It is nearly impossible to accurately forecast stock prices or market levels. An explanation for this could be the level of uncertainty that is inherent to markets, along with the behaviour of investors. However, while one is well aware of the invisible hands of demand and supply that shape the markets, the visible hand of regulation is often forgotten. Legislation has a tremendous impact on markets akin to the butterfly effect. In essence, the butterfly effect states that a butterfly flapping its wings in India could cause a tornado in Japan. The metaphor highlights how small changes in the environment can have a strong impact on the result.

We will highlight a few examples that have had a huge impact on businesses and sectors.

Foreign Exchange Regulation Act (FERA), 1973

While FERA was imposed by Indira Gandhi’s government, George Fernandes was responsible for its implementation as the Union Minister of the Janata Party under Morarji Desai. According to FERA (1973), foreign investors could not own more than 40% of the share capital in Indian enterprises. Forced to comply with this norm, most foreign companies complied by diluting their stake at extremely low valuations because prices were set by the controller of capital issues rather than free market dynamics. Compliant companies included the likes of Gillette (then India Shaving Products), Nestle, Hindustan Unilever (then Hindustan Lever), Procter & Gamble (then Richardson Hindustan) and Colgate, which were identified by veteran investors like Late Chandrakant Sampat as buying opportunities. The quality of these businesses and the returns made by them over the last few decades through both share price increases and dividends show the importance of legislation in wealth creation.

What happened to the companies that withdrew from the company instead of complying?

Two well-known companies, Coca-Cola and IBM, refused to comply with FERA and chose to exit the country. These decisions were nothing short of momentous for the soft beverage and information technology industries respectively. The departure of Coca-Cola, until its re-entry back in 1993 allowed Parle to grow Thumbs Up, Limca and its various other brands, with limited competition for 16 years. While Thumb’s Up was later sold to Coca-Cola upon its re-entry, the brand continues to dominate Indian taste buds.

The departure of IBM in 1978 created a vacuum in the Indian Information Technology Industry which led to the creation of Wipro and Infosys, essentially creating the Indian Information Technology industry as we know it. This industry continues to be dominated by Indian players and has generated tremendous wealth for shareholders over the last few decades.

The Patents Act, 1970

The Patents Act (1970) passed under the leadership of Indira Gandhi had a tremendous effect on the Indian Pharmaceutical Industry. At a time when most Indians were poor and medicine was controlled by multinational pharmaceutical players that commanded high prices for their drugs, The Patents Act reshaped the industry. The Patents Act gave a manufacturer of a drug a patent over the process of manufacturing rather than the product. This allowed smaller Indian players with smaller budgets to focus on reverse engineering existing pharmaceutical products, which required lower costs than innovation. The act reduced the barrier for entry, allowing low-cost drug development in India aiding both the citizens as well as Indian companies. Till date, India remains one of the lowest-cost producers of pharmaceuticals in the world. Although the law has been amended since to comply with international norms, the success of the Indian Pharmaceutical Industry can be largely attributed to this legislation.

While these changes occurred a long time ago, an investor would be interested in knowing whether such changes have occurred recently. Among many, this article will highlight two recent notable pieces of legislation: the Real Estate Regulatory Authority (RERA) Act (2016) and the Bureau of Indian Standards (Hallmarking) Regulations (2018).

Real Estate Regulatory Authority (RERA) Act, 2016

The problems with the Indian Real Estate industry have been well known to all homeowners. The real estate cycle before the implementation of RERA saw the entry of a large number of unorganised players with inadequate levels of competence. The industry was marked by cash transactions, project delays, money laundering and cross-financing of projects which left many such developers over-leveraged and homebuyers at the mercy of such developers.

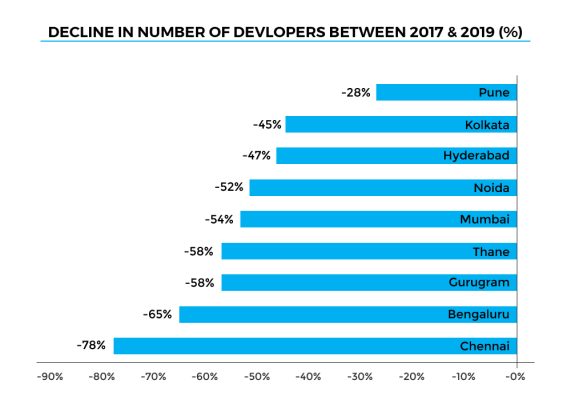

The implementation of RERA has improved quality control through standardisation of size measurements, improved transparency and increased costs for delay and quality issues. This has allowed stronger players with superior management and balance sheets to increase their presence in the market as small developers continue to face issues. The period between 2017 and 2019 witnessed a large number of these small developers exiting the real estate industry due to their inability to comply with the new norms.

