Merger and acquisition deals or M&A deals as they are called have now become a big part of the corporate world. Not surprisingly, these often make the headlines in the news, as they’re worth millions or even billions of dollars. On the face of it all mergers and acquisitions have one common goal: to create synergy that makes the value of the combined company greater than the two individual companies. No wonder you see words like, ‘synergy‘, ‘strategic fit‘, ‘value proposition‘ cropping up in media statements given by companies engaging in such deals! But history has proved that M&A deals fail, if the motivations behind them is to manipulate financial statements.

Merger and acquisition deals or M&A deals as they are called have now become a big part of the corporate world. Not surprisingly, these often make the headlines in the news, as they’re worth millions or even billions of dollars. On the face of it all mergers and acquisitions have one common goal: to create synergy that makes the value of the combined company greater than the two individual companies. No wonder you see words like, ‘synergy‘, ‘strategic fit‘, ‘value proposition‘ cropping up in media statements given by companies engaging in such deals! But history has proved that M&A deals fail, if the motivations behind them is to manipulate financial statements.

So, lets see how do companies manipulate financial statements using M & A deals?

1) Boosting cash flow from operation – When cash flows in but does not flow out! :

When a company acquires another company all the cash inflows and outflows of the acquired company become a part of the acquiring company. In the last Stock Shastra, we learnt about the 3 types of cash flows – operations, investing and financing. Let’s suppose that Big Industries Inc. is acquiring Small Corp. There are two ways in which Big Industries can pay for the acquisition, both of which would not affect its cash flow from operations (CFFO) – cash generated from day-to-day activities.

- The company pays cash for the acquisition : Since Big Industries has acquired a company and its assets, the cash payment is recorded as an investing outflow which only affects the cash flow from investing activities and does not affect cash flow from operations at all of Big Industries.

- The company offers stock of Big Industries instead, in which, of course, there is no cash outflow.

Now, consider this – Just before the deal is done, Small Corp (the company being acquired) must have incurred certain cost (i.e. Cost of Goods sold) towards manufacturing finished goods (i.e. goods to be sold at a later date). Without the acquisition, these costs would have led to a decrease in the cash flow from operations. However because of the acquisition, all these costs get reflected in the amount paid by Big Industries for the acquisition which is a part of cash flow from investing activities for the combined entity. Thus it does not not put any burden on cash flow from operations. Infact, to make matter worse, once Big Industries sells products after the deal, it will record revenues as an operating inflow further boosting its CFFO.

Thus, in an acquisition context, Big Industries is able to generate new operating inflows; whereas cash outflows never hit the operating section. By the very nature of acquisitions, companies can boost CFFO. The real problem arises when companies do serial (multiple) acquisitions and seek to grow only inorganically!!

2) Postponing cash inflows and preponing cash outflows: Another money generating trick to boost CFFO:

Now just before Big Industries acquired Small Corp, the CFO of Big Industries calls for a meeting with the executives of Small Corp. He asks for the executives to do a few things:

- Do not deposit cheques already received from customers; hold on to them for few weeks.

- Call our biggest customers and tell them they can take extra credit and pay us after a few weeks. Tell them we are doing this to gain their confidence and not lose them in the transition process.

- Pay all the bills immediately against the normal practice of waiting till the deadline.

- Prepay any vendors or suppliers if you can.

You may have noticed that all these activities will lead to lower cash inflows and higher cash outflows leading to a lower cash flow from operations before the acquisition deal.

The day after the acquisition, there is another meeting. Now the CFO asks everyone to go back to normal business – deposit cheques immediately, start collecting from customers and wait to pay the bills until deadline! Once the acquisition closed there were large collections to be made from customers and very few bills to be paid. With increased cash inflows and lower cash outflows, the cash flow from operations shoots up immediately after the acquisition giving investors the false belief that the acquisition was a resounding success.

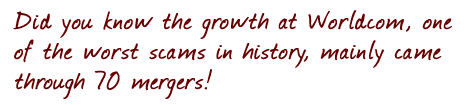

Tyco, another major scam in history, became infamous for using such deceptive accounting techniques during acquisitions. With 750 acquisitions in its kitty, from 1999 to 2002, no wonder Tyco was transformed into a conglomerate. The fake boosts provided to CFFO were also huge, with Tyco sometimes doing almost 200 acquisitions in a year!!

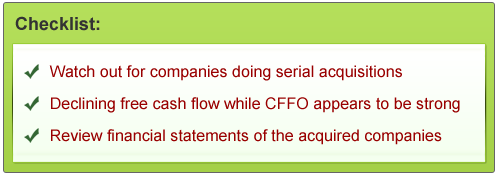

To summarize, YES, mergers and acquisitions might actually enhance shareholder value! But be very cautious about company involved in a string of acquisitions. Given below is a checklist of warning signals, to help you avoid such companies:

How to Make Informed Stock Investing Decisions:

Best Stocks From:

Nifty 50 Nifty Next 50 Nifty 100 Nifty 200 Nifty 500 Healthcare Auto FMCG Nifty Financial Services Chemicals & Fertilizers Dividend Opportunities SmallCap 250 MidCap 100

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463

This is great because no one ever told about this type of manipulation.You have quoted Worldcom and Tyco. It would be great if you can quote any Indian company with in depth details. There lies your strength and braveness.

Really an exceptional article, and quite insightful