Every bull run in the stock market feels different — but the story of greed, euphoria, and downfall remains the same.

From the Harshad Mehta scam of 1992 to the NBFC crisis of 2018, investors have repeatedly fallen for the same patterns: prices rising faster than fundamentals, excessive optimism, and the belief that “this time is different.”

So, what can we learn from history to protect ourselves from the next market bubble? Let’s look back at some of India’s biggest boom-and-bust cycles.

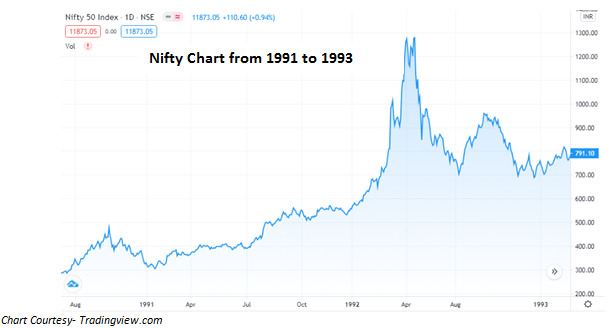

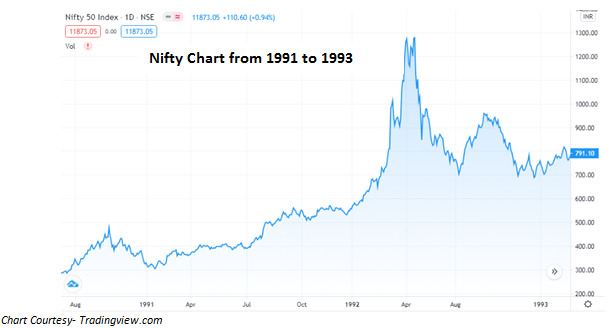

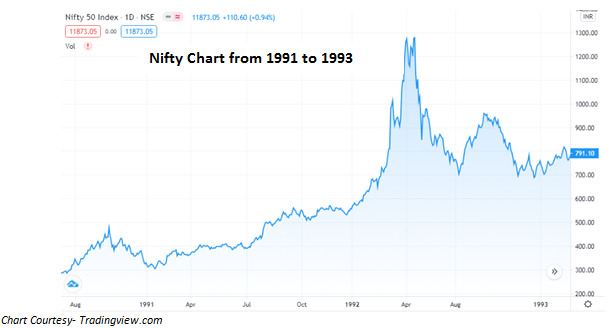

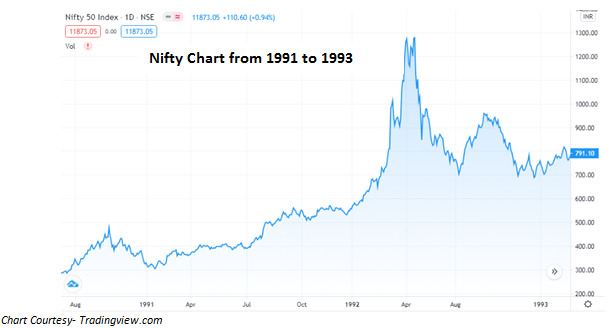

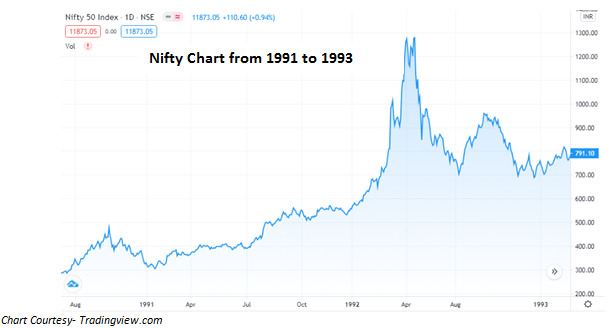

1992: The Harshad Mehta Scam and the Great Indian Bull Run

In the early 1990s, the Indian stock market was relatively small and illiquid. Then came Harshad Mehta, a charismatic broker who used money from the banking system to rig stock prices.

Between 1990 and 1992, the Sensex shot up from around 2,000 to 4,467 points — more than doubling in just a few months. By August 1992, it crashed back to 2,529, wiping out over Rs. 1 lakh crore in market value.