Source: PropEquity

As a result of this change in regulation, the Nifty Reality Index has gained 420% since the beginning of 2017, while Nifty has gained 166%. While there are idiosyncratic factors that have led to the growth of these real estate players, RERA has been an important tailwind.

Bureau of Indian Standards (Hallmarking) Regulations (2018)

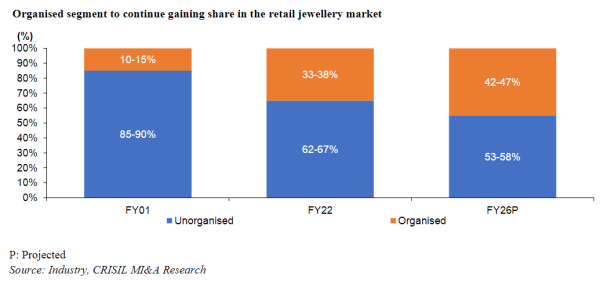

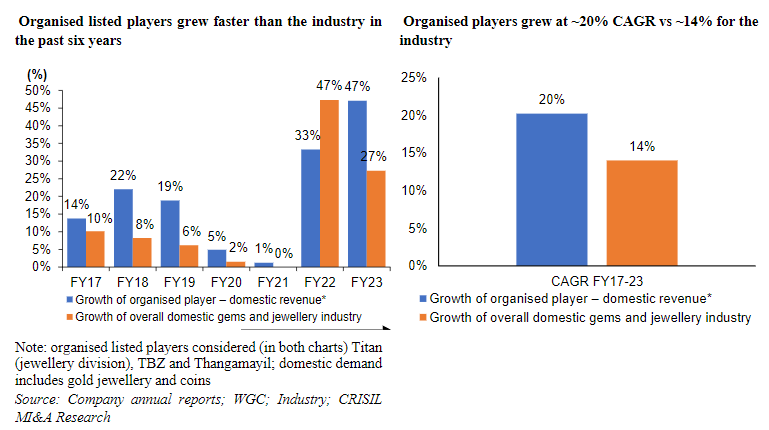

In the early 2000s, Tanishq cemented its brand as a trusted urban jeweller by highlighting the purity of its products compared to those of local jewellers. From a low teen market share in 2001, the organised jewellery industry has grown significantly to command 33-38% of the market share in the overall market. While branding has been extremely successful in urban areas, less urban areas have a stronger presence of local unorganized jewellers that resort to adulteration to boost margins at the expense of uninformed buyers that cannot verify the quality of jewellery purchased.

The Indian government has made gold hallmarking compulsory since 2021 on six categories: 14k, 18k, 20k, 22k, 23k and 24k. As a result, the ability of unorganised jewellers to adulterate their products has reduced; hurting their margins and growth prospects while organised players have been able to strengthen their brand value through their focus on hallmarking. Organised jewellers operating in smaller towns and cities would witness tailwinds as the competition in these regions weakens over time.

Conclusion

Analysts and business researchers have extensively used the PESTLE (Political, Economic, Social, Technological, Legal, and Environment) analysis framework to understand the external environment of a company. This research must be aided through an extensive study of the changes in the environment rather than just an understanding of the factors for the purpose of superior return generation. The goal of the article is to make an investor aware about the importance of change in legislation on businesses and sectors. While the result of such changes may not be immediate and may be followed by a temporary period of pain, a proper understanding of the long-term effects of such changes can lead to superior wealth generation.

Best Stocks From:

Top 10 Stocks in India Best EV Stocks in India Screener Alpha Cases Best 5G Stocks in India Top AI Stocks in India Best Drone Stocks in India Best Defence Stocks in India Top 10 Infrastructure Stocks in India Best Fintech Stocks in India Best Manufacturing Stocks in India Best Liquor Stocks in India

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463

*Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

*Disclaimer: The securities quoted are for illustration only and are not recommendatory