SBI Cards and Payment Services Ltd. IPO Details:

- Issue Open date: 02nd March 2020

- Issue Close date: 05th March 2020

- Equity shares offered: 13.7 Cr

- Price Band: 750-755

- Issue Size: 10,000 Cr

- Minimum lot size: 19 shares

Purpose of IPO

- The objective of the Offer for Sale is to allow the Selling Shareholders to sell an aggregate of up to 13 Crore Equity Shares held by them. The company will not receive any proceeds from the Offer for Sale.

- In addition, 66 Lakh shares issued will be part of a fresh issue. The net proceeds of the Fresh Issue are proposed to be utilized for augmenting the capital base to meet the company’s future capital requirements.

About SBI Cards and Payment Services Ltd

Incorporated in 1998, SBI Cards and Payment Services Limited (SBI Cards) is a subsidiary of SBI, India’s largest commercial bank in terms of deposits, advances, CASA and the number of branches.

The company is the 2nd largest credit card issuer in the country, with an 18% market share of the Indian credit card market (number of credit cards and total credit card spends) as of September 30, 2019.

As a subsidiary of SBI, the company has access to SBI’s extensive network of 22,007 branches across India.

The partnership enables it to market its cards to a huge customer base of 436.4 million customers.

SBI Cards offers a wide range of credit cards to individual and corporate clients including lifestyle, rewards, shopping, travel, fuel, banking partnership cards, and corporate cards, etc.

SBI Cards has partnered with several leading names across industries, including Air India, Apollo Hospitals, BPCL, Etihad Guest, Fbb, IRCTC, OLA Money and Yatra, amongst others.

Business of SBI Cards and Payment Services Ltd

The company generates revenue from:-

- Non-interest income (primarily comprised of fee-based income such as interchange fees, late fees, and annual fees) (constituting ~50% of revenue)

- Interest income on credit card loans

- MDR( Merchant Discount Rate)- The fees credit card company charges from the merchant for providing a facility to pay when a customer buys the product from the shop.

Card market of India

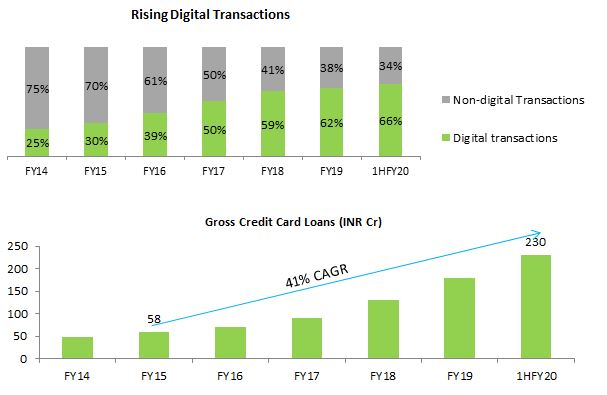

Rising consumerism in India is reflecting in changing savings rate (lower growth), spending (higher spends) and payment (non-cash) patterns in India (risen after the Demonetization).

Indians who were typically considered to be ‘credit-shy’ are now increasingly becoming more ‘credit-friendly’.

This new pattern is reflecting in strong growth trends seen across retail loans, including in personal and credit card loans.

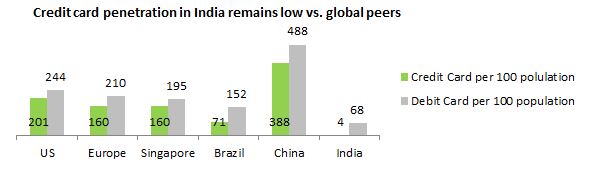

As per the RBI, India has progressed well in terms of banking customers and debit card issuance; however, credit card penetration similar to other retail loan products is still abysmally low (4/100 people vs >38/100 people for China and other developing/developed countries) and credit card receivables at 0.5% of GDP vs. 4% for the US.

