Why investors go for a variable fee?

As humans, we always seek value for money. We feel that no price is too high if there is enough value for me. However, many times value derived has a large intangible component that is hard to quantify or is derived after some time whereas prices are always tangible and usually immediately paid.

Therefore when someone offers investment advisory and portfolio management services with variable fees i.e. completely or partly based on the performance delivered We understand why investors often get carried away in favor of variable fee structure over fixed fee structure.

A fixed fee is something an advisor or fund manager charges every year irrespective of the fund’s return. In good years is acceptable but it pinches an investor in a bad year or two.

However, with variable fees, they find themselves willing to part away with fees, usually higher fees because they pay it only when they earn a return. However, we find this is very psychological (not rational) as arithmetic doesn’t add up. The typical fully variable fees range from a 10% share of profit above the 8% hurdle rate to 30% with a 15% hurdle rate. Let’s work with 20% profit sharing with a 10% hurdle rate, a commonly used variable fee structure.

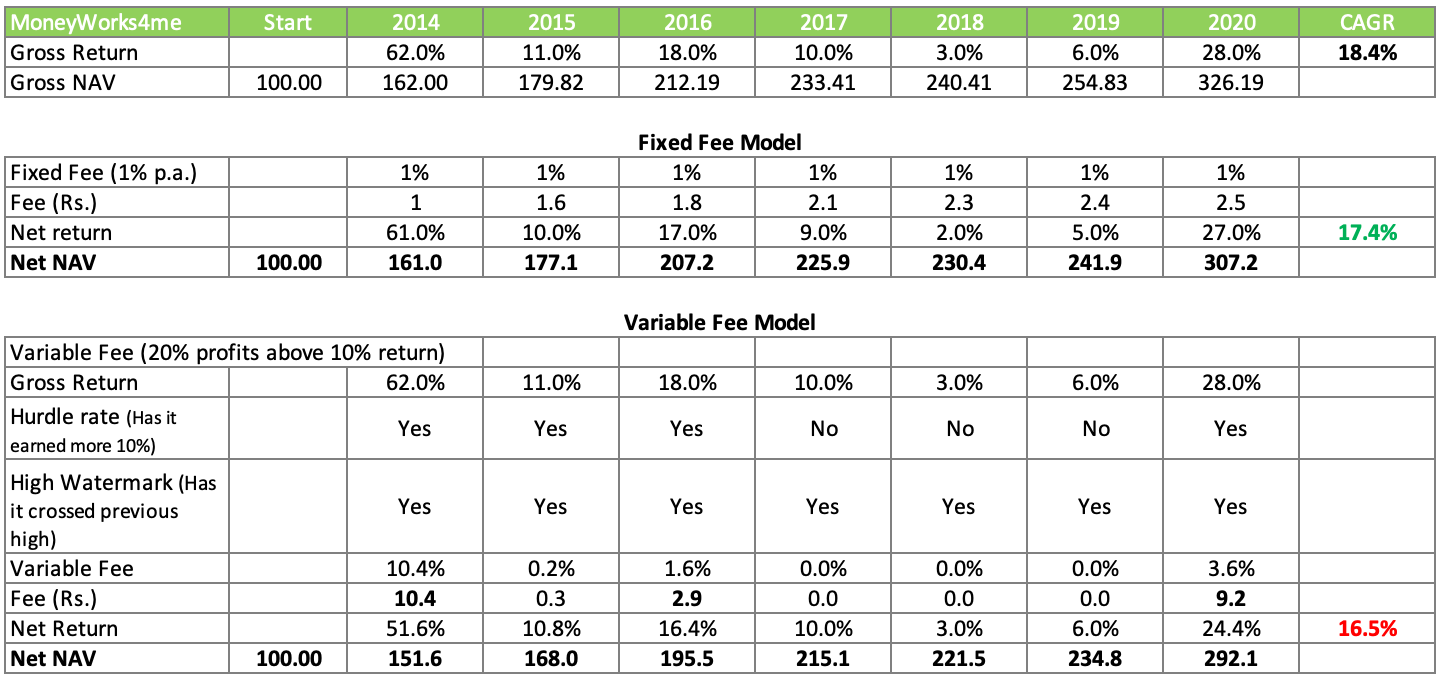

We assumed our own past performance to find out the difference in returns from Fixed Fee and the Variable Fee Model. If you invested Rs. 10 Lac, you would end up with Rs. 29.2 Lacs in variable fee model (192% returns) versus Rs. 30.7 Lacs in fixed fee model (207% returns) after 7 years, variable fee cost you ~15% lower absolute return.

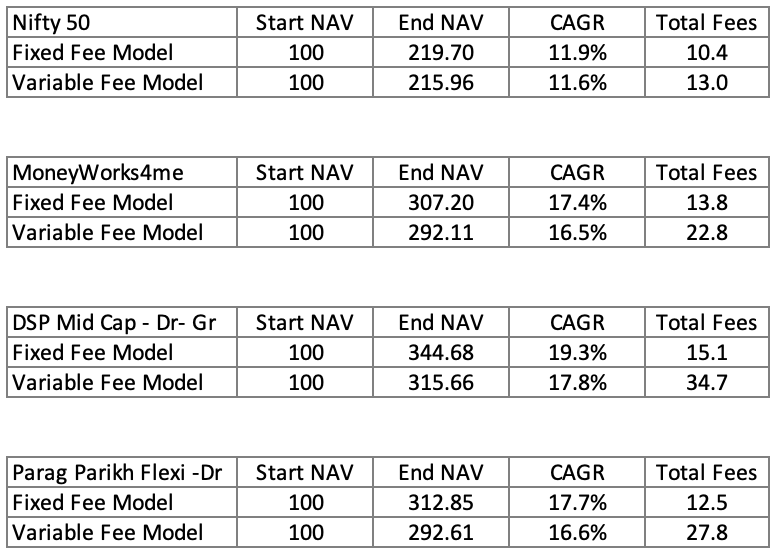

We evaluated other investment options for an average investor. Here are the results. In every category, i.e. Flexi-cap, Mid-cap, Nifty 50 the answer is the same. In all the following options, fixed Fee wins hands down.

