

Recent Acquisitions and JVs aimed at becoming a full solutions provider

These acquisitions and JVs are expected to enhance the company’s technological abilities and drive its growth in the short-term.

Yes, the company is facing competition from companies like ABB, Areva T & D etc. Though active participation by China and Korea players is a threat, the company managed to bag 1/3 of Power Grid’s orders. It is further expecting the orders from Power Grid orders to drive revenue growth in the short-term.

The company is expecting to register a 15% growth in revenues for FY11 on the back of these orders and, strong growth in consumer durables. Thus, it is seems that the company is well-placed to tackle competition in the future.

Hence, the short-term outlook of the company is Green (Very Good)

What is Crompton Greaves Long-term Outlook?

1) Diverse Business Mix serves as a stabilizer:

As you have read above, the company operates in 3 SBU’s – Power, Industrial and Consumer Durables. Two significant advantages that the company gains by these multiple business segments are:

a) It reduces volatility in the top line performance of the company: The impact of a slowdown in one segment is usually off-set by the performance of the other segments

b) Improvement in margins: Company’s standalone margins have grown from 9% in FY05 to 18% in FY10. Even on a consolidated basis the company has improved its margins from 9% to 15%.

Hence, this revenue mix acts as a stabilizer both for the company’s top line and bottom line.

2) Innovation in off-shore windmills (Europe):

Off-shore wind energy farms are settling in as a way of saving the environment and are right now being implemented across Europe. They convert wind which is a free, non-polluting resource into the electricity needed to feed the power-hungry world. However off-shore farms cost more than twice the onshore type.

In this context Crompton Greaves has been the first to find an innovative solution to this at the Belwind wind farm energy which is one of Europe’s largest and deepest offshore projects. In conventional offshore, there are lots of moving parts in the substation, needing maintenance. Crompton greaves has devised a way to move these moving parts from offshore site to on-shore site, where maintenance is much easier and cheaper. This dramatically improves the reliability and cost-effectiveness of the offshore farm. This solution is yet to be tested for success, but if it does prove to be successful, it will revolutionize the off-shore wind model by eliminating its major downside and will drive revenues in the long-term

Crompton Greaves is planning to get a patent for this innovation and is hoping that their success at the Belwind project will prove their technology superior in comparison to its competitors.

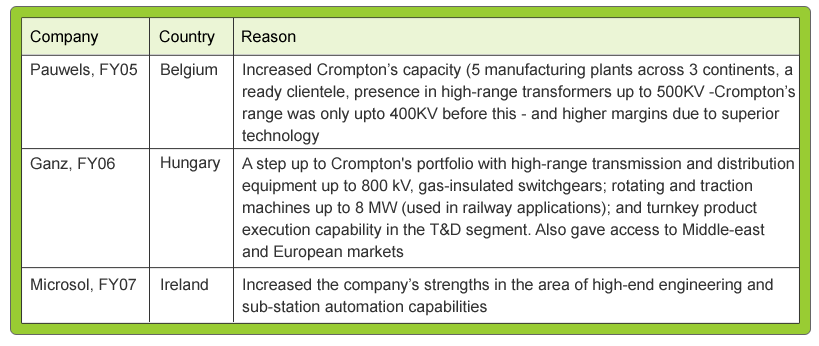

3) Strategic acquisitions to enhance portfolio and technology abilities:

Since India accounts for only 3% market share of transformers and switchgears in the world, Crompton Greaves decided to acquire international companies to establish a strong global footprint. Starting from 2005, the company has acquired a few companies especially in Europe and America to gain access to these markets. This has further helped the company strengthen its products and services portfolio and also increased its technological abilities. Let’s have a look at few of these acquisitions:

These acquisitions have catapulted Crompton Greaves into the global league. The company also has access to an expanded product range, with expertise in power services and the ability to provide total solutions. This along with the JVs mentioned in the short-term have been done with a similar aim to become a full solutions provider in the global market.

