This article covers the following :

What is ESG Investing?

As per MSCI, “ESG Investing is a term that is often used synonymously with sustainable investing, socially responsible investing, mission-related investing, or screening.”

In Organisation for Economic Co-operation and Development’s (OECD) opinion, “Among the long-term factors environmental, social and governance categories can include controversies and downside risks that have the potential to erode equity value and increase credit risk over time. As such, it aims to combine better risk management with improved portfolio returns, and to reflect investor and beneficiary values in an investment strategy.”

According to us, ESG investing is gaining traction as the investors and government are encouraging environmental care, social development, and better governance for equitable distribution of resources.

What are the most commonly found violations in ESG?

Environmental: Cutting trees for manufacturing, releasing poisonous chemicals in the water stream, releasing hazardous gases in the air, and burning fossil fuel.

Social: Production and distribution of hazardous goods for consumption or usage like tobacco, alcohol, asbestos, unstable, and unsafe work environment for employees, etc.

Governance: Executive compensation, insider trading, corruption and bribery, tax evasion, etc.

How to identify companies that do not practice ESG?

As per regulations, all companies have to list all their activities and interactions with the environment, society, and governance in their annual reports.

Many ESG rating agencies have developed a framework to score companies using company data. They assign points to each data and add all points to arrive at an ESG Score.

One can’t assume a low ESG score for a company by simply looking at the business. For example, a tobacco or thermal power company might be misunderstood as a poor ESG company.

A student who scores low in Social Sciences (SS) exam, doesn’t become a slow learner as he might have made up for a low score in SS by scoring high marks in Science and Math exams.

ESG score is a holistic measurement of ESG compliance, a company might lose a point due to one factor but score points on other factors ending up with a better than expected final score.

Few agencies have developed expertise in scoring companies on ESG. Investor can use their scores to avoid companies that score low on ESG. Some of the popular ESG rating providers are Bloomberg, FTSE, MSCI, Sustainalytics, Thomson Reuters, and Vigeo EIRIS.

Log In | Register FREE | Schedule a DEMO | Solution Enquiry | Subscribe

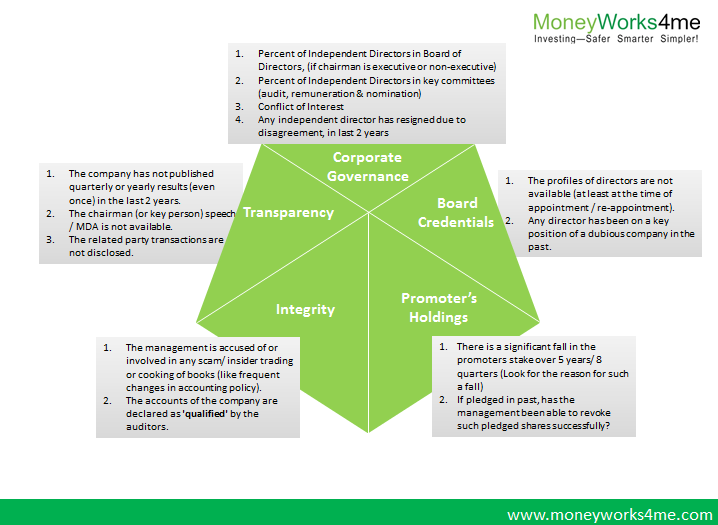

How does MoneyWorks4me assess Management Quality & Governance?

At MoneyWorks4me, we have an internal framework for scoring companies on Management. This framework also takes care of a few corporate governance lapses by companies.

MoneyWorks4me Management X-ray Framework

Corp Governance & Board credentials:

- The Board of directors is the representative of minority shareholders on board. They have a fiduciary responsibility to protect shareholders’ rights and value.

- The Board of Directors must have qualifications and experience to understand company operations and make recommendations in board meetings.

Promoter’s (Management) Stake:

- Ownership in the company incentivizes the promoter (management) to work to take the company’s value higher.

- Falling a stake or pledging it to borrow funds means his fortune is not linked to the company’s trajectory. This might lead to losing focus on the company’s operations.

Integrity:

- Management’s integrity is important for the longevity of a business

- Shortchanging minority shareholders or bribing officials for personal or business favors can lead to value erosion.

Transparency:

- Often promoters running the company work as if they are 100% owners of the company. Minority shareholders also own a stake in the company and must have access to the company’s vision, strategy, and future plans.

- Many promoters also have different ventures which they might fund through listed entities. Such conflict of interest can cause distrust in minority shareholders. It is often due to these reasons, the company’s stock would trade at discount to fair value.

How does opting for ESG investing help over the long term?

A company’s goal is not only to create wealth for its shareholders but also to do good for all its stakeholders including the environment, society, and employees.

While the financial health and ratios are widely discussed, the ESG factor doesn’t get its due attention. With ESG investing gaining traction, companies will be building themselves for sustainability.

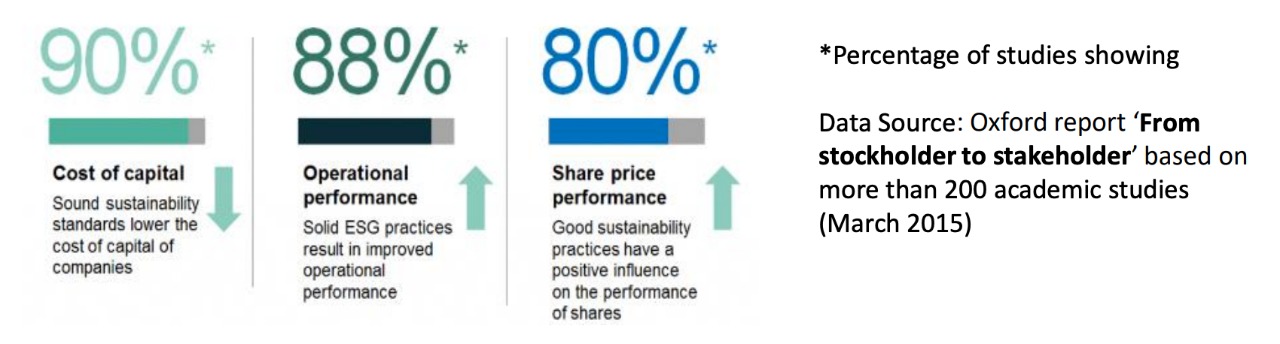

By signing up for ESG investing, an investor not only reduces risks in his portfolio but also benefits the whole society. A company destroying the environment will sooner or later get caught in violations as per law, another company with bad social influence can cause harm to society/government budget that affects investors too while a company with bad governance can misuse common resources, or cheat investors destroying the value of equity.

Companies that don’t score high on ESG are likely to trade at a discount to their financial fair value. Becoming ESG compliant will help companies raise funds for new projects easily, also at reasonable costs versus their counterparts. It will force low score companies to either adopt better practices or die. This trend in investing will increase shareholder value too in long term.

If you liked what you read and would like to put it into practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Why Register | Call 020 6725 8333 | WhatsApp 8055769463