Investing your hard-earned money wisely is a fundamental aspect of financial planning. Ever wondered, among the plethora of investment options available, equity investing has emerged as a popular choice, why? Due to its potential for superior returns and numerous advantages compared to investing in FDs, Gold, and Real Estate. In this blog, we will explore why equity investing is often considered the better choice and the key reasons behind its appeal.

Potential for Higher Returns:

One of the primary reasons why equity investing takes the lead is its unparalleled potential for higher returns. Historically, equities have outperformed FDs, gold, and real estate over the long term. While FDs, gold, and real estate can offer stability and security, they often fall short when it comes to generating substantial wealth. On the other hand, equities have the capacity to deliver substantial capital appreciation and dividends, allowing investors to accumulate wealth over time.

Liquidity and Accessibility:

Equity investments offer remarkable liquidity and accessibility. In the digital age, buying and selling stocks can be done with a few clicks, providing investors with the flexibility to adapt to changing market conditions and capitalize on opportunities swiftly. This liquidity contrasts with the relative illiquidity of real estate, which can require months or even years to sell, and the rigidity of FDs that often come with lock-in periods.

Diversification and Risk Management:

Equities also stand out due to their inherent diversification potential. Through mutual funds and exchange-traded funds (ETFs), investors can spread risk across a broad spectrum of stocks and sectors. This diversification minimizes the impact of poor-performing stocks on the overall portfolio. In contrast, gold and real estate investments often lack such diversification options, making them riskier should their respective markets face a downturn.

Tax Efficiency:

Equity investments often come with tax benefits that can enhance overall returns. Long-term capital gains from equities are taxed at lower rates compared to other asset classes along with relatively smaller tenure. These tax advantages can amplify the benefits of equity investing, especially when compared to the relatively higher capital gains taxes associated with real estate and gold investments.

Inflation Hedge:

Equities have historically served as an effective hedge against inflation. As the economy grows, corporate profits tend to rise, which drives up stock prices. This can help investors preserve the real value of their investments and ensure that their purchasing power remains intact over time, even in the face of rising prices.

Example:

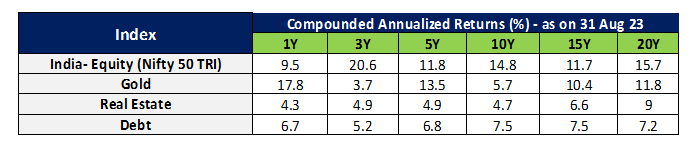

Let’s try to understand this with the help of an example. Imagine Mr. Shah, an Indian investor, with Rs. 1 lakh to invest. He is considering different investment options: Equity, Fixed Deposits, Gold, and Real Estate. Let’s compare the potential returns and outcomes for each investment over a 10/15/20-year period.

Source: FundsIndia Wealth Conversation Report September’23 (Returns as on 31 Aug 23)

You can easily be able to figure out that, as you increase the holding period beyond 10 years irrespective of any point of time in the market, equity beats by a mile with respect to any other asset class.

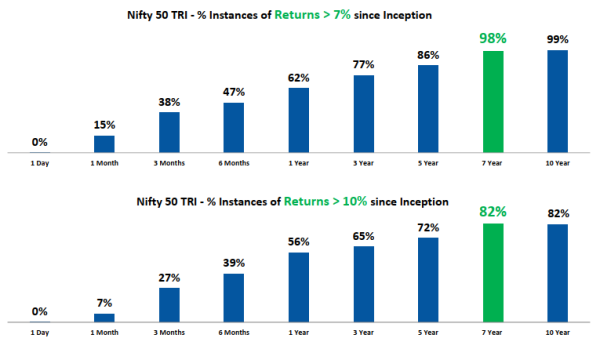

As the investment time horizon increases, the likelihood of achieving superior returns also rises. The graph below clearly illustrates that extending the holding period increases the probability of generating better investment returns.

Source: MFI, FundsIndia. (As on 31-Aug-23, Nifty50 TRI Inception date: 30-Jun-99)

In conclusion, you can easily see who the winner in the long run is. Nevertheless, the debate of equity investing vs. FDs, gold, and real estate investing is never-ending, there is no one-size-fits-all answer. Each option has its advantages and drawbacks, and the right choice depends on your financial goals, risk tolerance, and investment horizon. Equity investments offer the potential for high returns but come with higher volatility and risk. FDs provide safety and stability but may offer lower returns. Gold and real estate can act as hedges against inflation and provide diversification but compound slower than equity.

Diversifying your investment portfolio across these asset classes can help balance your risk and return. Consulting with your investment advisor to create a well-rounded investment strategy that aligns with your specific goals is often the best approach. Ultimately, the key is to strike a balance that suits your individual financial circumstances and long-term objectives.

Regardless of your current life stage, you need to hold equity for creating wealth in the long run. Period. There is no alternative. The extent of equity exposure varies based on the risk-taking ability. At Moneyworks4me, we assist you in building a long-term portfolio that aligns with your financial objectives, enabling you to work towards achieving them.

You can visit our site moneyworks4me.com for investment-related solutions and don’t hesitate to consult with our investment adviser.

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | About | WhatsApp: 9860359463

*Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

*Disclaimer: The securities quoted are for illustration only and are not recommendatory