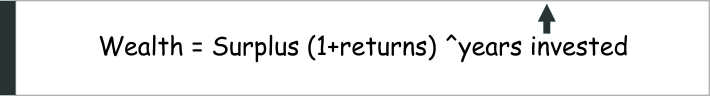

We want our saving, our surplus money to grow into wealth so that it can fund our future financial needs and goals and more. So how does money grow? Does it follow a formula? Yes, actually it does. We call it the Wealth Building Formula.

Essentially what this says is that wealth (money available to you in the future) is what happens when you put your surplus money to earn returns and let it compound for a number of years.

As you can see there are 3 variables, Surplus (the saving you put to work), Returns (CAGR) and No. of years you stay invested and earn the returns. So how does this formula help understand why Sensible Investing is the best way to grow your money.

As we have said Sensible Investing is about following two rules

Rule No 1: Stay invested and let the power of compounding do its magic.

Rule No 2: Do things that help you follow Rule No 1; avoid the rest.

What does the Wealth formula indicate about Sensible Investing?

The Sensible investor focuses on maximising the 3rd variable of the Wealth Formula i.e allowing his money to compound as long as possible. To do this he has a sensible returns expectation i.e. substantially higher than inflation rates but not so high that it requires taking high risks. These are the kind of risks that make him so uncomfortable that he wants to exit the market when it is volatile. Since he takes moderate risks he confidently invests a large portion of his total surplus in this manner. So Sensible Investing means using the Wealth Building Formula as follows

What leads to not staying invested?

The main reason investors exit their equity investments is their discomfort in handling a fall in the portfolio when the market corrects. The way to reduce the drop is ensuring asset allocation to debt and equity. For example a 50:50 split ensures that the investor’s portfolio drops by roughly half the amount the market corrects. So even if the market corrects by 20%, the investor sees about 10% drop in his portfolio something that makes us uncomfortable but not panicked.

Secondly a Sensible Investor invests only in strong companies, what MoneyWorks4me color-codes as Green and Orange. This gives him confidence to stay invested even when the market corrects. Imagine your portfolio is 1 cr, a 20% drop would mean a paper loss of 20 lacs. A portfolio with large amount of small and mid-cap stocks and some Red companies i.e. companies having business risk could fall by this much. Would you have the heart to hold onto such companies? Most would sell and get out and incur a real loss.

But this way of investing would take very long to create wealth?

Yes, it does. Investing is not a get rich quick formula. As you can see from the Wealth Building Formula if you wanted to get rich quick i.e. the period you stay invested is small, then to create wealth you need to earn very high returns; the kind of returns that is offered in casinos and race tracks, provided you win. But that seldom ever happens because the odds are always in favour of the house, the bookie, the casino. So remember investing is a marathon not a 100-meter sprint.

Now you need to choose between get-rich-quick and get- rich-definitely and sensible Investors choose the latter. After all, having worked hard for their money it is not sensible to let our impatience prevent us from growing our savings into wealth.

Wealth creation through investing follows the Wealth-Building-Formula and a sensible person aligns his behaviour to benefit from it. Join the Moneyworks4me Sensible Investing Club – Be Sensible, Become Wealthy!

Related Article:

In the Investing Race, Tortoises beat Hares, but it’s hard to stay a tortoise…until now!

Become a Member of the Moneyworks4me Sensible Investing Club

Bring discipline to your investing and reach your financial goals

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463