This is mainly due to various reasons such as;

- Demand – where Indian households are traditionally oriented toward savings;

- Supply – with a majority of the labour force occupied in the unorganized sector with the card issuers in all probability unwilling to take higher credit risks; and

The Indian ethos to pay for goods and services upfront on a purchase instead of running up credit lines.

However, these barriers are now breaking with the change in the demographic profile and consumption/spending/savings patterns of the consumers.

India’s credit card industry’s outstanding receivables saw 30% CAGR in FY15-19 to reach USD14 billion and are set to witness 23% CAGR over FY19-24E to USD47bn as per CRISIL.

However, despite growing at such a faster pace, it will still be significantly small compared with other global players (Indian outstanding dues will be ~6% of US’s current card debt).

Thus, credit card growth in India has a long way to go and intense competition among players is expected.

However, the card industry will have to endure the incoming asset-quality risk given weak economic trends and unemployment rate which could derail the card industry’s dream run.

MoneyWorks4me Opinion

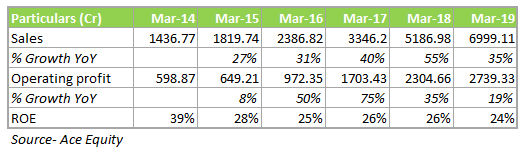

As fundamental investors, we prefer to own firms that have exhibited the ability to earn superior ROE, consistent growth and scaling up.

SBI Cards is one such company that has a strong franchise value, promoter backing and execution record as seen from numbers.

SBIC enjoys an advantageous relationship with SBI (promoter), India’s largest bank with a huge franchisee network and customer base, offering enormous cross-selling opportunities.

We believe that the company has a stronghold on the card market in India because:-

- Second biggest market share (first in terms of PSBs)

- Superior fee income due to strong growth in CIF and higher spends (however stagnating spends per card could be a concern)

- Second, highest spend per card by a user (Rs. 11,765 of SBI vs Rs. 12,619 by HDFC)

- SBIC is a pure-play investment in the growing card industry. Whereas in other companies, the only way of investing is through banks.

Risks

Along with the strengths, every business comes with its set of risks:

- Risk to growth: UPI & payment banks are steadily gaining ground in digital payments (although credit cards can find favour due to credit/deferred payment facility, reward/ discounting programs)

- Risk to balance sheet: SBI Cards has only an unsecured loan portfolio where recovery will be low. This impacts the balance sheet making it very risky. Usually, we find high NPA arising in economic slowdown liked it had happened in 2008-09 when even HDFC Bank faced a spike in credit card NPA. But since Banks have diversified portfolios, the impact is low while this standalone entity can have a disastrous impact for 2-3 years.

- High dependence on SBI for growth and distribution. SBI charges royalty and commission fees for using its brand and distribution.

Valuation

After listing at 750/share, the market capitalization of the company would be 71,000 Cr. This is almost 45x TTM EPS and 36x 1-year forward EPS.

We find that foreign peers were never this expensive even in their heydays with limited disruption potential then. This issue is expensive due to the high growth potential of the company hence probably justified today.

We expect 25% CAGR sales growth over the next 2 years and 12% thereafter.

Should you buy?

A lot of hands are chasing a handful of stocks; IPO issues may experience a rapid increase in share price in the short term.

As SBI Cards is fast-growing and no evidence of NPA in the near term, we find that one may buy as a special situation and not part of the core portfolio (Not buy and hold). This stock has to be sold at first signs of ‘slowdown in growth’ or ‘rise in NPA’. This is not a company where one holds on for 10 years. The business is cyclical and high valuation can be an additional drag on stock returns over the long term.

We recommend buying 1-2% of portfolio with say a Stop Loss of 20% below 52-week high to bail out on time.

We are risk-averse when it comes to IPO investing due to limited understanding of business model over economic cycles, many risks get overlooked.

Also, the seller has more information than buyers at the time of IPO. More than 80% of IPOs have fallen below their listing price at least once.

We also believe that due to the recent fancy of IRCTC, SBI Cards IPO may get a good response but it may disappoint due to consensus BUY on the IPO. But since we have recommended a Stop Loss idea, one can contain risk.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463