Stocks like ACC, Mazda Industries, and Apollo Tyres became legends of the boom — and casualties of the bust.

- ACC soared from Rs. 200 to Rs. 9,000 — 45× in months — before collapsing.

- Mazda Industries jumped from Rs. 20 to Rs. 1,600 without any real earnings growth.

- Apollo Tyres rose nearly 18× and later fell 90%.

The crash wasn’t just financial; it shattered retail investors’ trust in the markets.

2000: The Dot-Com Bubble and India’s IT Mania

In the late 1990s, the world was gripped by the Internet revolution. Indian IT companies like Infosys, Wipro, and Satyam became global service providers, and their stocks rallied to dizzying valuations.

Fueled by global liquidity and the US Fed’s easy monetary policy, investors extrapolated growth far into the future — assuming technology demand would rise forever.

But when the Fed raised rates in 2000, global liquidity reversed. FIIs pulled out of emerging markets, bursting the tech bubble.

Indian IT companies kept growing, but stock prices had run far ahead of fundamentals — leading to sharp corrections.

Lesson: Even strong companies can deliver poor returns when bought at inflated prices.

2007: The Infrastructure and Utilities Boom

Fast forward to 2006–07 — China was on a massive infrastructure expansion spree, pushing up global commodity prices.

In India, companies in infrastructure, power, and metals borrowed aggressively to expand capacity. Low interest rates and high optimism fueled a debt-driven boom.

But when the US subprime crisis hit in 2008, global liquidity evaporated.

Indian markets crashed nearly 60%, and over-leveraged infra firms were crushed under debt.

Lesson: Growth built on leverage and liquidity, not fundamentals, eventually collapses.

2010–2018: The NBFC Boom and Bust

Non-banking finance companies (NBFCs) grew rapidly by borrowing short-term money and lending long-term — a risky mismatch.

For a few years, this model worked beautifully. But when IL&FS defaulted in 2018, liquidity vanished overnight.

NBFCs like DHFL, Reliance Capital, and others faced a severe funding crisis, triggering a slowdown across housing, autos, and consumer lending.

Lesson: When everyone assumes liquidity will last forever, it’s already a bubble waiting to burst.

The Next Boom: Chemicals? Consumption? Something Else?

Every cycle starts with a kernel of truth — a genuine growth story.

Today, the spotlight is on specialty chemicals, pharmaceutical intermediates, and consumption stocks.

China’s environmental crackdowns and supply-chain shifts have benefited Indian chemical makers. Similarly, India’s consumption story — backed by rising incomes — looks solid.

But stock prices in these sectors have run up far faster than earnings. Valuations are stretched, and any disappointment could trigger sharp corrections.

Lesson: Great businesses can become bad investments when bought at unrealistic prices.

What Do We Learn from All This?

Every bull market begins with logic, but ends with emotion.

A few high-performing companies attract investor attention. Their success stories get amplified, optimism spreads, and soon, prices reflect not reality — but fantasy.

Eventually, expectations exceed what even great companies can deliver. The result? Prices collapse, leaving investors disillusioned.

As Warren Buffett said:

“You’re dealing with a lot of silly people in the marketplace; it’s like a great big casino and everyone else is boozing. If you can stick with Pepsi, you should be OK.”

The key takeaway: Don’t chase stories. Follow fundamentals.

Watch for sectors where:

- Valuations rise faster than sales or profit growth.

- Every investor starts believing “this time it’s different.”

- Stocks trade at record P/Es despite slowing growth.

Avoid overpaying, stay diversified, and focus on earnings power, not market hype. That’s how you avoid becoming a victim of the next “Harshad Mehta.”

The Bottom Line

History doesn’t repeat — but it rhymes.

Whether it’s the Harshad Mehta era, the dot-com frenzy, or the NBFC boom, every cycle ends the same way: fundamentals catch up, and reality wins.

To safeguard your wealth:

- Focus on business performance, not stock price momentum.

- Be skeptical of sectors where valuations rise faster than earnings.

- Maintain asset allocation discipline.

- Avoid blind faith in “heroes” or “themes.”

At MoneyWorks4Me, we help you separate real growth from market hype — so you can invest wisely, confidently, and stay safe from the next Harshad Mehta.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: