Balance Sheets provide investors an insight about the financial health of a company. Since this is a statement that is meant to give a true picture of the company’s financial condition, it is not a hidden fact that managements do spend a lot of time preparing the balance sheet in such a manner that investors are convinced that the company is in excellent financial health. One way to do this is to tweak the Asset side of the Balance Sheet. The most commonly manipulated assets are the operating-related items such as accounts receivable or inventory. Alternatively, they might be something more unusual, such as undeveloped land or artwork. The net result is the same, however: a misstatement of earning power and financial position.

Balance Sheets provide investors an insight about the financial health of a company. Since this is a statement that is meant to give a true picture of the company’s financial condition, it is not a hidden fact that managements do spend a lot of time preparing the balance sheet in such a manner that investors are convinced that the company is in excellent financial health. One way to do this is to tweak the Asset side of the Balance Sheet. The most commonly manipulated assets are the operating-related items such as accounts receivable or inventory. Alternatively, they might be something more unusual, such as undeveloped land or artwork. The net result is the same, however: a misstatement of earning power and financial position.

So let’s see what are the two assets that are most commonly manipulated by companies? And how is the manipulation done?

What are the assets that can be overvalued?

Assets can be divided into two categories: a) Fixed Assets b) Current Assets. Of this, current assets are the ones which are used in the day-to-day operations of the business like cash, inventory, accounts receivable etc. Of these the two which are most likely subject to manipulation are

- Accounts receivable

- Inventory

These assets feature on the balance sheet of a company as shown in the table below:

So, let’s look at how these assets can be overvalued?

Accounts Receivable/Debtors

Remember Mr. A from our previous Stock Shastra. Just to refresh your memory, Mr. A owns a bakery which produces the finest bread in town. He sells his bread to a number of people but has some faithful customers who buy products from him every day. In an attempt to further improve business relations with them, Mr. A gives them a special offer. Now, these customers do not require paying him on a daily basis; they can instead pay on a quarterly basis. However as the sale is already made, Mr. A records it as an asset on his balance sheet, called as accounts receivables. On certain occasions, if he realizes that some customer (say Mr. X), might not be able to pay him, he immediately stops his credit and reduces the value of accounts receivable by the amount due from Mr. X. He records this amount separately, called as ‘Provision for doubtful debts’.

So far so good. But, what if Mr. A decides to play a dangerous game and records receivables even when the sale isn’t made (as seen in Stock Shastra 39, the most abusive ways to increase sales). Or if he decides not to provide for the amount due from Mr. X. In this case the accounts receivable will go on increasing considerably every year. Infact, the growth rate will be higher than that of sales. Also debtors days, which indicates the average time taken by debtors to repay, will also go on increasing. Have a look at the table below to see how Mr. A’s accounts would look.

So, by overstating debtors, companies try to report that they have additional cash that is receivable in the future, enhancing their financial position.

So, what are the warnings/red flags available to us investors against overvalued accounts receivable?

Inventory

Inventory represents the value of goods that have already been manufactured/produced but not yet sold. Some companies manipulate inventory, as overstating inventory value will lead to a lower cost of goods sold, when sales happen at a later date; and therefore an artificially higher net income, then. There are four approaches available to a company intent on overvaluing inventory.

1. Overstating Physical Counts

The simplest way to overvalue inventory is to overstate the physical quantity of items included in inventory. Such an approach may employ the use of fictitious counts for fake goods or increasing the counts of existing goods.

2. Increasing Reported Valuation

A company simply may increase the reported valuation of inventory without changing its physical count. The inventory on hand is valued at a higher amount.

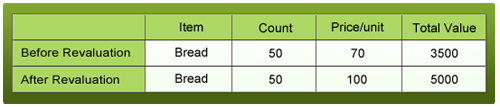

Suppose Mr. A realizes that the bread he bakes is the best in town and has a lot of demand. He thinks the customers will pay more for his product in future. Thus, he increases the bread prices and accordingly revalues his inventory at a higher cost. This is how his inventory for only breads would look like:

3. Delaying an Inventory Write-down

Suppose Mr. A overestimated the demand of bread. It turns out people have stopped buying bread from him and are buying it from another bakery. After two days of less or no sale, he should record the value of these breads as a loss and reduce the inventory value accordingly. Or he should revalue the inventory at a reduced cost for breads as no one would pay higher costs for stale breads! If instead he decides not to revalue inventory, it would result in inventory misstatement.

A company may thus overvalue inventory by postponing a needed write-down for goods that are obsolete or defective. A write-down in a company’s inventory is recorded by reducing the inventory amount which subsequently reduces net income.

4. Change in method of calculation

There are three methods of calculating inventory viz. FIFO, LIFO and average cost method.

- First in, First out:

In this method, the first unit that makes its way into the inventory is the first to be sold out.

- Last in, Last out:

In this method, the last unit included into inventory is the first one to be sold. The older inventory, therefore, is left over at the end of the accounting period.

- Average Cost method:

This method takes the weighted average of all units available for sale during the accounting period and then uses that average cost to determine the value of COGS and ending inventory.

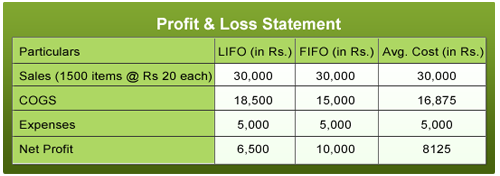

The inventory value and Cost of goods sold can vary depending upon which method is used. In the table given below as an illustration, the cost of goods sold is highest in LIFO, followed by average cost and FIFO. So, the net profit is highest if a company follows FIFO.

Companies can change inventory valuation methods which could lead to artificially higher/lower profits. For e.g. in the case given above if the company changes from LIFO to FIFO, its profit will be higher. However, companies have to declare a change in such an accounting policy and this can be found in the ‘Notes to Accounts’ section.

So what are the warning signals/red flags to help us identify inventory manipulation?

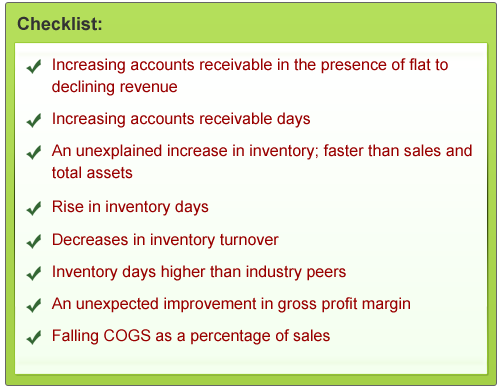

To summarize, there are various techniques used by companies to manipulate their assets. A company may not publish its entire asset situation in its annual report. However, it is required to report all such details about inventory and debtors in its notes to accounts. Given below is a checklist that summarizes all the warnings available to investors that suggest that a company may be involved in asset manipulation.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

1 comment