Since the beginning of liberalisation, FII flows to India have steadily grown in volume and importance. Historically, FII flows have been seen to be highly correlated with equity returns in India. FIIs hold over 30% of total free-float market capital of all listed companies in India. Over the same time, Sensex, the benchmark index measuring the stock market performance, has shown remarkable growth, thus, giving these investors, a smile that goes a mile!

So while these institutional investors have earned enormous profits from the India growth story, retail investors back home failed to do so. In this article, we try to find out what has stopped us from investing in our own country! Before we delve deeper into that lets understand institutional investors and their strategies.

Who are Institutional Investors?

Institutional investors are organizations (such as banks, insurance companies, mutual fund houses etc.) which pool large sums of money and invest it in securities, property and other investment assets. . There are two types of institutional investors’ viz. FIIs and DIIs.

Foreign Institutional Investors (FIIs) are non-residents of countries in which they invest. So, all institutions outside India who invest in India are FIIs in the Indian stock market. FIIs need to register with SEBI before they can invest in India. Currently there are 1749 registered FIIs in India and most of the FIIs are from US and Europe. As can be seen from the chart, this number too has increased consistently over the years.

Domestic Institutional Investors (DIIs) are institutions who invest in the Indian financial market being residents of India etc. They can also include operating companies which decide to invest their profits to some degree in these types of assets

So, lets take a look at the investment trend of these institutional investors…

Investing trend…

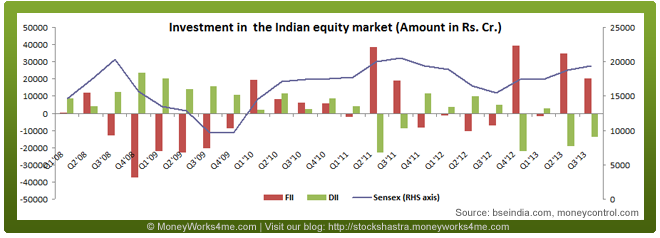

India, with the world’s second highest growth rate, has been an attractive market for foreign investors. Since 2001, FIIs have invested huge money into the Indian equity market which is one of the major reasons for the significant jump in Sensex over the last decade.

Despite the economic slowdown, FIIs have continued to pump in money in India. FIIs have already made net investments of $20.9 billion (about Rs. 1.14 lakh crore) in the Indian equity market so far in 2012, making it the second highest net inflow in a single calendar year since their entry into Indian capital markets in 1992. For 2010, the FII net investment figure stood at $29 billion. FIIs have seen to be buying even at a time when the economy is facing a slow-down.

DIIs too have been investing in the Indian stock market; however, the level of investments & their investment strategy differs from FIIs, as can be seen in the figure below:

As can be seen from the chart, while FIIs have started investing in the Indian market at low valuations, DIIs continue to withdraw money. One of the reasons for this is that DII investments are driven by retail investments, which is where their corpus of funds comes from. Thus, retail investors continue to be skeptical about the Indian markets, when it comes to both – direct as well as indirect investments.

However, FIIs and DIIs both have earned impressive return from the Indian equity market over the last decade. Considering QE3 in US and unlimited bond buying programme in Europe, we expect that they will continue to invest into the Indian equity market as India continues to have a competitive edge over other countries. Let’s look at the competitive advantages that India has-

Advantage India!

India is considered to be the third most favored destination for investment after China and the US for major global companies, according to UNCTAD’s World Investment Report 2012. The report anticipates that foreign investments in India could increase by over 20% in 2012-13. So, let’s see what sets India apart:

- India has the second highest growth rate in the world. Its GDP is growing at 5.30% even in times of an economic slowdown, while developed countries like the US, Euro Area, UK & Germany stand at 2.50%, -0.60%, -0.10%, and 0.40%, respectively. Going forward, it is expected to continue its strong growth path on back of huge investment and favorable demographics. This growth differential between India and the developed countries seems to be working in favor of India.

- Another reason for attracting foreign investment is India’s favorable economic development and change in consumer lifestyle over the last decade. Factors like India’s young population (average age of 25 years) leading to a greater proportion of working-age population as compared to any other country, higher disposable income, growing urbanization, rural expansion, infrastructure development, increased participation of women in the workforce etc. promoting economic development, have built confidence among investors about the future of India.

- Policy initiatives like the infrastructure sector investments being committed $1 trillion in the 2012-17 five-year plan, increase in FDI cap in the Aviation and Multi-brand retail sectors were announced recently. Also, the GST (Goods & Services Tax) and DTC (Direct Tax Code) are being contemplated to be introduced in India. These are positive signs of growth and development being envisaged, and implemented in India.

All the above factors will drive the GDP growth in future which would fuel the growth in the Indian equity market.

So, what’s stopping you?

The Indian retail investors have been traditionally investing their savings majorly in real-estate, fixed-deposit and gold. Historically, it has been seen that the return from the stock market has been far higher than these assets. Despite superior returns, there seems to be no change in the investment pattern of retail investors.

So, we here at MoneyWorks4me tried to analyze the reasons for such behavior and tried to give a solution to each pull-back. Read on to find out if you identify with any of these:

- Lack of adequate financial know-how

Investing in the stock market does not involve any rocket science. Once you begin, your knowledge and confidence expand along with your experience. For the beginners, there are enough free resources on the internet, which can help you place your first step in the stock market, which minimal risk or worry involved. One such source is our site www.moneyworks4me.com. Do check it out.

- Preference for steady, guaranteed returns

You may have a very low risk appetite, but what about the returns you’re currently getting from your risk-less investments? Are they enough to beat inflation and fulfill your dreams? The stock market, contrary to popular belief, does offer several large-cap safe best stocks to invest in, which are more suited to those with a low risk-appetite, and at the same time offer substantially greater returns than your current risk-less investments. These companies generally pay regular and/or increasing dividends, plus you gain via capital appreciation (i.e. rise in the market price of the shares) on your initially invested amount, year on year.

- Does the volatility of the indices and the stock market get you worried?

It should: only if you are a trader and not an “investor”. An investor has a time frame (usually 5-10 years) in mind, over which he/she seeks to get return in the form of both dividends, as well as capital appreciation. Hence, short-term volatility in stock prices or indices, largely triggered by market sentiments, news etc., shouldn’t concern you as far as you’re in the market with an investment, and not a trade.

- Perception that the stock market is “risky”?

Risk comes from the factors mentioned above viz. ignorance, perceived volatility etc. Investing in safe large cap stocks with some knowledge can reduce this risk substantially.

Do you want your share?

The Indian stock market is, and has been, an attractive investment destination for FIIs. They have invested, and gained heavily from the Indian stock market. Moreover, the volume of funds flowing into the stock market from domestic sources lags behind the level of investments being made by FIIs. It is time we took over!

Many experts believe that the Indian economy has bottomed out or will soon do so. Hence, it makes sense now, for long-term investors to buy great stocks which are undervalued and reap the gains when the markets rise. According to our analysis too, Sensex is currently undervalued and provides investment opportunity to the Indian retail investors.

Considering FIIs and DIIs flow to India and India’s competitive edge, we believe that the Indian stock market is expected to deliver returns of more than 15% over the long-term. So what are you waiting for? Invest in safe stocks at cheap valuations to maximize your returns.

Grow your money, fulfill your dreams!!

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

1 comment