HDFC Developed World Indexes FoF NFO Details:

Name: HDFC Developed World Indexes Fund of Funds

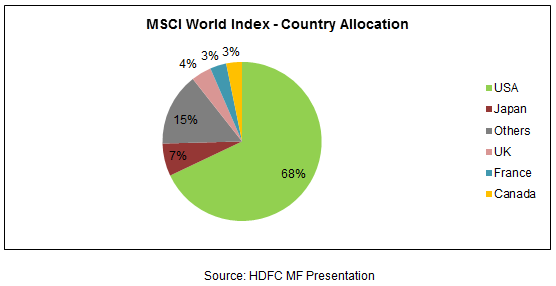

Benchmark: MSCI World Index (Net Total Return Index)

Fund Manager: Mr. Krishan Kumar Daga

Minimum application: Rs. 5,000 and multiples of Re. 10

Exit Load: 1% if redeemed within 30 days from the date of allotment; NIL thereafter

Option: Growth Option only

Expense Ratio: Regular Plan 1% ; Direct Plan 0.5%

Indian investors now have one more avenue to invest in the developed markets. HDFC AMC has launched the Developed World Indexes Fund of Funds and its NFO is open for subscription from September 17th to October 1st 2021.

Listen to Moneyworks4me Podcast – HDFC Developed World Indexes Fund of Funds

About the HDFC Developed World Indexes Fund of Funds

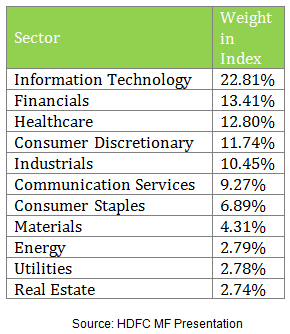

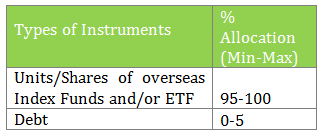

Index funds invest in prominent stocks based on size and liquidity. Although there are mutual funds that invest in global markets, HDFC Developed World Indexes Fund of Funds (HDFC DWI FOF) is a diversified index fund with passive management that invests in units/shares of overseas Index Funds and/or ETFs which will in aggregate closely correspond to the MSCI World Index (subject to tracking error).

Portfolio characteristics

The FoF (Fund of Funds) will in aggregate closely correspond to the MSCI World Index, (subject to tracking error). MSCI World Index has more than 1500 constituents and focuses on capturing large and mid-cap representation across 23 developed markets, covering about 85% of the free float-adjusted market capitalization in each country.

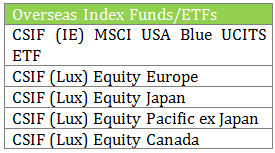

Hence, this FoF will provide exposure to 5 regions across 23 developed markets countries, 1500+ constituents, and 14 currencies with coverage of 56% of global GDP and 50% of world market cap in one single fund.

Following is the Proposed Asset Allocation of the Scheme:

Among the Index Funds/ ETFs, the proposed Index Funds/ETFs under the scheme are as follows:

The Scheme will invest in units/shares of overseas Index Funds and/or ETFs (as the mentioned names) offered by Credit Suisse Asset Management which operates as an asset management company.

MoneyWorks4me Opinion

Diversification outside the country and specially developed markets are very beneficial over the long term. Not only does it lower the volatility of the portfolio but also provides returns very close to Indian Equity pre-tax.

1. Developed markets tend to have a better business environment, more innovation, and governance

United States, Europe, and Canada have very high-quality mature companies with stable profitability, shareholder-friendly management, and transparent dividend policy.

The United States is a fertile ground for multi-bagger opportunities from innovative companies and multinational organizations.

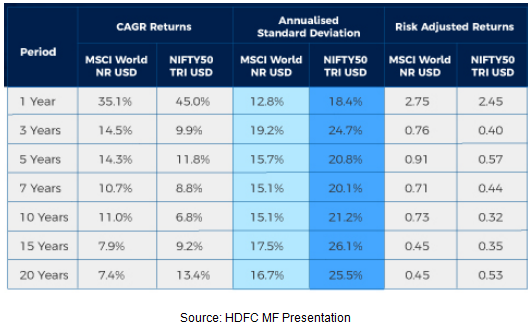

2. MSCI World Index dominated by US and European equity is less volatile versus Nifty/Indian markets

The above data shows that on all time frames, the annual volatility of the MSCI World Index is less than Nifty’s volatility measured in USD for the apples to apple comparison.

Annual volatility explains the range of returns. For example: If MSCI World and India both have an average annual return of 11%, 13% annual volatility in MSCI World implies a range of -15% to 37% return in most one year periods while 18% for India implies a range of -25% to 47% return in most one year periods. Because the range of India’s range of return is wider than MSCI World, Indian markets are more volatile. Adding MSCI World/Developed markets equity can lower volatility of equity portfolio.