4) Future Opportunities in Power, Industrial and Consumer Durables segment:

All these 3 segments are poised for growth in future:

a) Power: With the increasing focus of the Government on power and the increased spending (over 8 Lakh Cr. by FY12) the demand for transformers, switchgears is bound to increase in future. According to industry reports, globally the demand for power is expected to grow by 8-10%.

b) Industrial segment: Growing demand for capital goods will serve well for the company’s future growth in this segment.

c) Consumer Durables: Rise in consumption expenditure, growing % of working women, and a shift from non-branded to branded products coupled with a shift from joint to nuclear households is expected to drive the demand for its consumer durables and appliances segment.

Thus, CG has successfully established a strong position in all the 3 segments and is expected to take advantage of future opportunities available.

So, after seeing its positive points is there anything you should be concerned about?

a) In the consumer durables segment, Crompton Greaves faces competition from the unorganized segment (~50%) of the appliances segment.

Where competition with international majors ABB and Areva are a concern for the long-term too, Crompton Greaves seems to be in a position to tackle this competition due to its strong acquisitions aimed at becoming a full solutions provider in the global market, its revenue mix and good growth expected in the power, industrial and consumer durables segment.

Hence, we can expect the long-term future of the company to be Green (Very Good)

Conclusion:

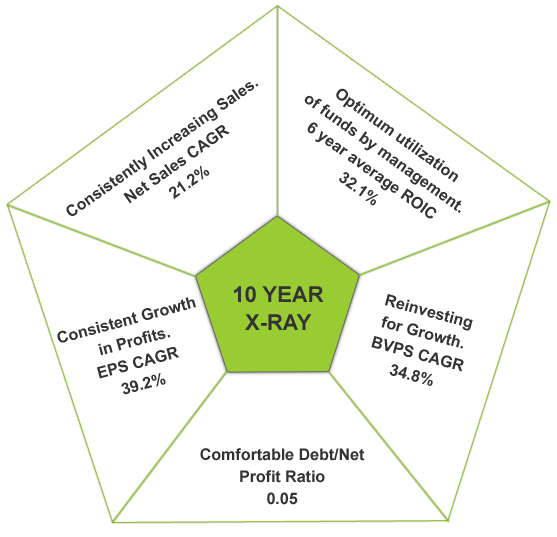

Crompton Greaves is a leading player in the electrical engineering space. Though the company’s major concern right now is growing competition, it is well-armed to tackle competition due to its strong fundamental past, strategic acquisitions and business mix

Yes, Crompton Greaves is an investment-worthy company, but is its share at a good price to buy? Or is the market overvaluing it? To find out what investment decision you must take on Crompton Greaves’ stock right now, become a member of www.MoneyWorks4me.com to find its right value.

Disclaimer: This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while taking investment decisions.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

nice article…. you team seems tp put in lot of effort to get people to invest the best way

@sb89, Krishnarajk1965, Leocap

Hi,

Thanks a lot for your appreciation. Keep reading and let us know your feedback.

good report, covers almost all areas to be analysed before picking

As a subscriber, let me compliment you for your exhaustive coverage of CROMPTON GREAVES. I find it very useful for my investment decision and look forward to more such reports from you.

Do continue to send such emails on your converage of selected companies so that it is easier to reach up to your research report.

Thanks

R.Radhakrishnan

(leocap@airtelmail.in)

Good article. A friend of mine works here and it was good to know what the company is all about. One suggestion though. The financials are becoming a bit complicated. As in I understood Net Sales, ROIC and all But the stock adjustment and all is becoming bit confusing for non finance person like me. Found earlier articles like Glaxo financials easier to understand

Hi Mughda,

Thanks a lot for the suggestion. The reason why we have extended the analysis on the financials, is because we feel it is important for an investor to understand the true reasons for sales and profit growth of a company. However, from the next Company Shastra we will try and keep it simple and bring out the underlying importance of these figures.

Is it a high beta valued stock ? Its price movement appears a bit different from normal one .

However, putting reliance upon such researched paper published before,I have gained . Hence my dear friends awaiting on the fence may start acting now without further delay.

Yes right price matters always! Still these views are of immense values.

Test & taste success.

Great article. I have been tracking this stock as well for some time. This stock appears to be on the rise.