If you had invested Rs. 10 Lac in DSP Mid Cap in 2014, it would have turned into Rs. 31.5 Lac on the variable-fee model (215% return) and Rs. 34.4 Lac in fixed fee model(244% return). Variable fees cost you an almost 30% lower return in absolute terms.

Why variable fee model would cost you more?

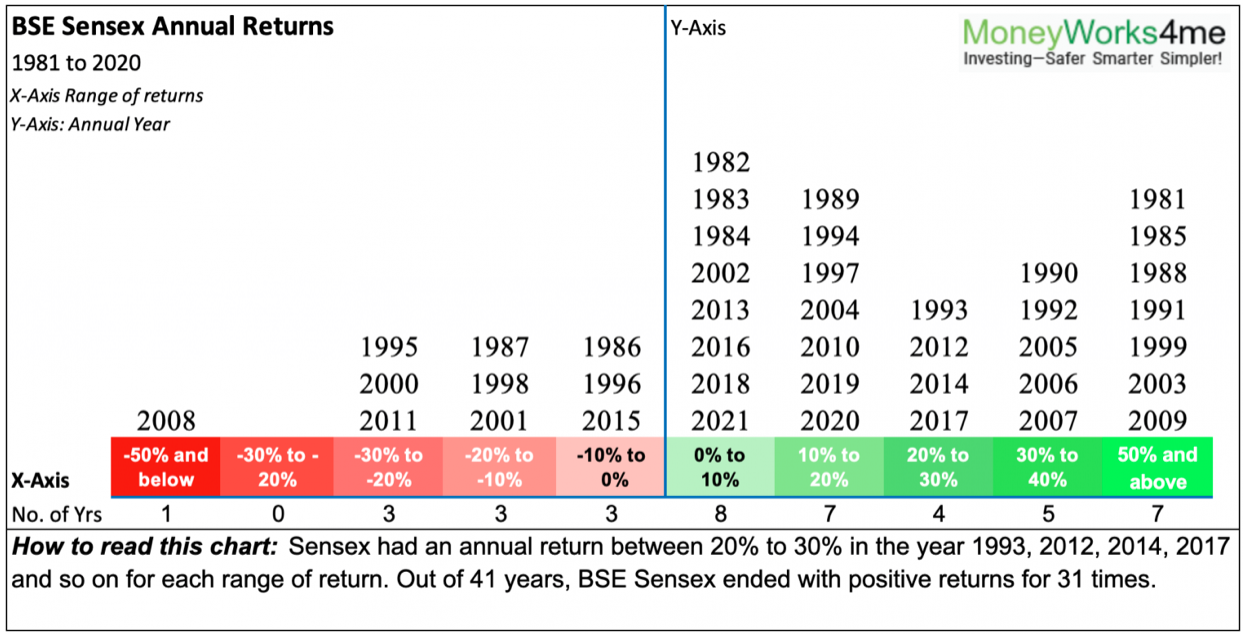

Equity markets are positive in 3 out of 4 years. So irrespective of a fund manager your portfolio return will be positive and most likely in excess of 10% on average as India’s growth rate is 12% p.a.

“If you’ve invested $1,000 with Buffett in 1965, it would now be worth $4.3 million. However, if Berkshire had been a hedge fund charging 2% & 20%, out of that $4.3 million; only $300K would have accrued to you, with a stunning $4 million charged by Buffett.” -Terry Smith, Fundsmith UK

Other risks in Variable Fee:

- Risk-taking: Fees linked to return would mean a fund manager would take more risk to earn higher fees. Well, in the stock market higher risk doesn’t necessarily imply a higher return, and on most occasions ends up with a lower return. If high risk indeed meant higher return, then we wouldn’t have called it high risk in the first place. Incentivizing for high risk-taking is bad for your wealth.

- Lack of incentive after a good year: Even if we assume the fund manager follows a mandate of no high-risk taking, there is no guarantee that he is incentivized enough to earn his fees after one good year. Take for example last year, many funds earned around 60-100% return. A variable fee is well over 8-10% of your portfolio. That’s almost several years’ worth of fees earned in one go, why bother to work towards performing each year?

- Bad Market/Closing down/Losing talent: Markets are volatile even if they are trending upwards. There are bad years when no return is earned. In that case, a variable fee fund manager will not earn any fees. How can he afford to stay afloat to pay salaries and costs? If a bad market continues well over few years (It may happen after a long bull market), such shops may lose talent for lack of incentive or worse, might close down.

To summarize, neither the arithmetic nor business model viability suggests that the variable fee model is better than the fixed fee model. We hope you are convinced that the variable fee does not work except for psychological reasons.

We believe investors feel the pinch to pay fees in a bad year but they ignore that they get to retain all the returns in a good year. Do remember, there are more good years than bad; so never fret over fees in a couple of bad years.

If you liked what you read and would like to put it into practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463