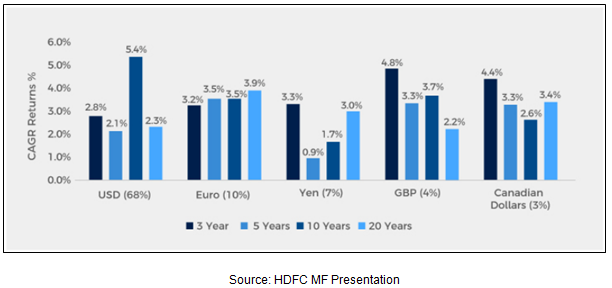

3. After adding the benefit of currency depreciation of Indian Rupee versus Dollar/Euro, returns are very close to India’s equity returns

Over the last 30 years since LPG reforms in India, India and the US have delivered similar returns after incl currency benefit. US forms the largest component in HDFC DWI FOF hence used for comparison.

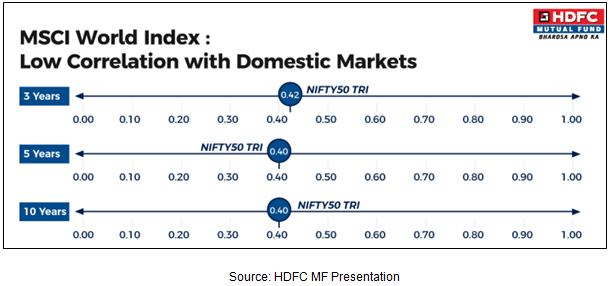

4. Developed markets are less correlated versus India equity markets in the medium term to long term even though they exhibit very similar movement in the short term

MSCI World Index (predominantly Developed markets) has a correlation of just 0.4 with Nifty in the medium to long term. This means 40% of the NIfty’s moves are explained by the movement of the MSCI World Index.

In the very short term like 1 month-6 month, the correlation is higher but over the longer-term like 3-10 years, it has a lower correlation which reduces the volatility of the entire portfolio.

Other features of HDFC DWI FOF:

- Developed nations are more efficient markets that make index funds score higher over actively managed funds; HDFC DWI FOF includes only Index Funds which replicate market returns.

- Index Funds also mean lower costs; by investing in HDFC DWI FOF, you get exposure to global markets with just 0.5% p.a.

- Till the time India remains a developing nation, it will have more inflation and also be a net importer of capital. This will lead to Indian Rupee depreciating versus the currencies of developed markets especially the US dollar. This further adds to the overall return.

Frequently Asked Questions:

1. Is it the right time to invest in international funds or HDFC Developed World indexes Fund of Funds?

No, go for SIP!

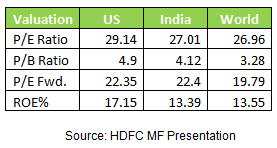

Global equity valuations are elevated due to lower interest rate scenarios and current fiscal stimulus across the world to recover from the Covid slowdown.

If you plan to invest for 10-15 years, current valuation will matter less but near-term returns can be inferior versus long-term average.

To avoid near-term disappointment, it is appropriate to take a staggered approach to international investment especially in funds that include large exposure to the US. Since HDFC DWI FOF has ~70% in US equity, one can adopt the SIP route to investing in this fund once it is launched. Currently, the fund house will accept only Lumpsum inside of the NFO window.

2. What is a better option, Motilal Oswal S&P 500 Index Fund or HDFC Developed World Indexes FOF?

Both the funds are (a) low cost, (b) index funds and (c) invest in developed markets. However, HDFC DWI FOF includes Europe, Canada, Japan, etc. which adds more diversification.

S&P 500, being a US index, has better prospects due to innovative culture, business-oriented policy-making, etc. S&P 500 companies have a large % of sales coming from other than the US which makes S&P500 a global index. So we recommend being indifferent to either of the funds. S&P500 is preferable for the reasons highlighted above.

3. What is a better option, Motilal Oswal Nasdaq 100 ETF/FOF Fund or HDFC Developed World Indexes FOF?

Both the funds are (a) low cost, (b) index funds and (c) invest in developed markets. However, HDFC DWI FOF includes Europe, Canada, Japan, etc. as well as includes all the sectors while Nasdaq 100 predominantly includes technology and new-age companies.

We would avoid Nasdaq 100 ETF/FOF as it can be very volatile and returns may vary dramatically from broad-based indices like S&P500 or HDFC DWI FOF.

For 10 years from 1990-2000, Nasdaq 100 was up 2000% while S&P500 was up 370%.

For 10 years from 2000-2010, Nasdaq 100 was down -36% while S&P500 was down -10%. Due to unpredictable performance, we recommend avoiding narrow indices like Nasdaq 100.

How are international funds or funds of funds taxed in India?

Investing in international funds or Fund of Funds is classified as a debt fund as per income tax rules, so HDFC DWI FOF will also be taxed like a debt fund. Debt funds are taxed as per your income tax bracket if sold within 3 years, and 15% after 3 years or 20% with indexation.

Register for FREE Live Webinar | Subscribe | MoneyWorks4me Podcast

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463